Recommendations:

Medium: Short the EURUSD at 1.3350, SL 1.3400, targets 1.330, 1.3150, 1.2800.

Risky: Short the USDJPY at 101.70, SL 102.50, targets 101.20, 100.50, 100.00.

Risky: Buy the USDJPY at 96.50, SL 95.70, targets 97.50, 99.00, 101.50.

Very Risky: Short the GPBUSD at 1.5450, SL 1.5510, targets 1.5400, 1.5200, 1.4850, 1.4250.

Analysis:

The giant money printing program unveiled by the Bank of Japan has been a major event last week, causing the USDJPY to fly swiftly +500 pips. The Euro also appreciated due to no interest rate cut by the ECB and some strong buying in EURJPY. We expect the USDJPY to continue to progress next week, however at a more moderate pace. The EURUSD should show some weakness in its upward march, and we would look for short entries. The US employment number have a mixed effect on the dollar: on one hand the unemployment figure went slightly down to 7.6% (a bit closer to the no-QE area of 6%) and on the other hand the job creation tumbled to 88k. If we have another month with NFP numbers below 50k, the chances of an increase in the QE flows of the fed become will become significant. The only significant event next is the FOMC meeting minutes which should be rather bullish for the USD since the meeting was held prior to the terrible NFP numbers of Friday. Finally, the SP500 remains silently stuck in the 1560 area

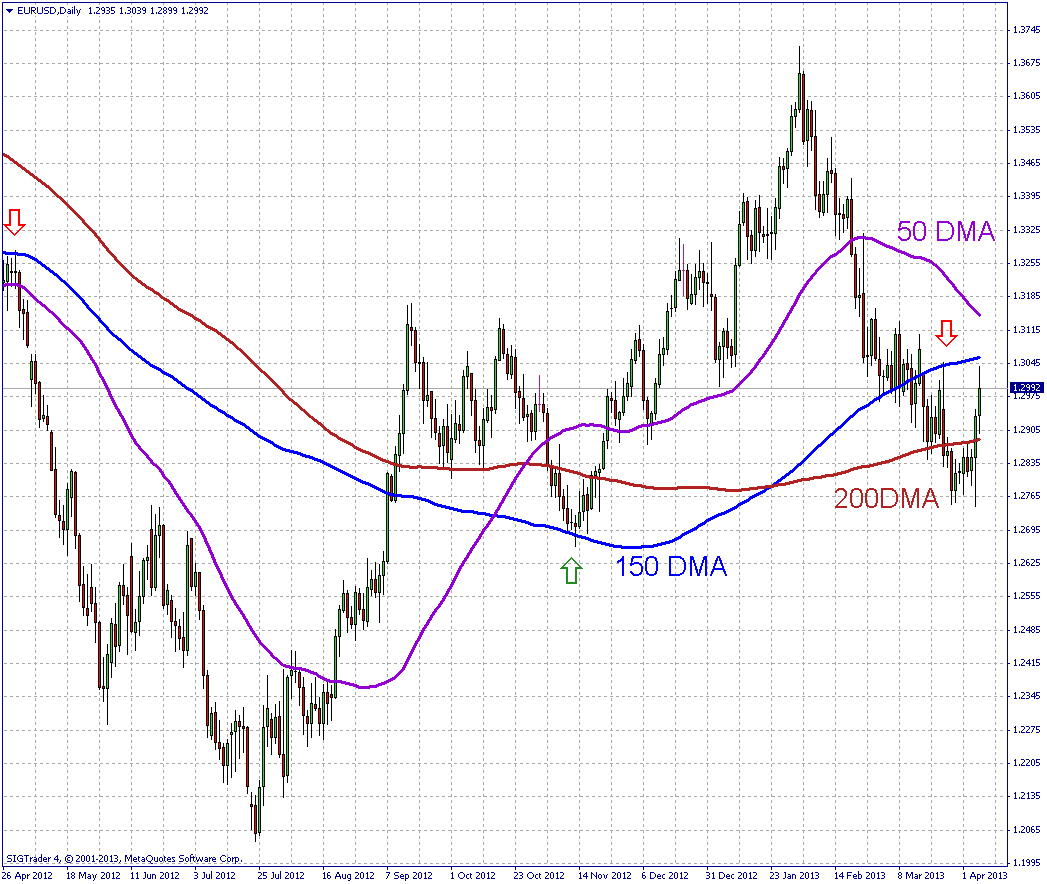

EURUSD: We doubt that the push higher in EURUSD will exceed 1.33, despite the uncertainty caused by low NFP numbers. We still think the trend is downside oriented in EURUSD, and we would look for a short entry around 1.3350 (61.8% Fibonacci retrace from 1.37 to 1.2750).

USDJPY: The massive money printing of the BOJ has taken the market by surprise. Next week we expect the USDJPY to test 100. A risky trade but possible would be to short the USDJPY above 101.50 next week, since this would be a very overbought level according to our mathematical models. Similarly risky and worth a try is to enter long at the previous highs around 96.50. With this BOJ easing, the trend for the yen is going to be more weakness in the coming weeks. The major trend line resistance comes now around 107.00

GBPUSD: The GBPUSD went up as we suggested last week and we are now very close to the decisive moment in this pair. Either we break above 1.54-1.55 and the trend becomes neutral. Or we fall heavily back below 1.50. A short entry is worth a try although we consider it very risky.

EURUSD Daily Chart

USDJPY Monthly Chart

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.