EUR/USD

Pushing lower.

EUR/USD has hourly broken support at 1.0905 (03/02/2016 low). Yet, the short-term technical structure still suggests a further bearish move. Hourly resistance lies at 1.1068 (intraday high). Hourly support can be found at 1.0810 (29/01/2016 low). Expected to show continued weakness.

In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD

Bullish consolidation.

GBP/USD is now consolidating. Hourly support lies at 1.3836 (29/02/2016 low) and hourly resistance is given at 1.4043 (26/02/2016 high). The technical structure suggests further decline. The road is wide open to stronger support at 1.3657 (11/03/2009 low).

The long-term technical pattern is negative and favours a further decline towards the key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY

Trading in range.

USD/JPY is trading mixed in the short-term and is clearly negative in the medium-term. Hourly resistance can be found at 114.00 (29/02/2016 high). Stronger resistance is given at 114.91 (16/02/2016 high). Hourly support lies at 112.16 (intraday low).

We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

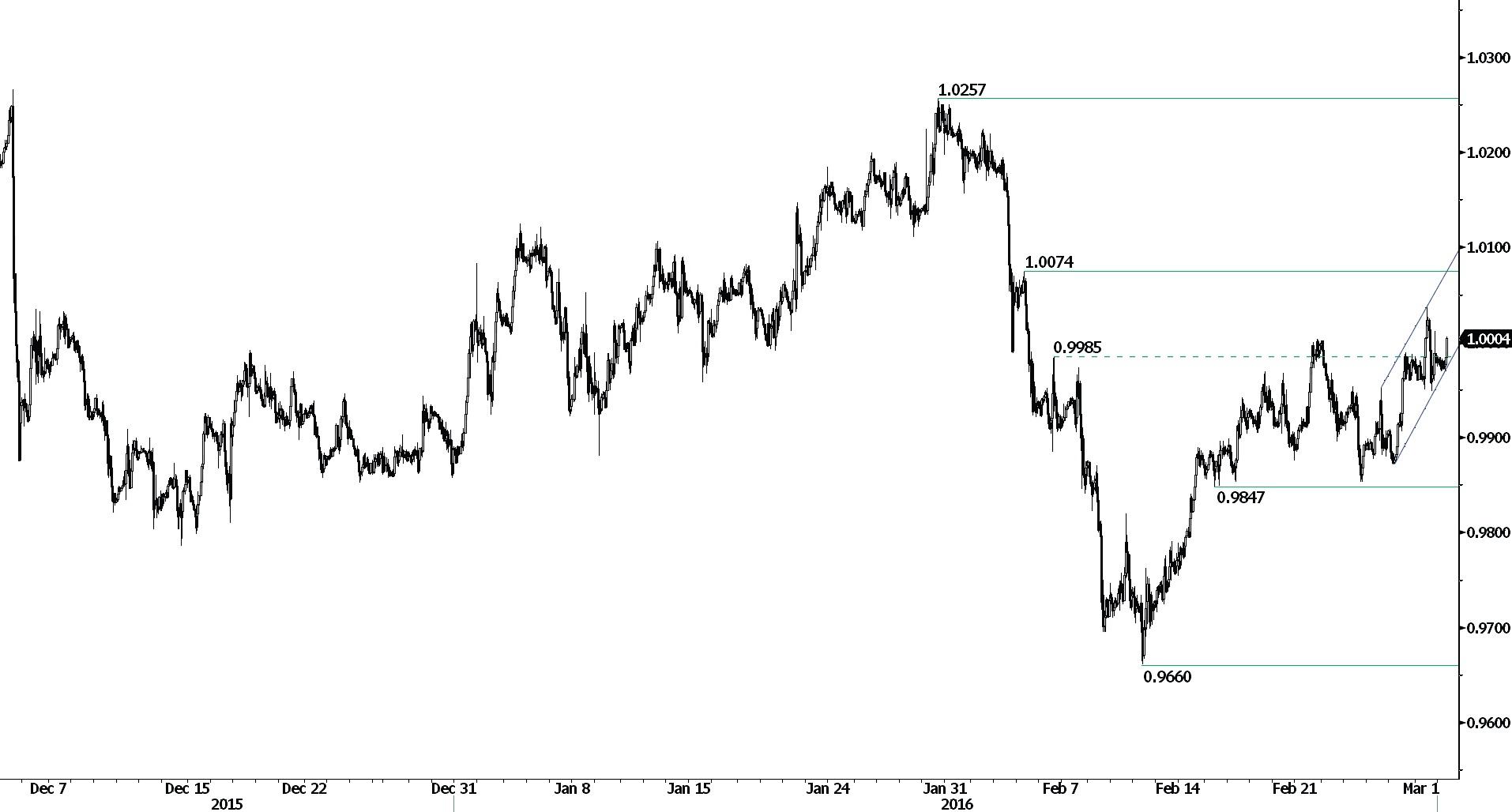

USD/CHF

Sideways price action.

USD/CHF is trading around 1.0000. Hourly support is given at 0.9949 (29/02/2016 low) and hourly resistance is given at 1.0040 (29/02/2016 high). Expected to see further weakening in case the psychological resistance at 1.0000 is not fully erased.

In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.

USD/CAD

Bearish momentum starts to fade.

USD/CAD's bearish momentum is now pausing. Hourly support is given at 1.3482 (01/03/2016 low). Hourly resistance can be found at 1.3587 (29/02/2016 high). Expected to see further consolidation.

In the longer term, the break of the key resistance at 1.3065 (13/03/2009 high) has indicated increasing buying pressures, which favours further medium-term strengthening. Strong resistance is given at 1.4948 (21/03/2003 high). Support can be found at 1.2832 (15/10/2015 low) then 1.1731 (06/01/2015 low).

AUD/USD

Lack of follow-through.

AUD/USD is very volatile. Hourly support is given at 0.7110 (intraday low). Strong hourly resistance is given at 0.7191 (01/03/2015 high). Expected to show continued weakness.

In the long-term, we are waiting for further signs that the current downtrend is ending. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair is approaching the 200-dma which confirms fading selling pressures.

EUR/CHF

Bearish !!

EUR/CHF's selling pressures continues. Hourly support can be found at 1.0810 (29/02/2016 low) is on target. Hourly resistance lies at 1.0946 (25/02/2016 high). The technical structure suggests further weakening.

In the longer term, the technical structure remains positive. Resistance can be found at 1.1200 (04/02/2015 high). Yet,the ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

EUR/JPY

Heading lower.

EUR/JPY is showing continued weakness. Hourly support is given at 122.10 (intraday low) and hourly resistance can be found at 125.01 (intraday high). Expected to further decrease.

In the longer term, the technical structure validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Key support at 124.97 (13/06/2013 low) has been broken. Stronger support is given at 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

EUR/GBP

Failing to go any higher.

EUR/GBP keeps on trading around its yearhighs. The short-term technical structure suggests a growing bullish momentum toward psychological level at 0.8000. Hourly support is given at 0.7784 (01/03/2016 low).

In the long-term, the technical structure suggests a growing upside momentum. The pair is trading well above its 200 DMA. Strong resistance can be found at 0.8066 (10/09/2014 high).

GOLD (in USD)

Strongly Bullish.

Gold's bullish momentum continues. The metal is pushing slightly higher. Hourly supports lies at 1211 (26/02/2016 low). Daily resistance can be found at 1263 (11/02/2016 high).

In the long-term, the technical structure suggests that there is a growing upside momentum. A break of 1392 (17/03/2014) is necessary ton confirm it, A major support can be found at 1045 (05/02/2010 low).

SILVER (in USD)

Strong volatility.

Silver is now bouncing back towards 15.00. Hourly resistance can be found at 15 (intraday high). Expected to further strengthening.

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Strong support can be found at 11.75 (20/04/2009). A key resistance stands at 18.89 (16/09/2014 high).

Crude Oil (in USD)

Riding short-term uptrend channel.

Crude oil's volatility is still strong for the time being. In the context of oil oversupply, we consider that there is still room for further downside moves. Yet, the higher highs suggest that oil is in a short-term bullish momentum. Hourly support stand at 28.70 (16/02/2016 low) and hourly resistance at 34.82 (04/02/2016 high). Expected to see continued strength in the shortterm.

In the long-term, crude oil is on a sharp decline and is of course no showing any signs of recovery. Strong support at 24.82 (13/11/2002) is now on target. Crude oil is holding way below its 200-Day Moving Average (setting up at around 47). There are currently no signs that a reverse trend may happen.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.