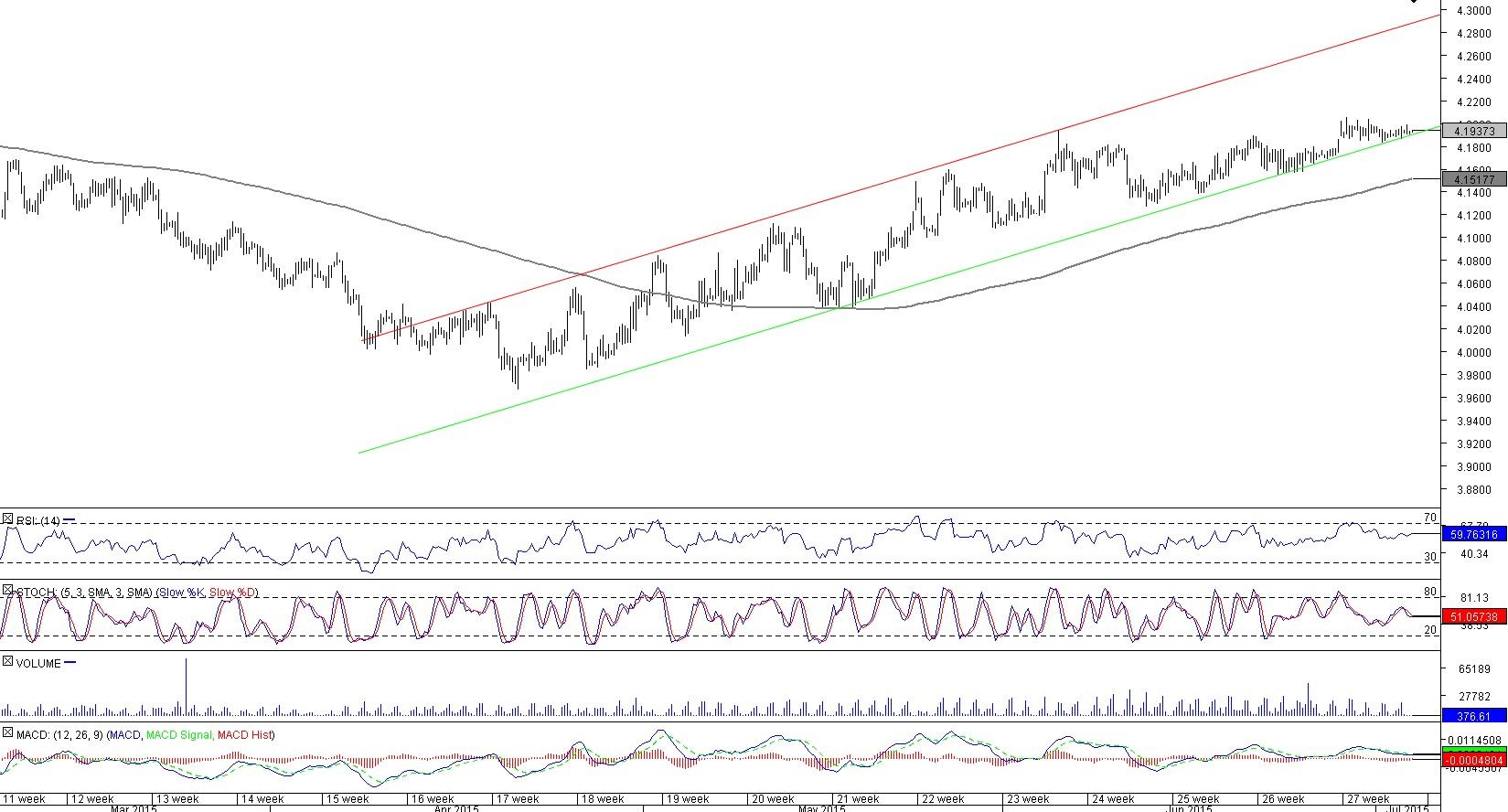

EUR/PLN 4H Chart: Channel Up

Comment: EUR/PLN appears to be offering a good buy deal. Right now the currency pair is trading just above the lower boundary of the bullish channel, and the base case scenario therefore is a rally towards the resistance trend-line at 4.30. Moreover, most of the technical indicators on all time-frames are pointing north. However, there is a risk of the price forming a rising wedge after several failures to escape the gravity of the lower trend-line. Accordingly, a long position before EUR/PLN surpasses the recent high at 4.2050 might be premature. In case of a break-out to the downside we expect the Euro to come down to 4.13, namely to the monthly S1 level and Jun 11 low.

EUR/NZD 4H Chart: Channel Up

Comment: Considering that EUR/NZD has recently surpassed one of the major 2014 highs (Sep 29), the pair may well keep advancing further north. The positive outlook is also implied by the well-defined bullish channel and technical studies. However, at the moment the upside is limited, since the up-leg is already entering the ending phase. In the near term the Euro is expected to rise up to 1.70, where the rally should be capped by the resistance line, monthly R3, and 2013 Dec high. From there we are likely to see a decline back towards 1.64. In the meantime, the sentiment of the SWFX market is strongly bearish, being that almost three thirds of open positions are short.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.