Established items need to be compared to estimates and historical trends, whilst the new methodologies need to be assessed and weighed against their peers, before being included in models and calculations. But as Mark Twain put it in his autobiography, as he discussed the use of figures to support an argument or view,

Whilst that may be a somewhat uncharitable viewpoint, it highlights the fact that we often do need to look beyond the headline figures in data releases to discover just what’s going on behind those numbers.

"There are three kinds of lies: lies, damned lies and statistics."

A case in point

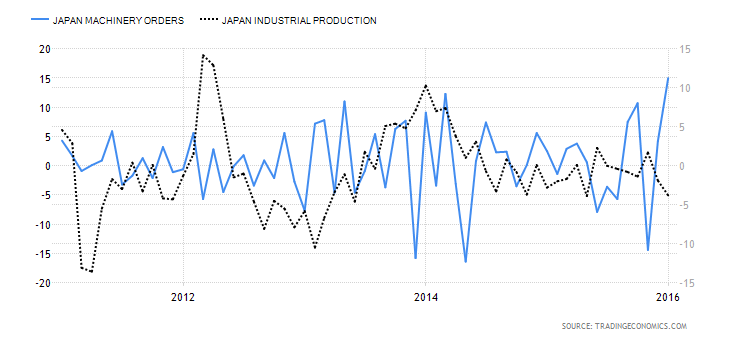

An excellent case in point would be the sharp jump in Machinery Orders seen in Japan during January. That data that was released this week. The headlines and the headline numbers show a 15% jump, month on month for January. Given that Japan’s economy is still largely reliant on manufacturing that should surely be seen as a positive, which of course it is. However we would not be wise to view that figure in isolation and we therefore need to look behind the headline data.

The sharp rise in machinery orders emanates from one sector, the steel industry, which had been shopping for boilers and motors earlier in the year. In fact we if look at Machinery Order data from manufacturers (which includes the steel sector orders) we find they have jumped 42% in January. However if we exclude those items (steel sector orders) or view them as one offs, which they most likely are. Then we find that the overall trend in Machinery Orders is actually flat at best. Furthermore the sharp jump in orders from manufacturers are largely offset by a sharp drop in orders from abroad, which fell 29.4% during the first month of the year.

As we can see from the chart above Industrial Production in Japan (the dotted line), which we can consider to be a broader measure of activity in Japan’s manufacturing economy, is actually trending lower and has been since the start of 2014. On that basis the Machinery Orders data would not have been a compelling reason to trade Dollar Yen, of and on its own, over anything other than the shortest of time frames. If you were even awake at midnight on a Sunday evening London time that is.

BOJ meets

Against that background the Bank of Japan meet on Tuesday to decide on the level of Interest Rates and Quantitative Easing in the country. In recent comments BOJ Governor Kuroda has suggested that the Japanese Central Bank will sit pat and take no further action. While it assess the impact of negative interest rates on the economy and the banking sector in particular. Whether the ECB decision, on Thursday last week, to move rates further into negative territory and boost QE, will have an influence on the BOJ, remains to be seen.

If the BOJ do surprise the markets and cut rates further I think it likely that the Yen could initially strengthen, just as we saw with the Euro when the ECB moved. At the risk of sounding like a broken record in both cases it seems clear to me that Monetary Policy is reaching the end of what it can usefully achieve on its own and that politicians in Japan and Europe now need to grasp the nettle and make the difficult choices and structural changes necessary to re boot their economies.

Fork in the road

On Wednesday evening we will here from the US Federal Reserve as it meets to make its own decision on interest rates. Of course US interest rates have taken a different fork in the road heading uphill whilst those of many other economies remain in the lowlands or have descend “below sea level".

The Fed must decide if the US economy, in its current state, warrants a further interest rate rise. I.E. is demand / inflation sufficiently strong to require the cost of money to rise? Historically inflation has been defined as “too much money chasing too few goods” and raising interest rates is seen as a method of slowing down the availability of money.

Whilst that definition might be too simplistic for a global economy that remains under the influence of unconventional monetary policy (QE) the Fed must try to look ahead or get ahead of the curve as they say and anticipate where levels of demand (inflation) are likely to be in the future. If they chose not to act now, as well as if they do.

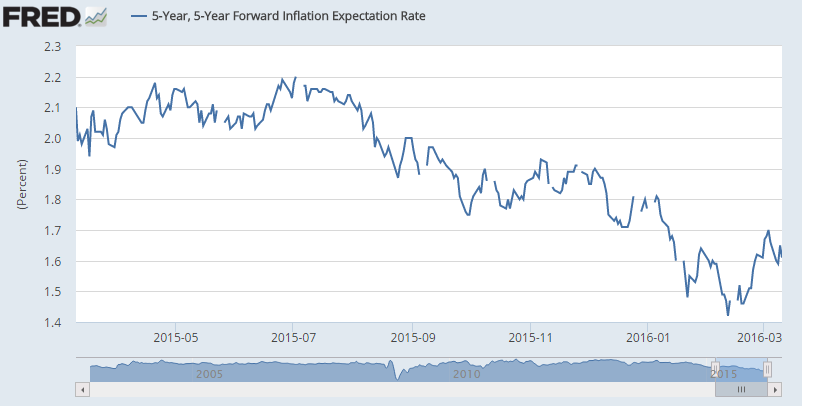

Chart plots the markets expectations of Future rates of US inflation (source Fred data)

Inflation expectations are picking up in the US. As we can see from the chart above a clear rally is visible from the end of February. However these projections are for rates of inflation that will apply five years into the future and they remain below the Feds own 2% target level out to 2020 /2021.

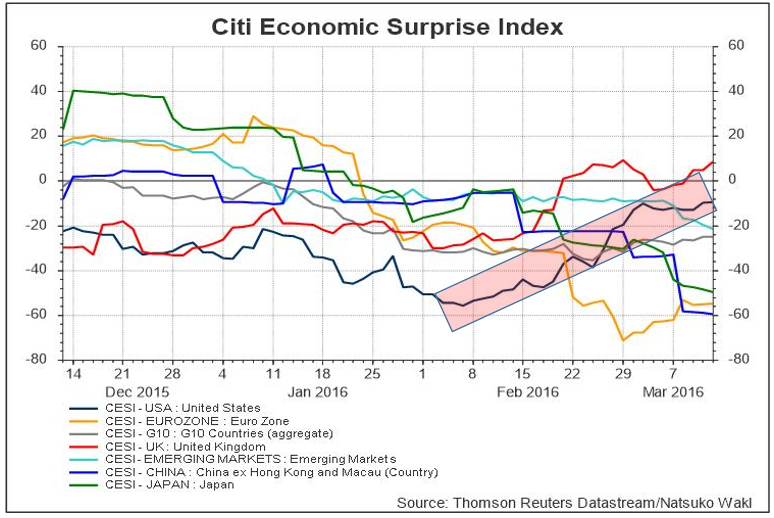

As I write Fed Funds Futures, which are used to calculate the probabilities of rate rise in a given month, show a zero percentage chance of Fed move on Wednesday evening. Despite the steady improvement in the flow of positive economic data coming out of the USA since mid-February, as can be seen by the rising blue line, highlighted in the pink box in the chart below.

Chart plots the level of economic surprises in selected economies vs analyst’s consensus forecasts

So let’s listen to what the Fed say and do on Wednesday evening (not forgetting that US clocks have moved to day light saving time) and prior to that what the Bank of Japan announce early on Tuesday morning. Whatever the individual outcomes are, as we move through 2016 Monetary Policy Divergence will take on an increasing importance and the proper interpretation of economic data that supports the policies that have brought it into being should become more prominent in our decision making and trading processes as well.

Trading with currencies and CFDs is speculative in nature and could involve the risk of loss. Such trading is not suitable for all investors. Before using the services of Admiral Markets AS please acknowledge the risks associated with trading, terms and conditions of the services and consult and expert if necessary.

Recommended Content

Editors’ Picks

AUD/USD approaches 0.6900 ahead of Australian inflation

The Aussie is among the best performers against the Greenback this week, trading at fresh 2024 highs, not far from the 0.6900 mark. Australian inflation data taking centre stage in the Asian session.

EUR/USD extend recovery amid persistent USD weakness

The Euro benefited from the broad US Dollar’s weakness on Tuesday, trimming weekly losses and looking to retest the 1.1200 level. Additional gains out of the table amid discouraging European data.

Gold's unstoppable run extends beyond $2,650

Gold price keeps posting record highs on a daily basis, now comfortable above $2,650. Poor United States data fueled speculation the Federal Reserve will trim rates by another 50 bps when it meets in November.

Crypto Today: Bitcoin, Ethereum and XRP consolidate as SUI continues impressive run

Bitcoin traded around $63,600 on Tuesday, as prices appear to be consolidating within the $62,000 and $64,700 key levels. On-chain data shows that the consolidation may be due to profit-taking by holders and mild Bitcoin ETF net inflows of $4.5 million, per Farside Investors data.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.