The continued optimism over the increased likelihood that the Federal Reserve may raise US interest rates next week for the first time in almost 10 years has created an incredible level of volatility throughout the global markets. Erratic movements are being seen in the currency markets as eager investors systematically offload and reload positions in the hope of being on the right side of one of the most anticipated financial events of recent times ahead of the FOMC decision next week. While part of the excessive volatility in recent days could be contributed towards the milestone lows found in the price of oil and the under delivery from the ECB last week, there are concerns that the statement from the FOMC next week will be downbeat and reiterate that the pace of US rate rises from the Federal Reserve will be slow.

Moving back to the ECB under delivery last week, this has continued to install aggressive bullish momentum for the Euro currency and subsequently pushed the EURUSD to fresh weekly highs above 1.10. While this is an impressive bounce considering that we were looking towards 12-year lows at 1.05 just a week ago, the appreciation in the EURUSD still looks short-term with most market spectators being strictly bearish in the longer term and expecting the pair to remain under pressure.

When taking a look at the bigger picture and away from the exaggerated reaction to the ECB’s under delivery last week, expectations remain quite firm that the Fed is likely to raise US interest rates next week and this furthers the ongoing divergence in both monetary policy and economic sentiment between the two economies and consequently means that the EURUSD is still open to losses in the future.

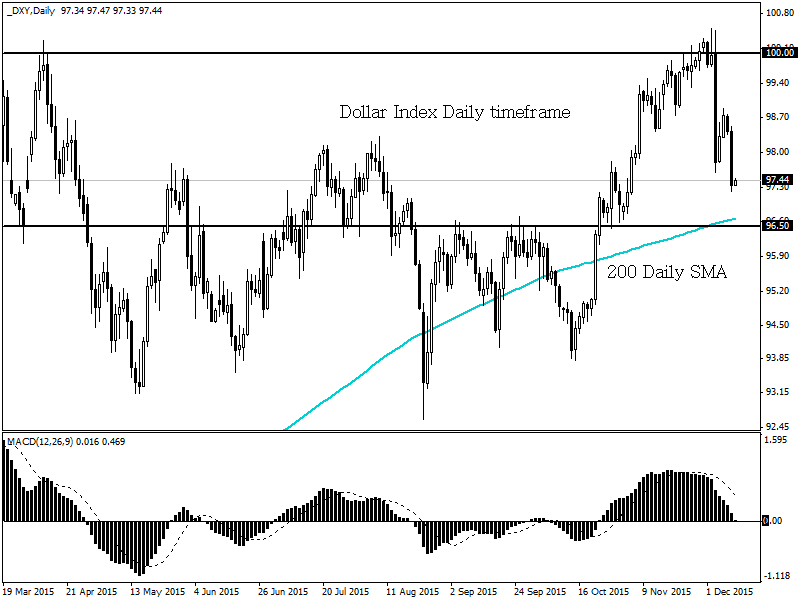

Elsewhere, investors pulled down the Dollar for the second trading day and drove the currency to multi-week lows against the Euro and Yen as most investors firmed up and took profit on positions ahead of next week’s Fed policy meeting. Despite the short-term USD weakness, sentiment towards the Dollar remains bullish and with data in November fortifying optimism around a US interest rate hike in December as well as other central banks still threatening further easing, the Dollar can likely regain ground and appreciate once again in the future.

While the Dollar Index has declined to fresh levels not seen in weeks, technical traders might be monitoring the 200 daily SMA highlighted in the chart below as a possible opportunity, which may provide a foundation to encourage buyers to send prices higher.

The instability created from the ECB’s under delivery last Thursday has continued to weaken the USD and as a result, offered an opportunity for bullish investors to drive Gold prices to a weekly high at $1085. Regardless of the recent gains, this precious metal remains bearish and the rising optimism over the reinforced expectations around the Fed raising US interest rates next week should limit how high Gold can advance. There is still potential for Gold bears to install another round of selling momentum throughout metals and with the Fed Funds markets pricing in up to an 80% chance of a US interest rate rise next week, Gold remains vulnerable and open to more losses.

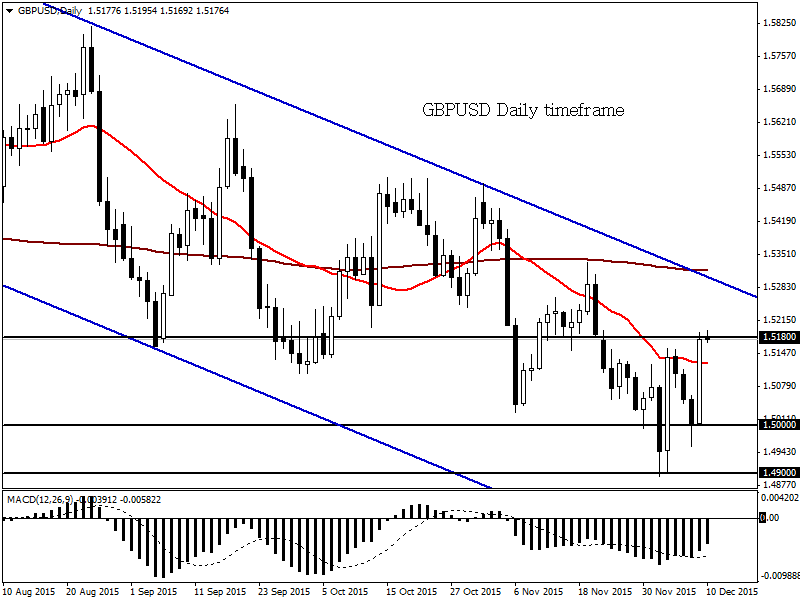

GBPUSD rebounds from 1.5000

The GBPUSD has experienced an aggressive appreciation to fresh weekly highs at 1.5190, which has been the result of temporary USD weakness and this has little to do with improved sentiment towards the Sterling.

The Sterling continues to receive regular punishment from the Bank of England’s (BoE) visible reluctance to begin raising UK interest rates, while other signs of slowing economic growth and stagnant inflation is also diluting any pressure on the BoE to act.

Later today investors will be awaiting the latest conclusion pf the monthly BoE meeting where the majority of onlookers are expecting interest rates to be left unchanged at 0.5%, which might be seen as a non-event for traders. Market participants will instead focus on the tone of the monetary policy summary for more clues on when the Central Bank may start raising UK interest rates, even though expectations have been pushed back beyond next year and more towards early 2017.

Despite the abrupt appreciation the GBPUSD has experienced in the previous trading session, the pair is still bearish and vulnerable to losses in my opinion. The lurking concerns over a potential slowdown in economic momentum for the UK economy mixed with strong expectations that the Fed may raise US interest rates next week holds the potential to encourage sellers to send the GBPUSD back down towards its recent lows at 1.49.

AUDNZD

The AUDNZD is technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. A breakdown below the 1.070 support may encourage sellers to send prices towards the next relevant support at 1.050.

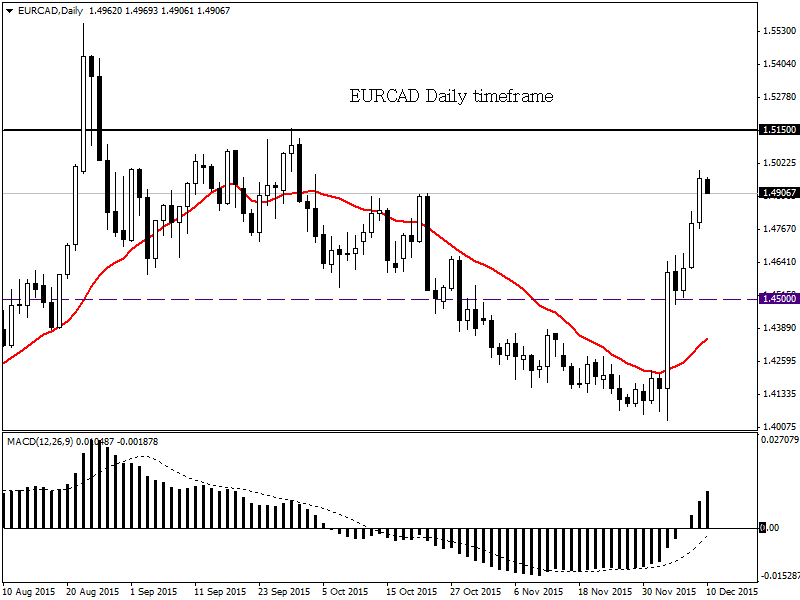

EURCAD

This pair is heavily bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has always crossed to the upside. The bullish momentum may send prices towards the next relevant resistance based at 1.5150.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.