Interested in more FX key technical levels? Take a look at Swissquote's daily technical outlook.

EUR/USD

Keeping below the 1.1400 level following rejection from the 1.1465 high and see the 1.1327 support under threat. Break of the latter will fade the upside pressure and swing focus lower towards the 1.1300 level and 1.1218 support. Above 1.1400/20 needed to revive upside focus. [PL]

EUR/CHF

Steady within a narrow range following bounce from the 1.0843 low last week. Upside still limited with resistance starting at 1.0900/13 area and lift over this needed to clear the way for stronger recovery to 1.0933 then 1.0954 high. Below 1.0843 will expose the 1.0821/10 lows. [PL]

USD/CHF

Recent weakness finally finding traction at the .9500 level and bounce eye recovery above the .9600 level. Lift over this will expose strong resistance at the .9651/61 recent lows. Would need to regain this to trigger stronger recovery. Support at .9494/76 lows now protecting the downside. [PL]

GBP/USD

Spurred by the appearance of a High-wave candle set last session, intraday trade settled into consolidation but still well-confined within the perimeters of a wider 1-1/2 month symmetrical-triangle and breakout will provide directional signals . [W.T]

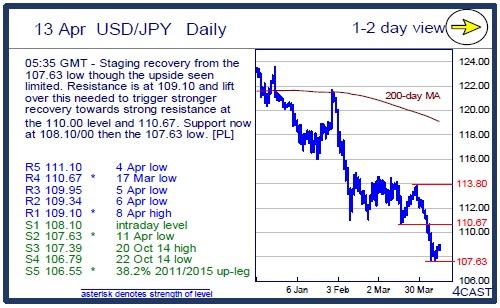

USD/JPY

Staging recovery from the 107.63 low though the upside seen limited. Resistance is at 109.10 and lift over this needed to trigger stronger recovery towards strong resistance at the 110.00 level and 110.67. Support now at 108.10/00 then the 107.63 low. [PL]

EUR/GBP

Follow-through below the .8000 level triggers deeper pullback from the .8117 high. Below the .7960 support see the Mar/Feb highs at .7947/29 to watch as break here will trigger deeper retrace of the up-leg from the Nov low. Resistance now at .8046 then the .8117 high. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD: A tough barrier remains around 0.6800

AUD/USD failed to maintain the earlier surpass of the 0.6800 barrier, eventually succumbing to the late rebound in the Greenback following the Fed’s decision to lower its interest rates by50 bps.

EUR/USD still targets the 2024 peaks around 1.1200

EUR/USD added to Tuesday’s losses after the post-FOMC rebound in the US Dollar prompted the pair to give away earlier gains to three-week highs in the 1.1185-1.1190 band.

Gold surrenders gains and drops to weekly lows near $2,550

Gold prices reverses the initial uptick to record highs around the $$2,600 per ounce troy, coming under renewed downside pressure and revisiting the $2,550 zone amidst the late recovery in the US Dollar.

Australian Unemployment Rate expected to hold steady at 4.2% in August

The Australian Bureau of Statistics will release the monthly employment report at 1:30 GMT on Thursday. The country is expected to have added 25K new positions in August, while the Unemployment Rate is foreseen to remain steady at 4.2%.

Ethereum could rally to $2,817 following Fed's 50 bps rate cut

Ethereum (ETH) is trading above $2,330 on Wednesday as the market is recovering following the Federal Reserve's (Fed) decision to cut interest rates by 50 basis points. Meanwhile, Ethereum exchange-traded funds (ETF) recorded $15.1 million in outflows.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.