EURUSD

The Euro reversed after Greek drama came close to its end, with yesterday’s rejection at 1.1195, leaving 1.12 area as strong resistance, where hourly double-top was left at 1.1195/1.1215. Fast acceleration lower was shaped in long red daily candle, with long upper shadow that confirms strong selling interest. Key near-term support, daily Ichimoku cloud base at 1.0992, provided temporary support, where yesterday’s trading was contained. Overnight’s narrow consolidation preceded fresh leg lower that looks for initial target at 1.0952, 29 June former low and key support at 1.0915, 07 July low, loss of which to probe levels below 1.09 handle, where Fibonacci 61.8% retracement of 1.0519/1.1465 rally lies at 1.0880. Near-term technicals remain firmly bearish, with daily studies turning into full bearish mode. Final break below 1.0915 pivot to open way for full retracement of larger 1.0818/1.1434, 27 May / 18 June upleg. Daily cloud base now acts as immediate resistance, along with daily 100SMA at 1.1017, guarding daily Tenkan-sen line at 1.1065, which is expected to ideally cap corrective rallies.

Res: 1.1017; 1.1065; 1.1120; 1.1175

Sup: 1.0952; 1.0915; 1.0880; 1.0818

GBPUSD

Cable failed to sustain yesterday’s gains that peaked at 1.5587, with quick reversal, returning below cracked falling daily 20SMA that continues to cap. Formation of 10/55 daily SMA’s bear cross, along with negative aligned technicals, keeps the downside at risk. Pivotal 200SMA support at 1.5428, holds for now, with close below here, seen as a trigger for further easing towards key levels, daily Ichimoku cloud top at 1.5377 and low of 08 July at 1.5327, loss of which to confirm bears fully in play for fresh extension of downleg from 1.5928 peak. Daily 10SMA offers initial resistance at 1.5506, ahead of yesterday’s high at 1.5587 and pivotal daily 20SMA at 1.5640.

Res: 1.5506; 1.5587; 1.5600; 1.5641

Sup: 1.5455; 1.5428; 1.5377; 1.5327

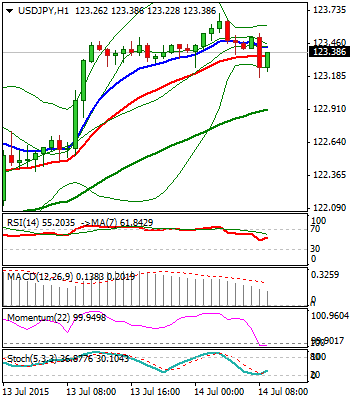

USDJPY

The pair formed daily Three White Soldiers reversal pattern on yesterday’s fresh acceleration higher that broke above pivotal daily 20AMA at 122.91 and daily cloud top at 123.30. Rallies peaked at 123.51 yesterday, with today’s spike higher, meeting initial target at 123.70, former top of 02 July. Daily studies are turning into bullish mode and see further upside favored, however, consolidative / corrective action on overbought near-term conditions, is expected to precede fresh leg higher. Daily 20SMA now acts as initial support at 122.91, with 122.40 zone, hourly higher base and Fibonacci 38.2% of 120.39/123.70 rally, expected to ideally contain dips, ahead of fresh attempts higher. Lower platform at 124.40 zone, marks next significant resistance.

Res: 123.70; 124.00; 124.36; 124.42

Sup: 122.91; 122.56; 122.40; 122.11

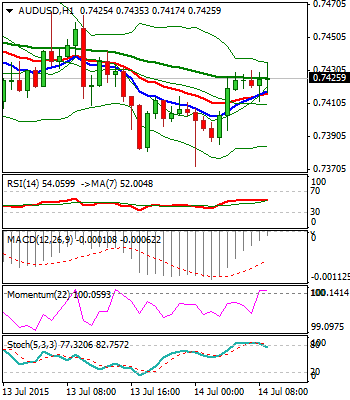

AUDUSD

Another long-legged Doji candle confirms near-term directionless mode, as the pair continues to consolidate recent losses that posted fresh 6-year low at 0.9370. Near-term price action holds within 0.7370/0.7494 range. Overall tone remains firmly bearish, with prolonged consolidation on overextended daily conditions, expected to precede fresh leg lower. Falling daily 10SMA, currently at 0.7487, caps, guarding former breakpoint at 0.7531 and former base at 0.7600, which is expected to cap extended corrective attempts. Near-term focus remains turned towards next target at 0.7204, Fibonacci 76.4% retracement of multi-year 0.6007/1.1079 rally.

Res: 0.7466; 0.7487; 0.7531; 0.7564

Sup: 0.7411; 0.7370; 0.7350; 0.7300

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.