It seems that the US economy has recovered sufficiently enough for the Federal Reserve to consider a slow gradual tightening of monetary policy. (It’s important to note that US inflation is still under the Fed’s 2% target). On the other hand, China’s economy has continued to slow.

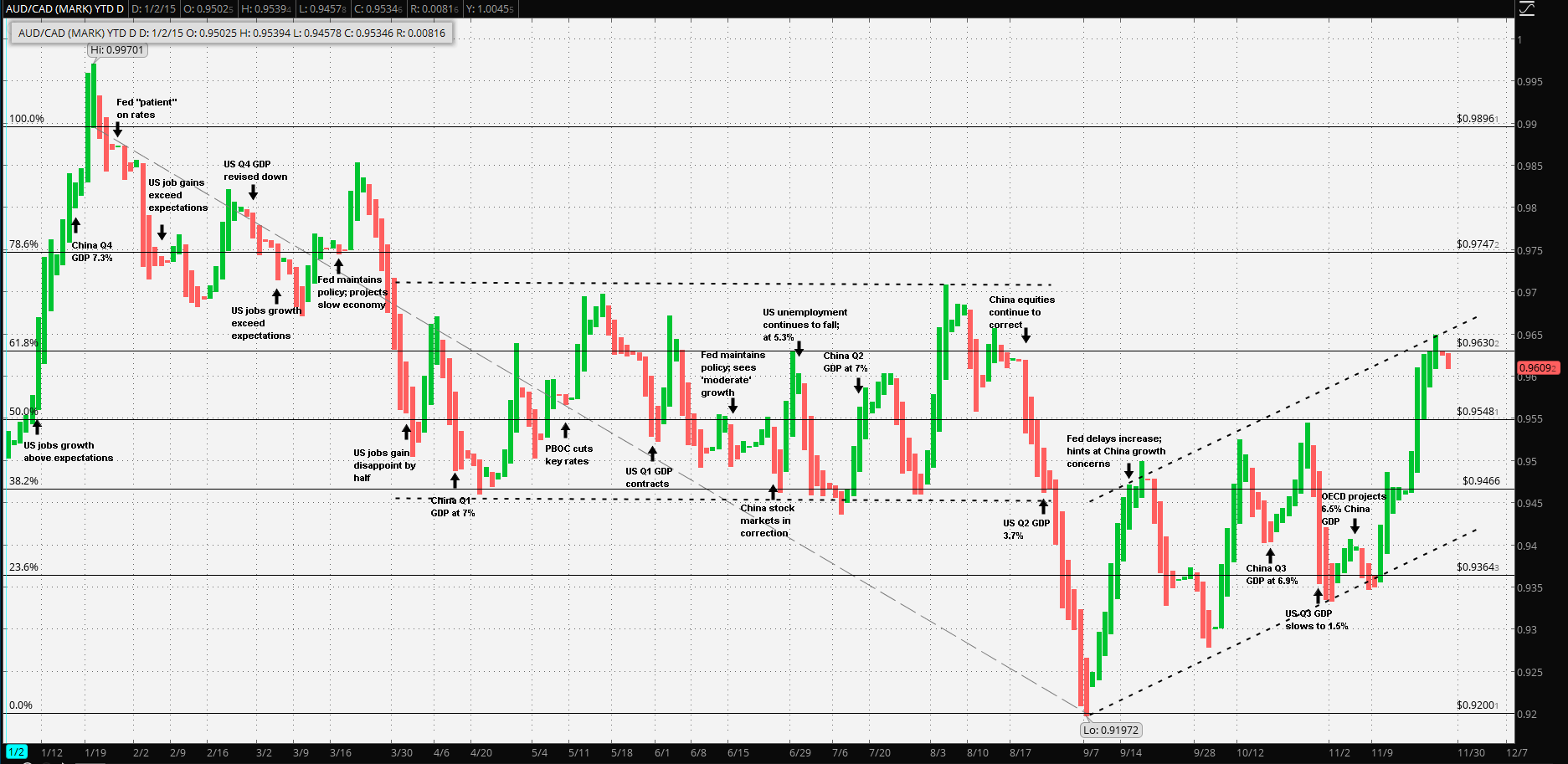

It’s well worth looking at the AUD/CAD price event chart above, keeping in mind the trade relationship which the former has with China and the latter has with the US. The noted events demonstrate a continuing decline in China’s economic growth. Further, all along this timeline, the PBOC has been using all the tools at its disposal in order to stimulate growthi. The collapse in the equity markets last summer further complicated the slowdown, causing the PBOC to ‘step up’ what looked like a measured easing cycle. Most recently, 15 November, margin rates were raised to 100% of equity.

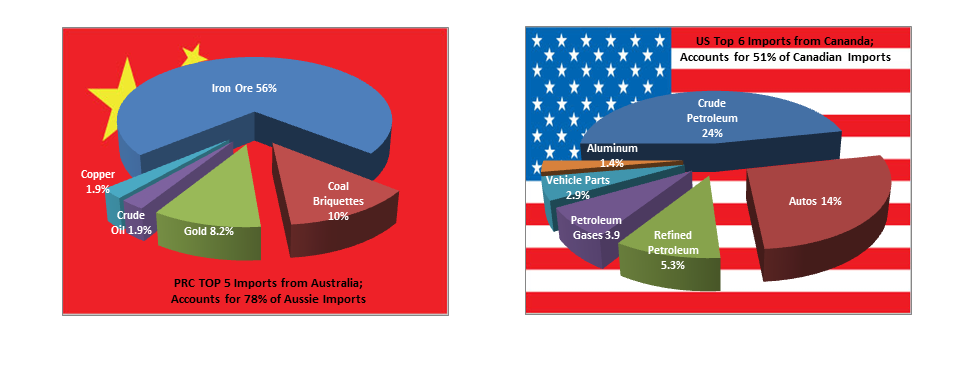

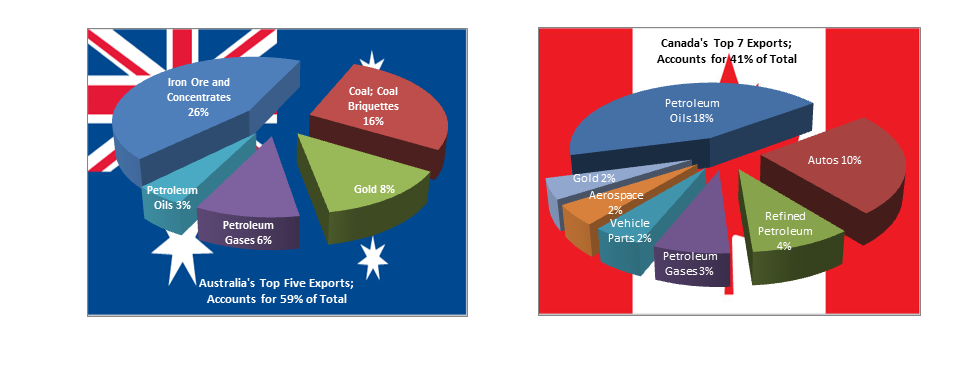

A combination of slowing demand as well as relentless crude oil production and the stockpiling of strategic commodities may have precipitated the collapse of all commodity prices, spilling over into 2015. China reported several quarters of declining GDP before officially announcing a reduction in future growth expectations in March 2015iii. Prime Minister Li Keqiang going so far as stating that “...China’s economic development has entered a new normal... ...Systemic, institutional and structural problems have become ‘tigers in the road’ holding up development. Without deepening reform and making economic structural adjustments, we will have a difficult time sustaining steady and sound development...”

On the other hand the US economy has been moving in ‘fits and starts’. The Fed seemed encouraged last January noting that the economy was expandingiv “...at a solid pace...” and indicated its ‘patience’ for maintaining policy. It should be noted here that wage and price growth have not expanded along with the US economy. Employment and GDP growth continued to be strong for the next several months; however, they began to slow in March. At the March meeting, the Fed maintained its bias towards a rate increase but downgrade the pace of growth. Chair Yellen remarked to reporters at the following press conferencev that: “...Just because we removed the word 'patient' from the statement doesn't mean we're going to be impatient... ...The committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium-term...”

US economic data has since has since been inconsistent, but there’s no doubt that the overall trend is improving. On the other hand, China’s economy seems to have not yet found a bottom.

Before becoming too sidetracked on the PRC and US, it should be noted how the data of the two large import economies may have affected the decisions of the central banks of their major trade partners, particularly RBA and the BOC. The latter had ended 2014 with the key policy overnight rate at 1.00%. There were two 25 basis points reductions, the first in January and a second in July. The current policy target rate is currently at 0.50%. Also, total CPI and core CPI are currently at the low end of the 1% to 3% for each.

The former ended 2014 with a 2.50% policy rate. Governor Glenn Stevens kept a steady hand on the tiller, reducing rates only twice even with demand from Australia’s main export partner steadily China declining. The first 25 basis point rate reduction occurred in February and the second in May. The RBA policy ‘Cash Rate’ is currently at 2.00%.

Since expectations are for a Fed rate increase at the December meeting, a further strengthening of the US Dollar vs the Canadian Dollar follows suit. With the US economy demonstrating at the very least moderate growth, particularly with automobile sales, the BOC does not need to do anything. Because of the strong trade relationship, a Fed Funds increase is as good as an BOC rate reduction.

The RBA has a more complicated decision, but the result might be the same. Commodity indexes are still falling or at best bouncing off lows. The problem for Australia is external demand for ore and oil. Further rate reductions will have very little impact on that, if any at all. Also, having a 2.00% policy rate gives the RBA more leverage to stimulate the economy if needed. Hence, it seems unlikely that the RBA would reduce at the 1 December meeting, ( but the possibility shouldn’t be discounted).

With the exception of the US and UK, most advanced economies have very low to outright negative rates. With a 175 basis point spread of the RBA Cash Rate over the BOC cash rate with no changes expected, it simply makes ‘more sense’ to sell the latter and buy the former.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.