The last week has seen the Australian dollar fall very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200. This has resulted in a new multi-year low near 0.7850 in the last day. A couple of weeks ago it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. A few weeks ago it drifted lower to a then multi-year low near 0.8030 before rallying higher. That low has now been broken over the last week and the area around 0.8000 to 0.8050 may now provide some resistance.

The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650. Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory.

It seems a long way away now but the Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

The Aussie dollar’s slide below 80 U.S. cents for the first time since 2009 is being fueled by speculation the central bank will need to reduce borrowing costs from a record low. The Bank of Canada’s surprise interest-rate cut and the European Central Bank’s quantitative-easing program have raised the odds of looser monetary policy in Australia. Traders on Thursday saw a 40 percent chance the Reserve Bank of Australia will cut rates at this year’s first policy meeting on Feb. 3, up from 25 percent odds on Jan. 16, according to overnight interest rate swaps. Currency traders turned the most bearish on the Aussie in more than a year, options show. While Australia’s central bank has kept its key rate at 2.5 percent for 17 months, the benchmark is at least 1.25 percentage points higher than any other major developed economy outside New Zealand. Australia has been struggling with the end of a once-in-a-century resources boom and a slowdown in China, which buys more than 35 percent of its overseas shipments.

(Daily chart / 4 hourly chart below)

AUD/USD January 26 at 21:45 GMT 0.7920 H: 0.7933 L: 0.7858

AUD/USD Technical

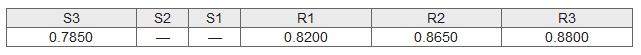

During the early hours of the Asian trading session on Tuesday, the AUD/USD is trading in a narrow range around 0.7920 after dropping sharply from back above the key 0.82 level down to a new multi-year low near 0.7850. Current range: trading right above 0.7900 around 0.7920.

Further levels in both directions:

- Below: 0.7850.

- Above: 0.8200, 0.8650, and 0.8800.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.