In the last 24 hours the AUD/USD has enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to a two week high, before easing back towards that level in recent hours. It started this week by slowly easing away from the resistance level around 0.9425 which continues to stand tall and play havoc with buyers. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 a few weeks ago, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. The 0.9220 level has repeatedly reinforced its significance as it is again likely to support price should the Australia dollar retreat further. Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time.

The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

The house price boom shows no sign of cooling despite the onset of winter. Price growth in almost all capital cities in the three months to June has helped the median Australian house price soar almost 11 per cent in just 12 months. Sydney is leading the surge, where the median house price climbed by more than $100,000 in the year to June, or 17 per cent, to hit a record $812,000. Melbourne recorded 10 per cent growth to $608,000, according to the latest report from Australian Property Monitors (APM). June quarter prices showed capital city housing markets are showing no signs of slowing down, APM senior economist Dr Andrew Wilson said. "Most capital cities are maintaining or exceeding the solid to strong prices growth levels recorded during the previous quarter," he said. "Other leading indicators of housing market activity such as home loan activity and auction clearance rates point to continued solid buyer activity through 2014." Canberra was the only capital city not to have an increase in house prices in 2013/14, dropping by 0.5 per cent to a median price of $576,000. Despite strong growth in median house prices, unit prices were more varied. Sydney's 13.3 per cent growth did pull the national average up to 8.3 per cent, but Brisbane, Canberra and Hobart all fell.

(Daily chart / 4 hourly chart below)

AUD/USD July 24 at 00:30 GMT 0.9437 H: 0.9462 L: 0.9436

AUD/USD Technical

During the early hours of the Asian trading session on Thursday, the AUD/USD is easing back towards the key 0.9425 level after enjoying a solid 24 hours which saw it surge higher through the resistance level at 0.9425 to a two week high. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to well above 0.95 again. Current range: trading below 0.9400 around 0.9390.

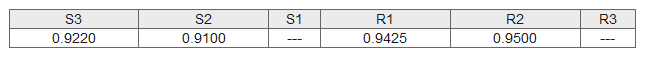

Further levels in both directions:

- Below: 0.9220 and 0.9100.

- Above: 0.9425 and 0.9500.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.