The last few weeks has seen a strong decline for the Australian dollar moving from close to 0.94 down to near 0.87 and an eight month low in the process. In the last day or so it has taken a breather just above 0.87. A couple of weeks ago the Australian dollar found some much needed support at 0.8950 and rallied back up to just shy of the key 0.90 level before resuming its decline. The long term key level at 0.90 was called upon to desperately provide some much needed support to the Australian dollar, which it did a little a couple of weeks ago, however it has more recently provided resistance. Several weeks ago the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory.

The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year.

Australian house prices flattened in September after the strongest winter gains in seven years. A daily home value index for mainland state capitals compiled by RP Data and CoreLogic was down 0.3 per cent in the first 26 days of September, compared with the average for all of August. But the trend picked up late in the month, making a “relatively flat” result likely for the month as whole, RP Data research director Tim Lawless said. “The first month of spring has seen housing market conditions remain buoyant with clearance rates consistently above the 70 per cent mark on a weighted capital city basis and agents continuing to report strong housing market activity,” he said. “From a valuations perspective we have seen a flattening in the rate of capital gains over the month of September.” The September result would bring the three-monthly growth rate for prices back to about 2.5 per cent, a “healthy reduction” from growth of 4.2 per cent over the three months to August, Mr Lawless said. “With the debate around sustainability of dwelling values heating up, the softer September result should be viewed as a welcome evolution in the housing market, although it remains to be seen whether these softer conditions will persist throughout the rest of Spring.” The final figures for September, which will include data for smaller capitals and regional areas, are due for release on Wednesday.

(Daily chart / 4 hourly chart below)

AUD/USD September 29 at 23:40 GMT 0.8720 H: 0.8722 L: 0.8715

AUD/USD Technical

During the early hours of the Asian trading session on Tuesday, the AUD/USD is trying to edge higher back up to the 0.88 level, after falling down even further to finish out last week. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to near 0.95 again earlier this year. Current range: trading right around 0.8720.

Further levels in both directions:

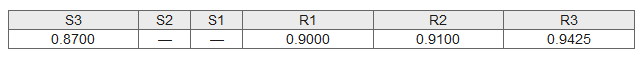

- Below: 0.8700.

- Above: 0.9000, 0.9100 and 0.9425.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.