On Friday, the dollar traded with a negative bias going into the US payrolls release as investors clearly avoided USD long positions after Yellen’s soft comments. The payrolls were strong, but close to expectations, while the ISM and Michigan consumer confidence were stronger than expected. Every attempt to rally intraday ran into dollar selling. What cannot go up, must come down. The price action reflects the negative sentiment surrounding the dollar. The inverse correlation between the dollar and oil didn’t work either on Friday. EUR/USD closed just below 1.14, little changed versus Thursday, but off the intraday highs around 1.1435 and closing in on major resistance. USD/JPY fell even below the 112 handle and closed near 111.70, once again approaching the sell‐off lows around 110.70.

Overnight, an initial attempt to push the dollar further down in the Asian session failed, even as USD/JPY trades currently still at 111.54, 20 ticks off the opening quotation. No major news for the FX. The dollar decline may have been due to comments of the New Zealand PM who said that Yellen confined him she is in no hurry to raise rates. No major eco releases in Asia, but oil remains weak and tests first key support at $38.32/barrel. Copper is weak too. The Aussie dollar (0.7630) trades slightly lower on modestly weaker local data. EUR/USD trades little changed at 1.1385. The trade weighted dollar is virtually unchanged. Asian equities are narrowly mixed. US Treasuries are nevertheless 6/32 higher, likely due to the ongoing oil weakness.

Today, the eco calendar contains mostly second tier releases and that remains the case later this week. In EMU, there might be some attention for PPI inflation and the unemployment rate (see fixed income section). However, markets usually don’t react much and/or in sustainable way to the reports. Similar in the US, the NY ISM and the factory orders probably won’t have much impact. Regarding the speech of Praet, he is close to ECB president Draghi and often gives important guidance about future policy. Inflation expectation have gone down again since the last ECB meeting and the euro has strengthened across the board but especially against dollar and sterling. This works against the ECB attempt to push inflation up. So, will Praet try to talk the euro down? Key resistance versus the USD looms and a break would be unwanted.

Over the previous days, the dollar was hit hard after the soft Fed comments.

So, substantial Fed softness is already discounted in US bond markets and in the dollar. That said, EUR/USD broke a first key technical level, suggesting ongoing underlying USD weakness, which was reflected in the inability to gain on strong US eco data Friday. Therefore, we remain cautious on the dollar and want to see signs of resilience before considering USD long positions.

After the March dovish ECB and FOMC meetings, the dollar was sold and EUR/USD broke above the 1.1200/1.0810 range. The 1.1376 resistance was extensively tested and broken after soft comments from Yellen extending the EUR/USD rally to an intra‐day high of 1.1438 on Friday. The pair now approaches the 1.1495 resistance, the key line in the sand medium term. The soft Fed approach pushed USD/JPY temporary below the 110.99/114.87 range. The move was countered by warnings from the BOJ. However, on Friday after strong US data and constructive US equities, USD/JPY was heavily sold and is now about only 1 yen above the range bottom, presumably defended by the BOJ. Unless risk sentiment turns outright negative we belief the range bottom may stay intact. However, a test is no longer excluded and a drop below 110 may trigger a wave of dollar selling (see graph).

EUR/GBP spurts to new highs

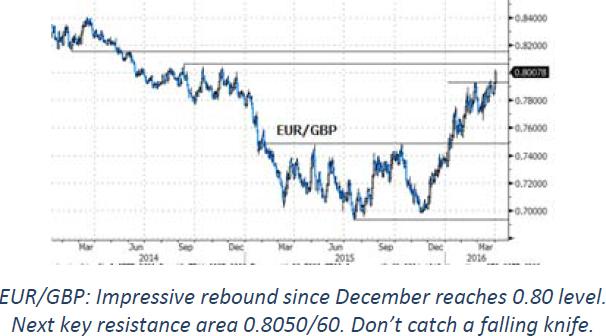

On Friday, sterling was again on the defensive due to lower oil prices, modestly weaker than expected UK manufacturing sentiment and a technical break higher in EUR/GBP. Of late, negative global risk sentiment associated with lower oil often put sterling under pressure and this was again the case. Mid‐morning, the UK manufacturing PMI rebounded marginally less than expected. This deviation was insignificant, but nevertheless put sterling under extra downward pressure. It tells more about the (weak) underlying sterling sentiment than about the data. EUR/GBP lost ground from the European opening to mid‐US trading session. It closed near the 0.80 level (0.7925 previously), while Cable traded also poor, finishing at 1.4227 from 1.4360 previously.

No key data today: Sentiment to drive price action

The technical picture of EUR/GBP improved further as the pair broke above 0.7929/31 resistance. EUR/GBP marched higher since December (0.70) without significant corrections. It closes in on the 0.8050/60 resistance area (H2 2014 highs) and erased the steep early 2015 losses. We never try to catch a falling knife and remain cautious on sterling longs. The Brexit referendum is still about three months away and more sterling rate support is unlikely to be forthcoming soon. Even a better services PMI (on Tuesday) wouldn’t be a guarantee for a sustained sterling comeback. The outlook for Cable is a bit more mixed, as dollar sentiment is also weak. The broad sideways range with boundaries between about 1.38 and 1.46 is still intact. Intermediate support stands at 1.4050/60.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.