Outlook:

Everyone expects the market to be thin and choppy today, with most of Europe on holiday for May Day. But London and New York are open, and those are the top FX trading centers and top centers for equities, oil and gold, too. And traders have good reason to pay close attention. As noted above, the euro is overbought. The last time the euro was this overbought was Friday, April 3—and the correction started promptly the following Monday. Then we had an intermediate high on Friday, April 17—and a correction ensued the following Monday. We didn’t get this pattern last Friday, April 24, because that time the correction started early, on the Friday. But it was short-lived. By Monday morning in the US, traders were willing to bet on the euro (or rather, to bet against the dollar) ahead of the GDP and Fed.

So, if we were to see a euro pullback starting today, we would guess it’s because of the technicals—RSI screaming “overbought”--coupled with expectations of good US data to come. First quarter GDP and the nervous-Nellie Fed are behind us. Everyone expects a good Q2, and yesterday’s data points that way, too. And next Friday we get April payrolls, which often boosts the dollar by mid-week. So this Friday, we could see the correction begin, or we may have to wait for Monday, but a correction is coming.

First up is the PMI and then the ISM manufacturing index, forecast up to 52 in April from 51.5 in March, according to the Bloomberg survey. We also get auto sales and the University of Michigan consumer confidence, but ISM manufacturing is the biggie. If manufacturing is recovering, jobs and wages might be recovering, too. Yesterday analysts found the wage data encouraging--private sector wages rose 2.8% y/y, from 1.7% a year ago and 1.9% average in 2013.

One analyst told Market News that another measure of personal income is “real disposable personal income” and that is up 6.2% annualized, leading to rosy forecasts for consumption. And consumption drives the US economy. The WSJ says it may be a long-awaited turnaround—with total salaries and benefits up 1.2% q/q and 4.4% y/y, “labor’s share of gross domestic product to 53.6%, continuing a gradual improvement since hitting a 63-year low of 52.4% in late 2013.” To pose wage gains as “labor vs. capital” is really dumb, though.

It’s conceivable that we will stop looking backwards at a crummy Q1 and start looking forward to a bright Q2—the seasonal cycle we have been seeing of late. The cherry on top of a change in sentiment is probably next Friday’s payrolls. We got sucker-punched by super-bad numbers in March, only 126,000 jobs after 240,000 the month before and an average over the previous year over 200,000 per month. Jobs were lost in 31 of 50 states, led by the energy sector. We need some of the drop in energy prices and related job losses to fall off the month-over-month and year-over-year data, or at least stabilize.

The logical deduction is that if economic data is good, starting with ISM and ending with payrolls a week from today, the bond gang will continue to hold the 10-year yield over 2% and maybe push it up some more. Rising yields are consistent with good economic data that points to the Fed getting over the heebie-jeebies. It’s even possible that by end-June, the September rate hike date will have become written in stone and folks will be talking again about the pace of increases. We have been neglecting the many warnings from Feds that even after the first hike, the pace of later hikes is likely to be tortuously slow. Nothing can change that except stupendously good data.

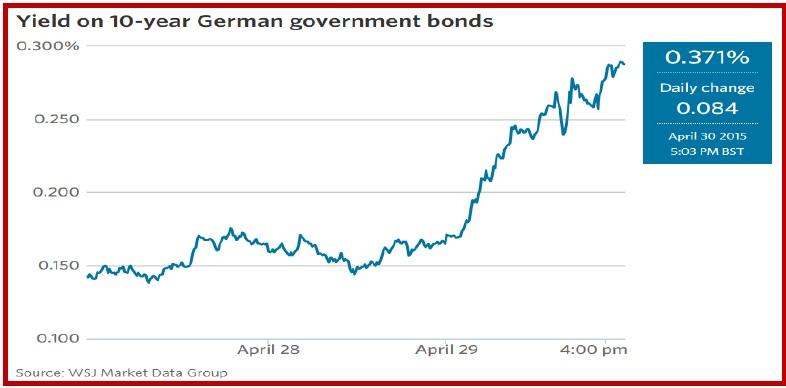

Meanwhile, the ECB shows no sign of retreating from its QE plans (to end-2016), whatever the data. This makes the massive sell-off in Bunds over the past two days a mystery. The yield zoomed from 0.16% to 0.37% in just over 24 hours late yesterday. See the chart. Why? The WSJ says it’s a combination of “patchy liquidity and crowded positions.” Commerzbank goes so far as to call it a flash crash. But as the WSJ notes, bad liquidity exacerbates a move but doesn’t cause it. What causes it is an expectation of a shortage of paper to buy when a giant new source of demand emerges—the ECB. So, with traders already loaded with Bunds, any effort to lighten up can move the market disproportionately. Also, managers are unwinding swaps to go for the Bund itself—since the ECB is buying Bunds, not swaps. And finally, managers want to shift shorter on the yield curve, selling the longer maturities for the shorter ones.

So what happened to forecasts of even the mighty Bund going to zero or negative yield? We need the yield spread to get to 250 points and be seen to be holding that spread in order for the differential to provide lasting dollar support. Today the spread is 171 points, even though the US note is yielding 2.07%, because the Bund yield went up so far. It doesn’t much matter whether the widening spread is due to Bund yields falling or US yields rising, although rising US yields contain a lot of embedded information about growth and inflation expectations. There is a whiff of sentiment that the bond boys have underestimated the economy and the Fed—not that the long end will explode, but bad data will no longer have an outsized effect. As for the story that the Bund yield is higher because managers and investors expect higher inflation, or at least an end of deflation—poppycock. The ECB has only just begun QE. Data might be better because it’s less bad but that’s not the same thing as looming inflation.

Finally, let’s not downplay the holiday effect. Japan was technically open today but the Golden Week holiday closes it down until next Thursday. Europe is on holiday today and London on Monday. Tuesday everyone will be slow to get up to speed again. If we don’t get normal participation until next Thursday, that gives us only one day to prepare for payrolls. Yikes!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.