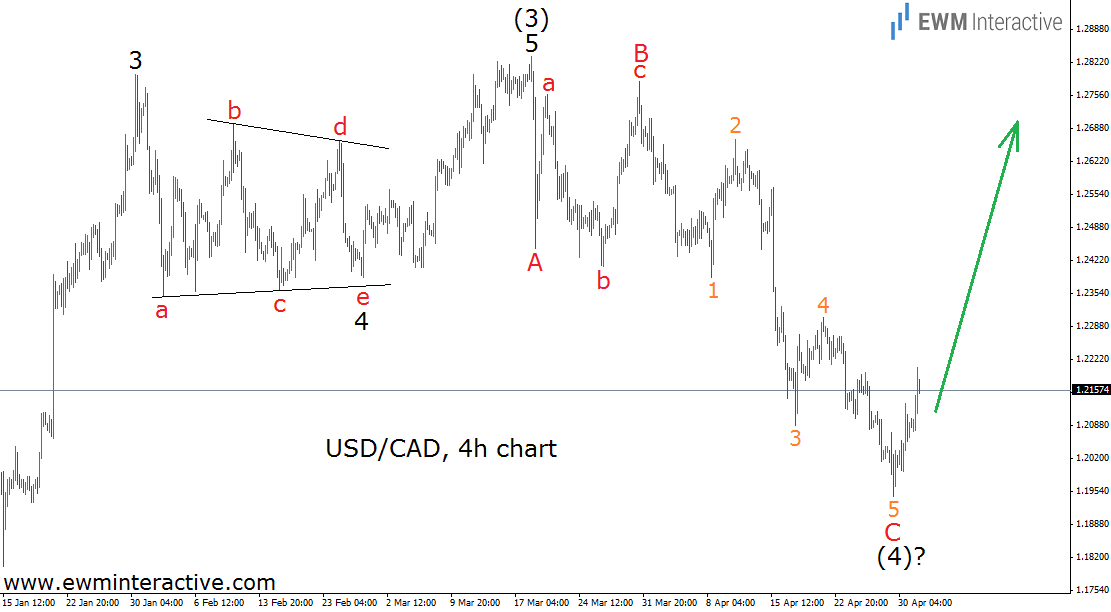

April was not the best of months for the bulls on USDCAD. Not only the March top of 1.2835 remained untouched, but the pair fell much lower to 1.1945 last week. What to expect from now on? Should the buyers abandon ship? Well, the Elliott Wave Principle suggests things are not that bad, because the larger uptrend is still in progress. However, it has to be looked at from the proper angle. The weekly chart of USDCAD can help.

According to the theory, trends move in five-wave sequences, called impulses. As you can see, the impulse in USDCAD is not complete yet. It appears to be in wave (4) of III, which means wave (5) to the north should begin soon. In addition, fourth waves tend to retrace around the 38.2% Fibonacci level of the third wave. This is exactly where the bulls on USDCAD decided to wake up and form that nicely-looking hammer weekly candle you see on the chart. But let’s go deeper into the wave structure to gain a more precise outlook.

In order to be qualified as a correction, the decline from 1.2835 to 1.1945 has to consist of three waves. And it does. USDCAD has drawn an A-B-C zig-zag, where wave B is an expanding flat correction. That is why we can prepare for a significant recovery in the near future. However, this three-wave decline might turn out to be just wave (A) of a wave (4) triangle. Nevertheless, the bears are not supposed to test 1.1945 again any time soon.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.