Are ya lookin’ for an economic release to trade? If yes, then you’re in luck since the U.S. is gonna be releasing its advanced Q2 2015 GDP estimate at 1:30 pm GMT this Thursday (July 30). So gear up by reading up on the latest edition of my Forex Trading Guide.

What is this report all about?

If you didn’t sleep through your high school economics class (shame on you if you did), you already know that the GDP or Gross Domestic Product is the most comprehensive gauge of economic performance within a country’s borders, which is why it’s very important to forex traders and decision-makers alike.

The U.S. usually issues three GDP estimates for three times the fun: the advanced reading, the preliminary reading, and the final reading. The upcoming release is the advanced reading and as the name implies, it is the market’s first glimpse of the U.S. GDP, so it usually generates a lot of volatility in the forex market, especially among dollar pairs.

How did forex traders react last time?

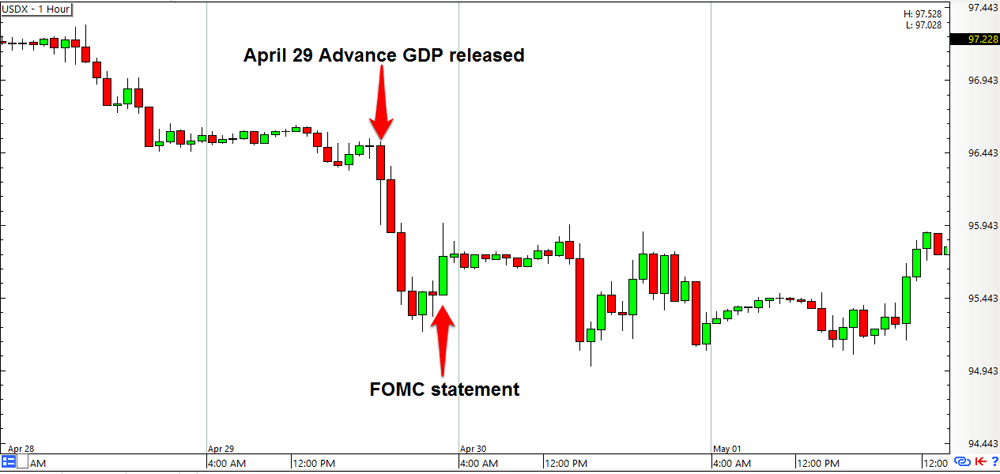

The advanced estimate for the Q1 2015 GDP disappointed forex traders everywhere (except for those who were shorting the Greenback) as the U.S. economy only printed a 0.2% growth, which was a far cry from the expected 1.0% growth and the previous quarter’s 2.2% expansion.

Due to the economic slowdown, expectations for a June Fed rate hike were crushed and doubts began to arise on whether or not the U.S. central bank would hike rates within the year, which is why forex traders dumped the Greenback pretty hard. The selloff only lost steam when the FOMC’s statement began to loom ever closer, leading some forex traders to cover their shorts ahead of the top-tier event.

As a side note, there was little seller follow-through after the FOMC statement because policymakers revealed that they’ve already seen the economic slowdown coming. More importantly, they attributed the slowdown to “transitory factors” that would be shrugged off soon, so the Committee remained open to hiking rates and most forex traders clapped their hands and supported the Greenback.

What’s expected this time?

The general consensus among market analysts is that the U.S. economy grew by around 2.5% in Q2 2015, a significant rebound after the disappointing Q1 GDP, whose third and final reading was a revised 0.2% economic contraction. According to the U.S. Bureau of Economic Analysis (BEA), the Q1 contraction “primarily reflected negative contributions from exports, non-residential fixed investment, and state and local government spending.”

In her July 15 testimony before the U.S. Congress, Federal Reserve Chairperson Janet Yellen stated that the “available data suggest a moderate pace of GDP growth in the second quarter” as “transitory factors, including unusually severe winter weather, labor disruptions at West Coast ports, and statistical noise” are “dissipated.” We’ll see, shall we?

How could the Greenback react?

As usual, the U.S. dollar is expected to appreciate against its forex rivals if the actual reading beats market expectations and might depreciate if it fails to meet expectations. Very short-term plays based on the market’s knee-jerk reaction to the data could still be viable, but longer-term plays would probably be harder to pull off because the BEA announced that the upcoming GDP estimate coincides with the annual revision process. This means that the GDP readings from all the way back in 2012 until Q1 2015 would be recalculated to reflect the most accurate data available and could possibly yield better or worse readings.

This means that forex traders will have to take any revisions and the overall GDP trend into account, which could promise greater volatility. But if the revisions continue to support a future rate hike, then we can probably expect more buyers than sellers.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.