Political developments in UK over the weekend heightened fears of Brexit and kept Cable under pressure throughout yesterday’s European session. The offered tone around GBP was accompanied by unwinding of dollar shorts in the NY session after Fed policymakers, via their mildly hawkish comments, indicated a possibility of sooner than expected rate hike.

As early as last week, Fed killed rate hike bets by stating it now sees only two rate hikes happening this year. However, within one-week Fed policymakers are out on the wires talking up rate hike bets. Fed’s Williams downplayed soft inflation expectations and said rate hikes could happen soon (April/June) given the encouraging data.

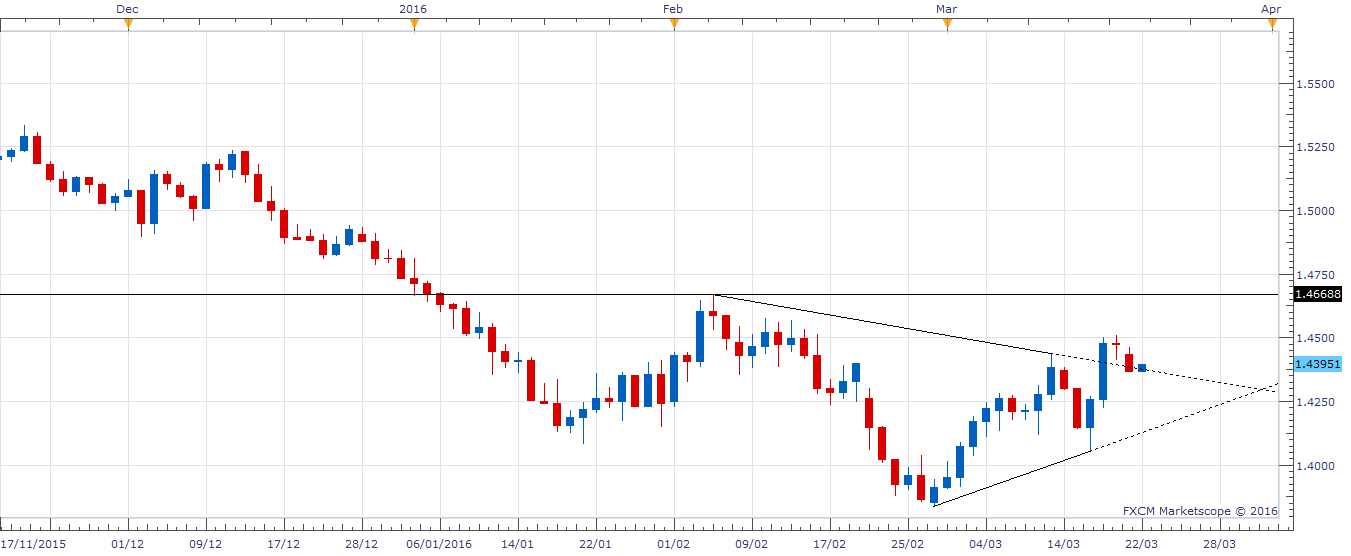

Consequently, GBP/USD closed on a weaker note at 1.4367, which means the spot has re-entered symmetrical triangle formation seen on the daily chart. The currency pair regained poise in Asia, but the momentum looks weak, given it is struggling to cut through 1.44 handle.

Weaker core CPI could hurt Sterling

Cost of living as measured by consumer price index (CPI) is due for release in the UK. The headline figure is seen rebounding 0.4% m/m in Feb. The annualized figure is seen coming in at 0.4%. An upbeat headline figure is welcome news, but the real test would be core CPI, which is seen unchanged at 1.2% y/y.

The headline has been under pressure mainly due to energy price slide and given the recovery in oil in February, a rebound in headline inflation would not be surprising. Hence, core CPI is likely to get more attention. A weaker-than-expected print could push Cable down to 5-DMA support around 1.4338. On the other hand, a combination of strong headline figure and core figure could result in another attempt to cut through offers around 1.45 handle.

Technicals – increased odds of a drop 38.2% fibo support

Sterling’s daily close back inside symmetrical triangle on the daily chart after multiple failed attempts to take out 1.45 hurdle has left the doors open for a drop to 1.4338, which is 38.2% Fibo of 1.4053-1.4515.

Pair breached falling channel seen on 15-min chart during the NY session, but has failed to capitalize on the bullish break and finds itself stuck below 1.44 handle. Repeated failure to take out 1.4394 (5-DMA) would add to bearish tone around Sterling.

A break above 1.4405 (23.6% of 1.4053-1.4515) would shift risk in favor of a re-test of 1.4473 (76.4% of 1.4669-1.3835) – 1.45 levels.

However, fresh bids are seen coming-in only if the spot sees a convincing break above 1.45 handle, in which case hurdles at 1.4533 and 1.4578 could be put to test.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.