GBP/USD Forecast: GBP bulls could opt out due to BOE’s wait-and-watch approach

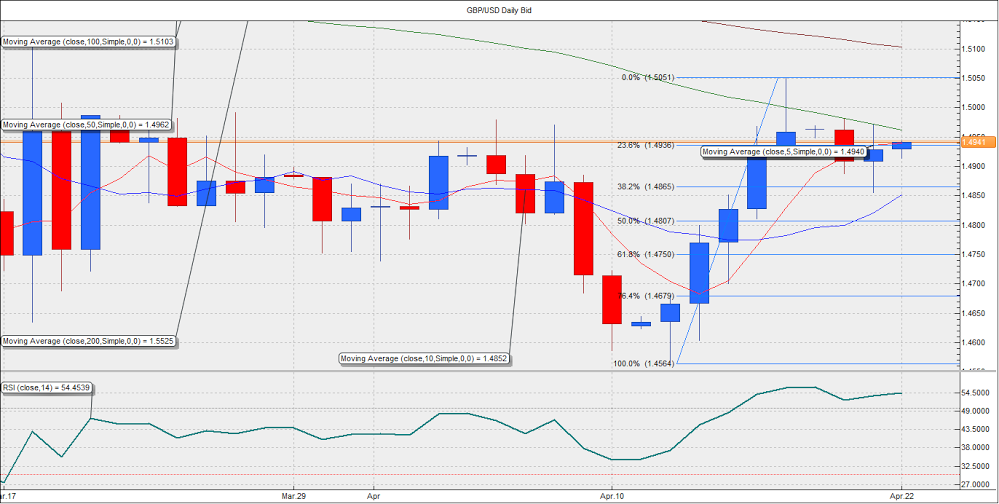

The GBP/USD pair recovered losses on Tuesday to hit an intraday high of 1.4971, whereby the pair ran to sellers. The subsequent losses were capped at 1.4912 levels earlier today. The pair now trades at 1.4937 levels with traders eyeing the Bank of England (BOE) minutes from the April 9th meeting. This will be the last set of comments from the BOE members before the elections. The minutes are widely expected to show a unanimous 9-0 vote in favor of keeping monetary policy unchanged. If the number of policymakers in favor of hiking rates sooner than later increases, the pair could make a fresh attempt at 1.5 levels. However, with GBP at multi-year highs against the EUR, there is a very little probability that policy makers would favor a rate hike this year. The last month’s PMI reports in the UK showed growing concern among industrials regarding the strength in the GBP against the EUR. Thus, it is more likely that the tone has turned more dovish, with policy makers increasingly favoring a wait-and-watch approach. In such a case, the GBP bulls could opt out, thereby taking the pair below 1.4865 levels.

As per technical charts, the 50-DMA located at 1.4962 is likely to act as a strong resistance, since the gains are being capped at the same for two consecutive sessions. Additionally, the 5-DMA at 1.4939 is proving to be a stiff resistance at the moment. Sellers are likely to chip in anywhere till the 50-DMA, a break above which can open doors for an intraday rally to 1.5 levels. On the other hand, failure to sustain above 1.4936 (23.6% Fib retracement of 1.4564-1.5051) could open doors for a re-test of 1.4865 levels. The overall outlook stays bearish till the pair does not confirm a daily close above 1.5 levels.

EUR/USD Analysis: Greece continues to dominate sentiment

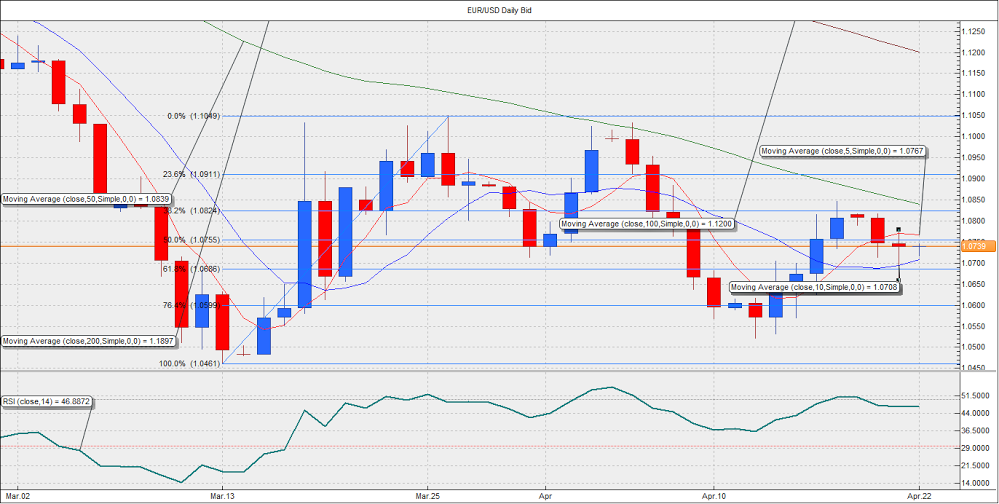

Amid the absence of a major market moving fundamental report, the EUR/USD pair is likely to take cues from the Greek issue. The EUR recovered losses in the previous session after the Greek finance minister Varoufakis said there are clear signs that Greece, and its EU/IMF lenders are likely to reach a deal. However, Germany is likely to refuse releasing additional bailout funds without a credible reform plan. If Greece fails to secure a bailout, the IMF's May 12th payment and the ECB/IMF/Treasury Bill payments in June and July will be at risk. Such an event could weigh heavily on the EUR. Moreover, the uncertainty about the future is quite evident from the German Zew survey released on Tuesday, which showed the future expectations index declined for the first time in six months.

On the charts, the pair is currently stuck at its hourly 100-MA located at 1.0745, with the hourly RSI bullish at 54.58. A break above 1.0755 (50% Fib retr. of 1.0461-1.1050) and 1.0767 (5-DMA) could push the pair higher to 1.0824 levels. On the other hand, a break below 1.0686 (61.85 Fiib retr. Of 1.0461-1.1050) could drive the pair lower to 1.06 levels. Given the absence of a major market moving data, we could see the pair being restricted to a range of 1.0767-1.0686.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.