It has been a relatively rocky ride for the venerable Cable over the past few weeks as the talk of a BREXIT continues to impact the currency. However, despite some of the recent selling, the pair is firmly within the grips of a consolidation pattern that could see some dramatic moves in the week ahead.

Undertaking a technical analysis of the Cable’s 4-Hour chart yields some potentially interesting clues for the week ahead. It is readily apparent that the currency pair has largely been trapped within a slightly bearish consolidating channel since the middle of March. Although the pair has reacted sharply to a range of external shocks, including increased talk of a BREXIT, price action has remained within a relatively tight range. However, some sharp recent selling has seen the pair trend towards the bottom of the range which could indicate a strong move ahead.

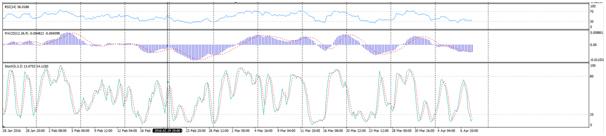

In fact, the technical indicators are showing some interesting signals as the RSI Oscillator remains relatively flat, near over-sold territory, despite the recent price declines. Subsequently, there is some divergence between the indicator and price action that could be indicating a reversal of the short term trend. In confluence with RSI, the stochastic oscillator is also deep within oversold territory which lends further credence to the argument for a short term reversal.

Subsequently, there is plenty of scope for the entry of a long position above the key 1.4170 resistance level. Alternatively, a break below the 1.40 handle would indicate a sharp push towards the bottom of the channel is likely. However, be aware of any short side move as the Risk/Reward ratio is not advantageous.

Ultimately, the Cable’s forward trend is likely to wait upon the UK Manufacturing Production results before making a strong move. However, given the recent collapse in the pair’s value, the downside might be relatively limited. Subsequently, the most likely scenario is a sideways consolidation at the current level before a challenge of the 1.4170 resistance level.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.