I love the silver market. If you read my articles you can understand why, because when it comes to the technical side of things it loves to play along and has done so for some time.

In the current period silver has been going through a strong technical pattern of consolidation. This has been after a steep down trend over the previous months, where a lot of metal traders took full advantage of the situation. The reason for this down trend was the appreciation of the USD and the outlook remaining positive for the US economy – nothing keeps the speculators further away than a booming economy for a change.

With a ceiling at 17.55 and a floor at 17.07, the markets will be eyeing up the possibility of a fall below the 17.07 level, a solid bearish candle below this level could bring the bears back into the market to swipe down silver once more. This is not something that is unreasonable either when you think about it, despite some recent US woes the labour market and consumer sentiment is still very strong. The prospect of rates is ever more increasing as a result.

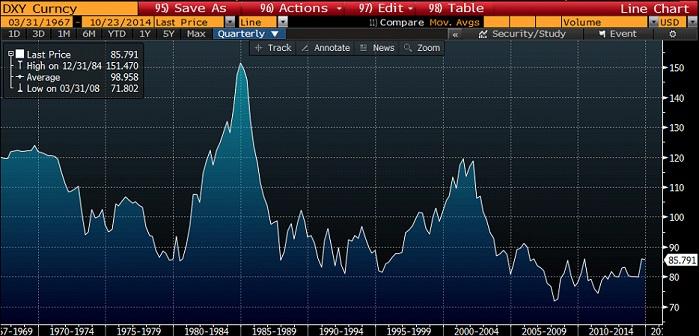

To put it in an even better perspective long term; we have seen the dollar index well below its average against other trade weighted indexes. This is unlikely to remain the same in the long term as other currencies look to devalue themselves in an effort to stimulate their economies. In the long term metals will likely fall against the US dollar as a result.

Overall, silver in the long term looks likely it will drop further and it is just a matter of time. In regards to justification, I look fundamentally to the US dollar strengthening and demand for precious metals tapering off further. From a technical point of view we have seen silver consolidate a few times before a large drop, and this looks no different.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.