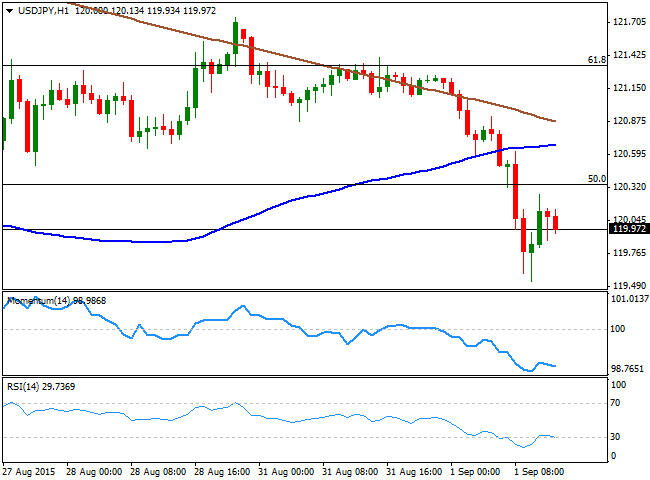

USD/JPY Current price: 119.97

View Live Chart for the USD/JPY

Fresh lows below 119.35 now eyed. The USD/JPY pair fell down to 119.54, over 150 pips below its daily opening as risk aversion spurred yen demand. The pair bounced from the level on dollar's mild recovery, but is having a hard time to regain the 120.00 level, maintaining an overall negative tone while trading within key Fibonacci levels. The 1 hour chart shows that the price accelerated lower after breaking below its 100 and 200 SMAs, whilst the RSI indicator is heading back south around 30 after correcting the extreme oversold readings reached with the European opening. In the 4 hours chart the price has fallen further below a bearish 100 SMA, whilst the technical indicator maintain their strong bearish slopes well into negative territory, supporting additional declines on a break below 119.35, the 38.2% retracement of the last two weeks decline, and the immediate support. The upside is now being limited by the 50% retracement of the same rally at 120.35, where the pair has stalled its recovery several times by the end of last week.

Support levels: 119.70 119.35 118.80

Resistance levels: 120.35 120.60 121.00

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.