EUR/JPY

The dollar traded higher against most of its counterparts during the European morning Wednesday, recovering a large portion of yesterday’s losses following the disappointing retail sales data. The greenback was lower only against NOK and JPY, while it traded virtually unchanged against AUD. The main losers were EUR, GBP and SEK.

The euro depreciated the most against the dollar ahead of the ECB policy meeting, where President Draghi is likely to say that officials are planning to continue the easing programs as scheduled as risks to growth remain and inflation is subdued. This would banish talk that the Bank might start scaling back its asset purchases sooner and remove that upside risk to EUR/USD. Draghi may also get questions with regards to Greece’s debt problems. EUR/USD fell below the 1.0600 support (now turned into resistance). A dovish stance by Mr. Draghi is likely to encourage the bears to pull the trigger for the psychological zone of 1.0500, I believe.

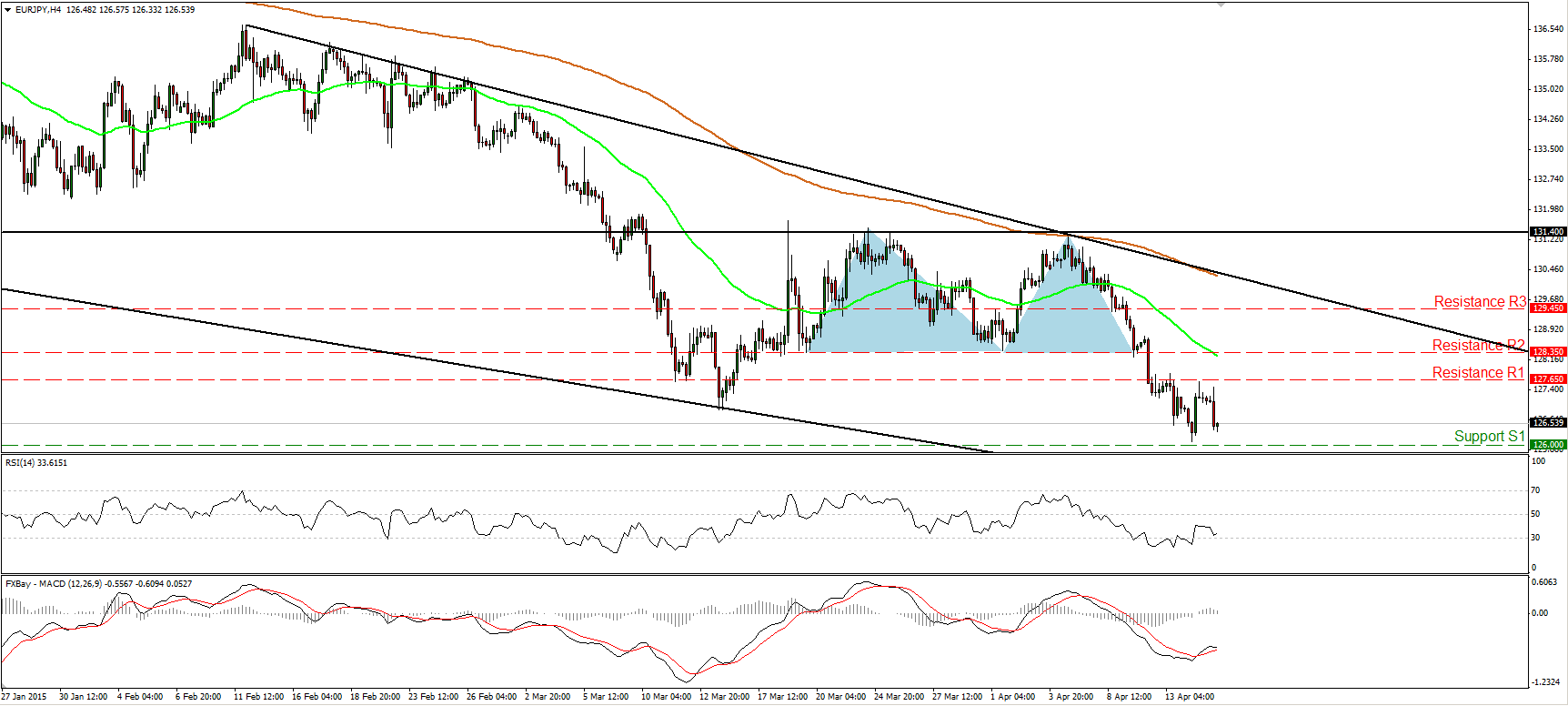

EUR/JPY fell sharply after hitting resistance at 127.65 (R1). Currently the rate is headed towards the support area of 126.00 (S1), where a clear break is likely to pave the way for the psychological territory of 125.00 (S2), also marked by the low of the 13th of June 2013. After failing to break above the strong hurdle of 131.40 on the 6th of April, the rate started sliding and the break below 128.35 (R2) signaled the completion of a double top formation. Consequently, I believe that the short-term bias is to the downside. Our daily momentum studies support my view and amplify the case for further declines. The 14-day RSI slid after hitting resistance at its 50 line, while the daily MACD, already negative, has peaked and fallen below its trigger. As for the broader trend, I still see a longer-term downtrend. EUR/JPY is printing lower peaks and lower troughs below both the 50- and the 200-day moving averages.

Support: 126.00 (S1), 125.00 (S2), 123.85 (S3).

Resistance: 127.65 (R1), 128.35 (R2), 129.45 (R3).

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.