![]()

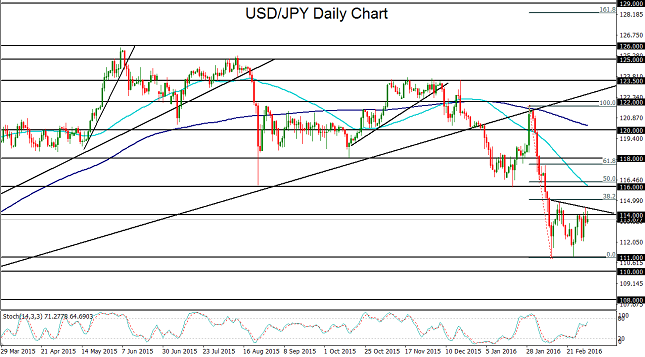

During the course of the past three weeks, USD/JPY has plunged to establish a 15-month low around 111.00 support, re-tested that support level to form a potential double-bottom technical pattern, and then fluctuated in a consolidation above those lows. Currently, the currency pair has struggled to climb towards the top of this consolidation, but has been impeded both by technical resistance as well as a continuing sentiment of caution in the global equity markets.

This sense of caution lingers despite a recent resurgence in stocks. USD/JPY tends to track stock indices relatively closely due in part to the role of the Japanese yen as a “safe haven” currency. As such, higher stock index prices often tend to result in a higher USD/JPY, and fear-driven drops in stocks tend to pressure USD/JPY due to capital being drawn back towards the safety of the yen. Recently, this positive correlation can readily be seen in the coordinated free falls of both stocks and USD/JPY during the first half of February.

After that early February plunge, USD/JPY began to stabilize and consolidate due to a general rebound in the equity markets that was driven to a large extent by a moderate recovery in crude oil prices. As noted, however, this rebound has proceeded in a cautious manner, and any return to recent market volatility could potentially send USD/JPY plummeting once again.

What could limit any overly dramatic plunge, however, is the potential for a currency intervention by the Bank of Japan, which has a consistent aim of curbing unwanted appreciation of the yen. But uncertainty remains as to how effective such an intervention may actually be and at what USD/JPY level an intervention might be initiated. In any event, intervention could have the effect of limiting any extensive rise in the yen (or drop in USD/JPY).

This Friday’s US Non-Farm Payrolls (NFP) report for February should also play a key part in guiding the near-term direction of USD/JPY. Because of its potential role in helping to shape the Federal Reserve’s decisions on implementing future interest rate hikes, the NFP employment data may prompt a substantial move for both the US dollar as well as the equity markets, which could then have a significant impact on USD/JPY.

Any NFP reading significantly above the consensus expectation of 195,000 jobs added could likely boost both the dollar and stocks, which could then cause USD/JPY to break out above its current resistance and target the key 116.00 resistance level. This would bring the currency pair back up to approach its 50-day moving average, as well as confirm the noted double-bottom pattern for a renewed bullish outlook. Conversely, a worse-than-expected reading should pressure both the dollar and stocks, which could then have the effect of pushing USD/JPY back down towards its noted double-bottom lows around 111.00 support. With any further breakdown below 111.00, which would confirm a continuation of the medium-term downtrend, the next major targets to the downside reside at the 110.00 and then 108.00 support objectives.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.