![]()

After residing in traders’ doghouses throughout all of last year, everyone’s favorite yellow metal has been on much better behavior thus far in 2016.

As we’ve noted before, the price gold is determined by the interaction of supply and demand, as with any commodity. While the supply of gold is relatively predictable in the short term, the demand for gold is not driven by the conventional industrial demand that drives most commodities. Instead, gold demand is driven primarily by its attractiveness as an investment, which is in turn driven by real interest rates and the value of the US dollar.

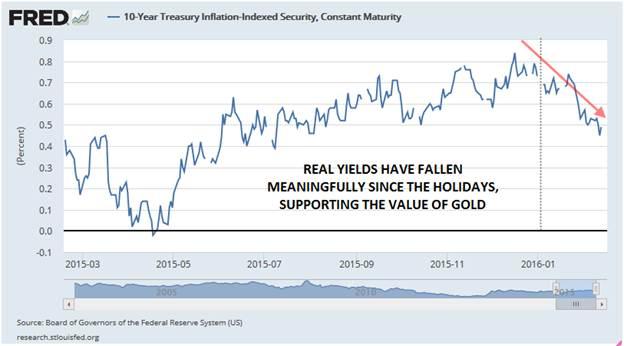

Fundamental Driver #1: Real Interest Rates

Real interest rates simply represent the opportunity cost of holding gold. When real interest rates are low, investment alternatives like cash and bonds tend to provide a low or negative return, pushing investors to seek alternative ways to protect the value of their wealth. On the other hand, when real interest rates are high, strong returns are possible in cash and bonds and the appeal of holding a yellow metal with few industrial uses diminishes. Beyond the opportunity cost of holding gold, interest rates also play a role in the cost of funds when buying gold on margin, as many traders do. One easy way to see a proxy for real interest rates in the United States, the world’s largest economy, is to look at the yield on Treasury Inflation Protected Securities (TIPS).

Fundamental Driver #2: The US Dollar

The other major fundamental driver of gold prices is the US dollar. Of course, gold is denominated in US dollars on the international market, so all else equal, a decline in the value of the dollar would increase the price of gold in dollars and vice-versa. Beyond this mechanical relationship, the US dollar has also been seen as a bit of a “risk” currency given the (relative) hawkish positioning of the Federal Reserve. Therefore, traders have been selling the greenback and buying safe haven gold as a result of the global market turmoil thus far this year, exacerbating the upside move in gold. As long as these conditions (falling real yields and a weak US dollar) remain intact, gold will continue to shine.

Technical view

Everyone’s favorite yellow metal had a rough start to the week after stalling out in the key 1250-60 resistance zone, but based on the recent price action, we may be back testing that area before long. The metal dipped back down to test key previous-resistance-turned-support at 1195 on Tuesday, but the rally is showing signs of resuming so far today. Meanwhile, the MACD continues to trend higher above both its signal line and the “0” level, showing bullish momentum, while the RSI is holding at an elevated level above its own bullish trend line.

On a longer-term basis though, there is critical resistance in the 1250-60 zone, where two key Fibonacci levels converge (the 61.8% retracement of the drop off the March 2014 high and the 78.6% retracement of the fall from the January 2015 high). In addition, the top of the bearish channel that has contained gold prices since mid-2013 comes in at that same zone, so buyers will need to muster significant strength to break that barrier conclusively.

If gold can establish itself above 1260, further gains toward 1300 or higher are likely in the weeks to come, whereas a drop back below the key 1195-1200 zone would shift the medium-term bias back in favor of the bears.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.