![]()

As anyone who’s had a baby can tell you, regular check-ups and measurements can help assess progress, and with fully 40% of the companies in the S&P 500 (as of Friday’s close) reporting earnings, we wanted to check in on the Q4 earnings season.

So far, this earnings season marks an extension of the same themes that drove the last few earnings seasons, namely falling earnings and sales, weak performance out of the energy sector, continued improvement in margins, and the dramatic impact of the US Dollar.

The earnings and revenue recessions continue…

According to the earnings mavens at FactSet, the “blended” (combining actual results from companies that have already reported and estimated results for companies yet to report) earnings decline is tracking at -5.8% year-over-year, with the blended revenue decline currently coming in at -3.5% y/y. If these results hold, it would mark the third consecutive quarter to show year-over-year declines in earnings and fourth straight quarter of falling revenues. For what it’s worth, analysts do expect earnings and revenue growth to return in the first half of this year, though traders are understandably skeptical until results actually start to improve

Sector breakdown: Running out of Energy…

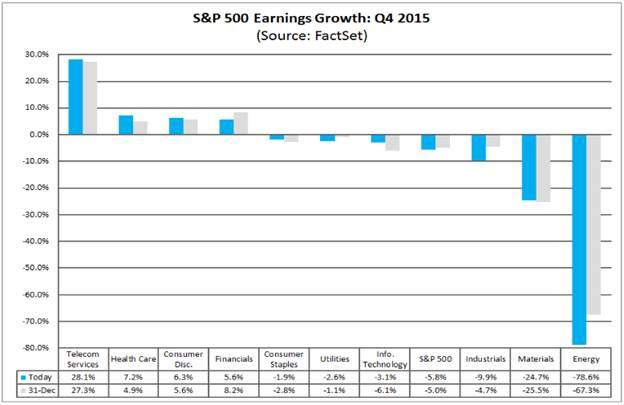

In terms of individual sectors, the energy and materials sectors are leading to the downside. Staggeringly, the energy sector is currently reporting a -78.6% decline in profits from last year, driven heavily by a -35.9% drop in revenues; the equivalent numbers for the materials sector are -24.7% and -14.9%. On the other side of the coin, the Telecom (+28.1% earnings growth and +11.9% revenue growth) and Health Care (+7.2% and +7.7%) sectors are outperforming the broader market’s results.

Margins keep beating expectations…

Of course, it doesn’t take a genius to realize that low oil prices would hurt energy companies’ profits; instead, traders focus on how different companies are performing relative to analyst expectations. On that front, the picture is more optimistic. Overall, 72% of companies have beat earnings estimates thus far, solidly above both the 1-year (69%) and 5-year (67%) averages. However, top-line sales estimates have been notably harder to beat, with only 50% of reporting companies topping analysts’ revenue expectations – this figure is in-line with the 1-year average (50%), but below the 5-year average of revenue beats (56%). In other words, companies continue to cut costs aggressively and exploit accounting gimmicks in order to overcome weak overall global growth.

…And the buck is still king

As has been the case with the last few earnings seasons, the market theme for US large cap stocks has been the strength in the US dollar. Relative to Q4 of last year, the greenback is roughly 11% stronger against its major rivals, using the US dollar index as a proxy. This means that foreign sales at many of the large, multinational firms that make up the index are less valuable when translated back into US dollars than they were at this time last year. In fact, several major companies including Nike, FedEx, and Costco have all cited the dollar as a major headwind. Of course, the precipitous drop in oil prices continues to help some large manufacturing, consumer discretionary, and transportation companies offset the negative impact of the rising dollar.

Looking ahead…

This week will be a critical one for US companies reporting earnings. Nearly a quarter (23.6%) of S&P 500 companies will report earnings this week, including Alphabet (Google) after the bell, which has a chance to surpass Apple as the world’s most valuable company by market cap. Other “heavy hitters” this week include Dow Chemical, Exxon Mobil, Pfizer, and UPS on Tuesday morning; GM, Merck and Yum! Brands on Wednesday; and LinkedIn and Credit Suisse on Thursday.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

GBP/USD bulls retain control near 1.3300 mark, highest since March 2022

The GBP/USD pair trades with a positive bias for the third straight day on Friday and hovers around the 1.3300 mark during the Asian session, just below its highest level since March 2022 touched the previous day.

EUR/USD grapples with higher ground as Fed cuts weigh on Greenback

EUR/USD found the high end on Thursday, holding fast to the 1.1150 level, though most of the pair’s bullish momentum comes from a broad-market selloff in the Greenback rather than any particular bullish fix in the Euro.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.