![]()

Given today’s Japanese bank holiday (Labor Thanksgiving Day), it’s not surprising that the FX markets have gotten off to a bit of a slow start. The performance of the US Dollar has been mixed in Asian and early European trade as traders weigh the sustained uptrend against the lack of new bullish catalysts for the world’s reserve currency. Further complicating matters, many US traders may restrain from meanginful trades ahead of Thursday’s Thanksgiving holiday. While US economic data tomorrow and on Wednesday may inject some volatility to the markets, the overall environment favors potential countertrend pullbacks this week.

One pair that may be particularly vulnerable to a countertrend pullback is EURUSD, which collapsed on the back of some dovish comments from ECB President Mario Draghi on Friday. Draghi’s focus on the Eurozone’s subdued inflation expectations has caused some traders to speculate that the ECB may enact a sovereign QE program as soon as next month (see my colleague Kathleen Brooks’ note “The Dollar Index Takes a Stab at 88.00 Resistance” for more).

That said, EURUSD has stabilized off key technical support at 1.2360 so far today, helped along by a better-than-expected German IFO report in today’s early European session. The monthly survey of German manufacturers, builders, wholesalers, and retailers improved from 103.2 last month to 104.7, beating the expectations of a drop to 103.0. Notably, this marks the first time that the widely-watched index has improved since April, suggesting that the Eurozone economic activity may finally be stabilizing after the precipitous decline in Q2 and Q3.

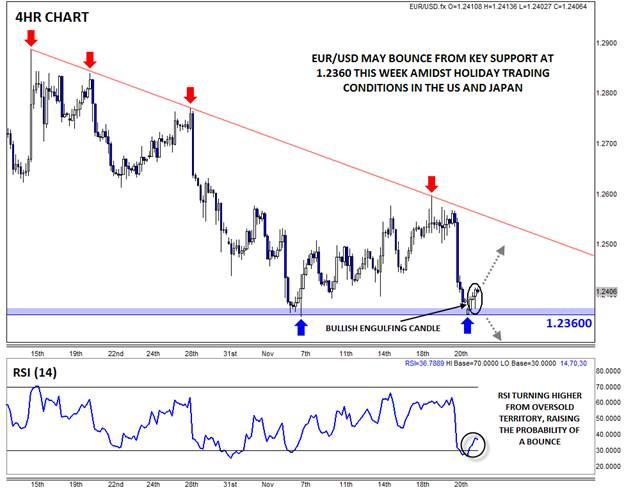

On a technical basis, the pair remains within its longer-term downtrend, though Friday’s big drop has opened the door for a modest recovery within the context of the overall downtrend early this week. Looking at the 4hr chart, the rates carved out a Bullish Engulfing Candle* on the back of the IFO report, showing a shift to strong buying momentum in the near term. In addition, the 4hr RSI has turned higher from oversold territory, marking a potential trough on the chart.

As long as rates stay above horizontal support at 1.2360, EURUSD could bounce back toward its bearish trend line near 1.25 in a potentially slower holiday week. Of course, a break below key support at 1.2360 would suggest that the bears have reasserted control of the market and would open the door for a drop toward 1.2300 or 1.2200 next.

A Bullish Engulfing candle is formed when the candle breaks below the low of the previous time period before buyers step in and push rates up to close above the high of the previous time period. It indicates that the buyers have wrested control of the market from the sellers.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.