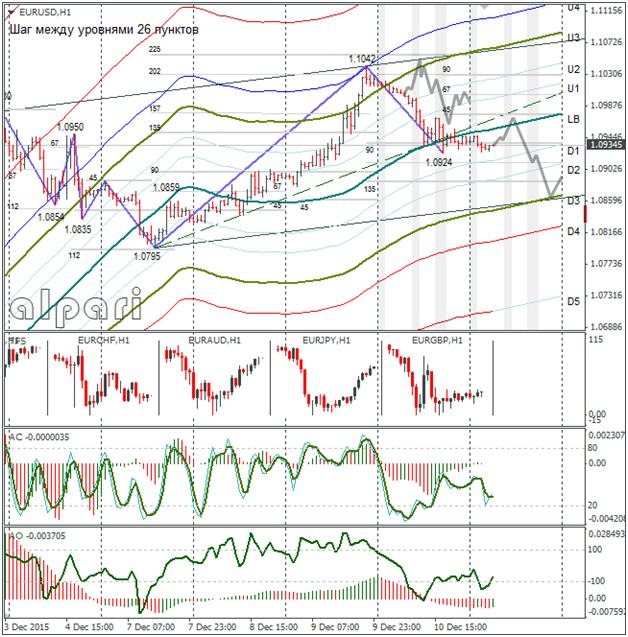

Hourly

Yesterday’s Trading:

The USD on Thursday managed to break its two-day falling habit. The euro/dollar bounced from the LB at 1.1042 to 1.0924. The forecasted data for initial unemployment benefit applications in the US was exceeded and this held back the pair.

The number of for initial unemployment benefit applications in the US for the week ending 05/12 was 282k (forecasted: 269k, previous: 269k).

Main news of the day (EET):

9:00, German November CPI;

11:30, UK consumer inflation expectations;

15:30, US retail sales and producer price index for November;

17:00, US Reuters Michigan December consumer confidence index for December;

On Sunday at 7:30 in China some data will be published on changes in retail sales and industrial manufacturing for November, in addition to data on investment volume in the key funds for October. These are important indicators for currency trading.

Market Expectations:

The pair has been consolidating in a narrow range for 13 hours. I had a look at the different options for Friday: most of them are showing a sharp fall for the euro to the D3. This sort of fall contradicts the daily forecast from the previous idea.

If we make a channel along the three points, 1.0980-1.1042 and 1.0795 (black channel), then the lower limit sits on the D3. We wouldn’t want it to fall below 1.0858, otherwise we will once again see the euro shoot down as the FOMC meeting approaches (16th December). What we get is a wide range forming in which the euro/dollar could remain until the new year.

Technical Analysis:

Intraday target maximum: 1.0971, minimum: 1.0861, close: 1.0890;

Intraday volatility for last 10 weeks: 103 points (4 figures).

On Friday I expect to see the euro cheapen against the dollar to 1.0861. I am a little at odds with myself in saying this, but I will offer one scenario. How else could it go for the euro? A fall to 1.0910 and a ricochet back to 1.1005. As to whether to take a decision on which trade to make, follow your trading rules and signals. The market is changing fast and in an hour the technical picture could be flipped on its head.

Daily

My upward triangle formation is so far being confirmed (read my last euro idea). After a renewal of the maximum, the euro fell. So the pattern isn’t ruined, we need the day to close below 1.0860. Now to the Weekly.

Weekly

I’m continuing to track the forming of a double bottom. The weekly indicators are showing a strengthening of the euro and the daily ones are signalling the death of the bullish impulse. Today is important since any fall in the rate could bring about a bear signal on a pinbar.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.