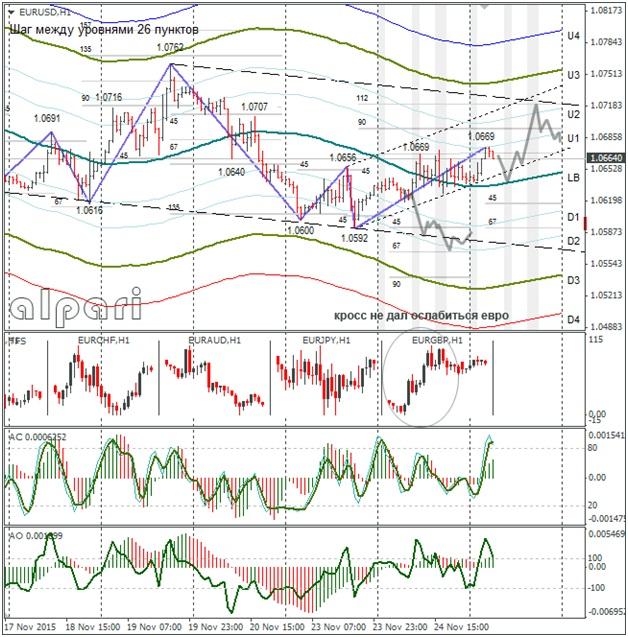

Hourly

Yesterday’s Trading:

On Tuesday, euro/dollar trading closed slightly up. Support for the rate came from euro crosses. The dollar also weakened against the Japanese yen and Swiss franc. They became safe haven assets as geopolitical tensions were ratcheted up; yesterday the Turks shot down a Russian plane. Oil and gold is up and the euro has a positive correlation with these commodities.

US industrial manufacturing for October was down 0.2% (forecasted: 0.1%, previous: -0.2%).

Main news of the day (EET):

15:30, US October data for incomes and expenditure, durable goods orders, initial unemployment benefit applications;

16:00, US September housing index;

16:45, Markit November service sector business activity index;

17:00, October new housing sales.

Market Expectations:

The US Fed published the minutes from their closed meeting on discount rates from 24th November. Two reserve banks requested that the discounted rate remain at 0.75%, one asked that it be dropped to 0.25%, nine wanted to raise the rate by 0.25%. The rate was left where it was but it’s possible that it could be up following the FOMC’s meeting on 16th December.

Europe’s calendar is empty, this means that the market will be working off technical analysis and the price levels of the supports and resistances until the evening. The euro/dollar rate is above the LB. The 1.0600 and 1.0592 minimums can be seen as a double bottom. The target on it is 1.0750.

It’s not worth really trusting my forecast because since 20th November I’ve only been seeing signals which indicate euro growth and it’s not for nothing that I see this: the cycles are showing a strengthening for the euro and on the daily time period there are three downward fractals with bull divergence. I’m not excluding a return of the euro to the trend at 1.0575. The situation is a complete 50/50.

Technical Analysis:

Intraday target maximum: 1.0723, minimum: 1.0635, close: 1.0685;

Intraday volatility for last 10 weeks: 103 points (4 figures).

The euro/dollar is trading by the LB. The market is balanced so the pair is ready to stray from this line.

Daily

I’m just going to repeat myself again here. The cycles are telling me that the bear phase switched into a bull one on 20th November. Bull divergence has formed between the price and the indicators. The inverted price pattern on the hourly also indicated that the euro is to strengthen. These are technical signals, so it’s not worth ignoring them. If the first target of 1.0730 is brought back, its break will lead to another target of 1.0829 being formed. Now to the Weekly.

Weekly

The bulls are trying to break from 1.0592. The weakness of the pound in its cross with the euro has aided the euro bulls. The CCI indicator has flipped downside up, but it is for the moment still below -100. As soon as the line crosses the level, on the daily we will have a signal to leave short positions. The closest target is still at 1.0520.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.