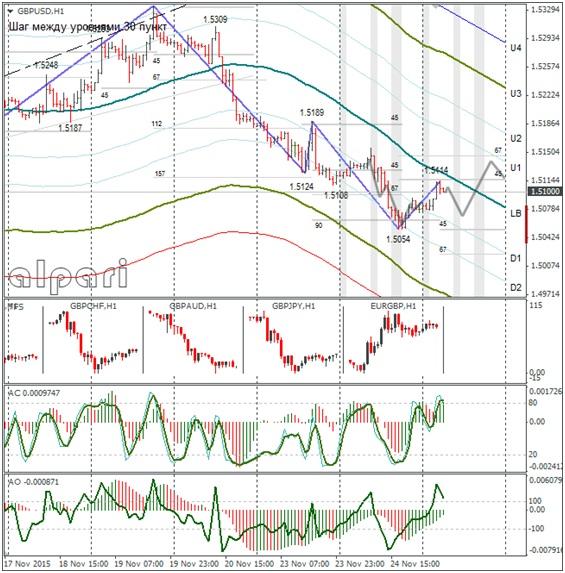

Hourly

Carney and Haldane aided the pound to pass exactly as I forecasted. My euro expectations didn’t come off, since the euro pound cross rose due to active pound sales.

The Bank of England’s Mark Carney announced that the interest rate for the country will remain low for some time. The Bank’s economist Haldane announced that the risk balance for the UK economy and inflation is skewed downwards.

The pound/dollar has fallen to 1.5054. The price in Asia returned to the LB at 1.5114. There is divergence between the AO and the price. The euro/dollar was up on Tuesday. For Wednesday, I’ll risk saying that we’ll see a rise in the pound to 1.5140 after a correction to 1.5070/75.

Daily

On Tuesday I believed we would see the pound fall to 1.5065/75. The GBP rate against the dollar fell to 1.5063. The rebound was right off the support. I don’t expect to see a fall lower since Thursday is a holiday in the US. I think that some traders will want to close their short positions near the support.

Weekly

The 1.5065 level was not passed. I expect to see a strengthening of the pound today before tomorrow’s day off in the US. Then we can once again look for a fall in the rate.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.