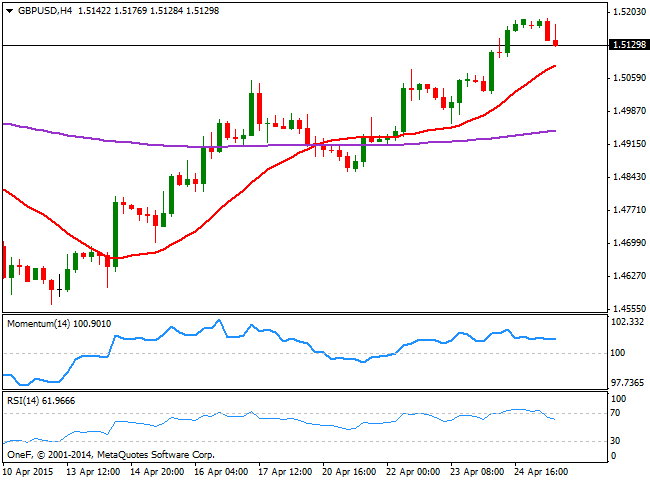

The GBP/USD pair retreated from a daily high set at 1.5189 with the European opening, down to 1.5129 before bouncing some. Nevertheless, the pair trades in the red daily basis, although the technical picture is far from suggesting a stronger decline.

In the 4 hours chart, the price stands above a bullish 20 SMA, currently at 1.5090, whilst the Momentum indicator is horizontal well above the 100 level, and the RSI indicator corrects extreme overbought readings, now around 63. The price may extend its decline down to the mentioned 1.5090 level now, but it will take a price acceleration below it to confirm additional intraday declines towards the 1.5050.

A recovery beyond 1.5150 on the other hand, should ease the bearish pressure, and push the pair back towards the 1.5200 region, with some steady gains above this last suggesting an upward extension up to 1.5250.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.