Introduction

Both AUD and NZD lost approx. 0.7% versus US Dollar and EUR, with Kiwi Dollar following its cousin after comments from RBA Governor Stevens. The central bank chief spoke in Sydney to weigh on AUD by mentioning that the inflation target in Australia was currently below target. Concerns were raised by Glenn Stevens regarding household debt too, leading AUD/USD to reach a low of .7167. The MSCI APAC Index moved lower by close to 0.7% overnight, with stock indices within individual nations in that region all falling too.

Asian Session

Citibank analysts note that retail investors have been notable buyers of AUD/JPY as leveraged names hit AUD/USD and NZD/USD. The cross-currency pair has still moved lower and trades below its 2016 average of 82.86, at 78.39 right now.

Bloomberg notes that Fed Funds Futures are indicating a benchmark interest rate rise in the states for the first time since March. The analysis correctly suggests that similar patterns are emerging in comparison to the market moves after the hike there in December; a strong USD and an equity sell-off.

WTI Crude Oil Futures trade at US$47.84 per barrel, a decline which has weighted upon Malaysian Ringgit. Malaysia is Asia’s only major net exporter of crude oil and as such has an economy impacted by demand. In the European emerging space, eyes are focused on a meeting in Turkey between President Erdogan and the PM-Designate Binali Yildrim.

The day ahead in Europe and NY

GDP figures have been released in Germany this morning and printed bang in line with expectations. EUR/CHF trades at 1.1100 after the aforementioned data release and also the publication of Swiss trade balance data. Further economic data will be released out of Germany in the form of the monthly ZEW survey. This will also print for the continent as a whole.

Elsewhere in Europe, the Swedish unemployment rate will be released at 08:30 BST. Interest rate decisions will take place in both Turkey and Hungary, with The Confederation of British Industry in the UK releases its Distributive Trades Survey at 11:00 BST with Sterling showing some resilience recently.

In the US later, new home sales figures will be published before the opening of equity markets, along with a manufacturing index for May from the Richmond Federal Reserve. Lastly, weekly info. regarding crude oil stocks will be released at 21:30 BST.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.1203 | -0.15 | 1.1227 | 1.12 |

| USDJPY | 109.39 | -0.15 | 109.46 | 109.17 |

| GBPUSD | 1.4484 | 0 | 1.45 | 1.4474 |

| AUDUSD | 0.7167 | -0.74 | 0.7228 | 0.7167 |

| NZDUSD | 0.6713 | -0.73 | 0.6768 | 0.6713 |

| USDCHF | 0.9906 | -0.12 | 0.9915 | 0.9891 |

| EURGBP | 0.7735 | 0.13 | 0.7751 | 0.7731 |

| EURCHF | 1.11 | 0.16 | 1.1113 | 1.0944 |

| USDCAD | 1.3179 | -0.27 | 1.3186 | 1.3138 |

| USDCNH | 6.5641 | -0.04 | 6.5693 | 6.5607 |

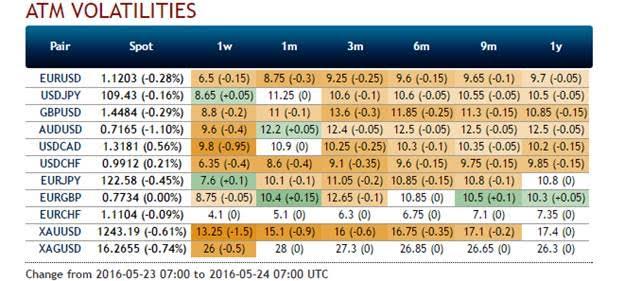

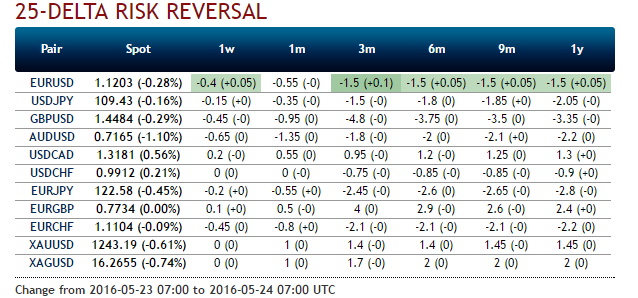

FXO

Gamma is lower, largely across the board. In the EUR/USD space, one week and two week strikes have stark difference in volatilities, since the two week date contains a speech by Janet Yellen.

The two month Cable 25-delta risk reversal is trading with a volatility differential of 5.5% for the downside. This shows how the market is protecting itself for a potential move lower, despite the fact that spot has been firmer and the polls show an increased chance of a resulting vote to remain. Essentially, should the referendum result in a decision to leave, the move in spot would be significantly more dramatic, so more protection is required in this event, however less likely it may be.

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.