Next report will be publish in Monday

Do you want to know which are the Current Trading Positions of our contributors? Get a glance here.EUR/USD: Dollar Stronger After Mixed US Data

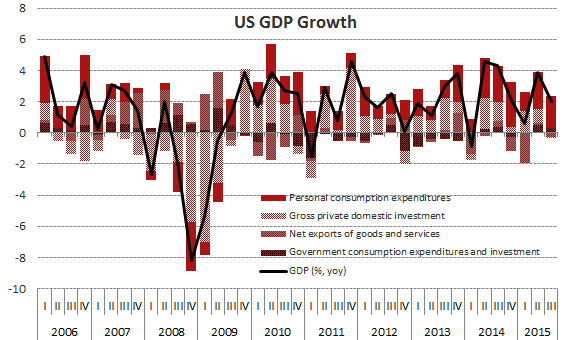

The Commerce Department said in its third estimate that US GDP grew at a 2.0% annual pace, instead of the 2.1% rate reported last month. While that was a sharp deceleration from the brisk 3.9% pace logged in the April-June period.

Businesses accumulated USD 85.5 billion worth of inventory in the third quarter, instead of the USD 90.2 billion reported in November. That meant the change in inventories sliced off 0.71 percentage point from third-quarter GDP growth, instead of the 0.59 percentage point the government estimated last month. A record increase in inventories in the first half of the year left warehouses bulging with unsold merchandise and businesses with little appetite to restock. Despite efforts to whittle down the stockpiles of unsold goods, inventories remain relatively high and will probably be a drag on growth in the fourth quarter.

Consumer spending grew at a 3.0% rate in the third quarter as previously estimated. Spending is being supported by a strengthening labor market and rising home values. Savings, which are near three-year highs, and low inflation are also helping to underpin consumption.

Growth in business spending on equipment was raised to a 9.9% rate from a 9.5% pace.

Growth in exports, which have been hurt by the strong dollar and sluggish global demand, were revised to show a slower 0.7% rate of increase. With imports advancing at a slightly faster pace than reported last month, that left a trade deficit that subtracted a bigger 0.26 percentage point from GDP growth.

US consumer spending rose in November by 0.3%, according to data inadvertently released late on Tuesday by the US Bureau of Economic Analysis, about 12 hours ahead of schedule. While consumer spending is likely running below the third-quarter's annualized brisk pace of 3.0%, November's increase could prompt market to modestly lift their fourth-quarter GDP estimates.

The National Association of Realtors said existing home sales plunged 10.5% to an annual rate of 4.76 million units. That was the sharpest decline since July 2010. October's sales pace was revised slightly lower to 5.32 million units. Housing has been providing a sizable boost to US economic growth this year as a strengthening labor market and low interest rates have helped young adults to leave their parents' homes.

The Fed hiked rates for the first time in nearly a decade on December 16, confident the US economy can stand higher borrowing costs after years of stimulus and near-zero rates, although Janet Yellen, who chairs the rate-setting Federal Open Market Committee, made clear future increases would be gradual.

Considering the muted outlook for inflation and oil prices, a strong dollar hurting US manufacturers, and the continued fragile state of the global economy, the Fed may have to be cautious with future rate hikes. The market predicts the US central bank would raise rates again in March, but in our opinion the Fed will hike in April.

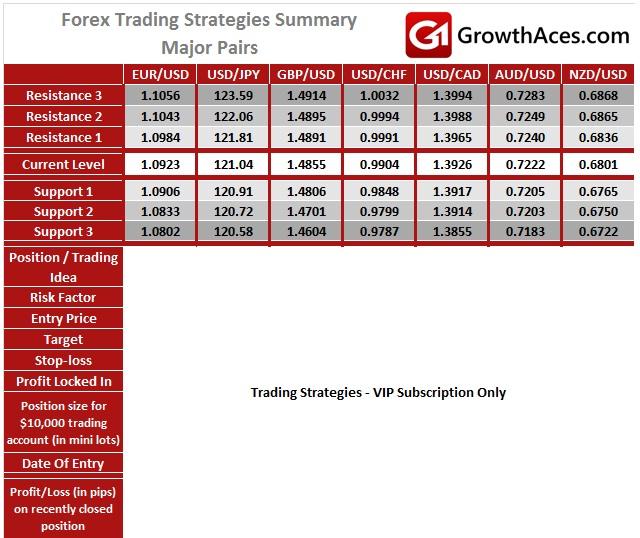

The EUR/USD was rising gradually yesterday and reached its daily high at 1.0984, slightly below the target of our long position. Today the EUR/USD retreated, but is still above the 10-day exponential moving average (currently at 1.0889), which keeps our long in play. In our opinion the 1.10 will be broken soon. We will be looking to take profit at 1.1020.

MAJOR PAIRS:

MAJOR CROSSES:

How to read these tables?

Support/Resistance - three closest important support/resistance levels

Position/Trading Idea: BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level. LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

Position Size - position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD/USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

Profit/Loss on recently closed position - is the amount of pips we have earned/lost on recently closed position.

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.