Analysis for March 10th, 2016

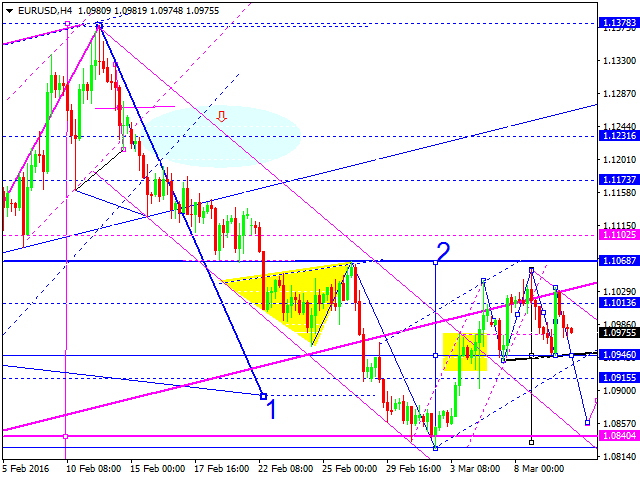

EUR USD, “Euro vs US Dollar”

Eurodollar is forming another descending impulse. We think, today the price may break its consolidation channel downwards and then continue forming this wave with the target at 1.0860. Later, in our opinion, the market may test 1.0946 from below and then continue falling to reach 1.0840.

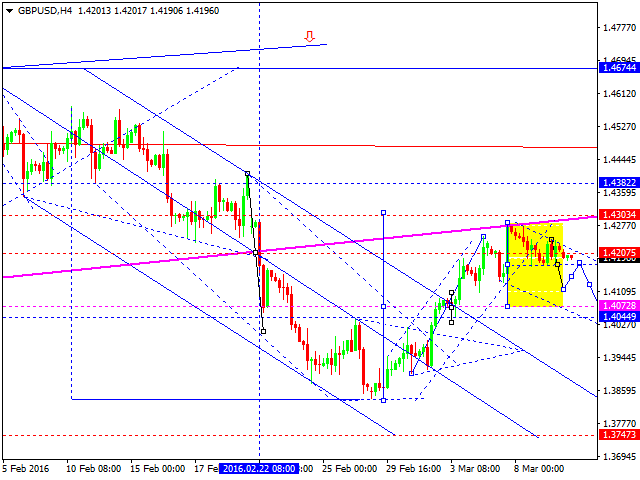

GBP USD, “Great Britain Pound vs US Dollar”

Being under pressure, Pound is falling. We think, today the price may reach 1.4073 and then complete this correction by growing towards 1.4300. After that, the pair may start another decline with the target at 1.3750.

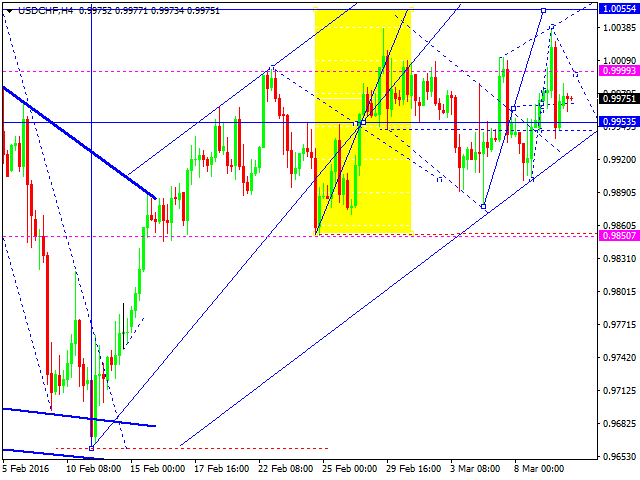

USD CHF, “US Dollar vs Swiss Franc”

Franc is moving at the top of its consolidation channel. We think, today the price may reach 1.0055 and then test 0.9955 from above. Later, in our opinion, the market may start another growth with the target at 1.0250.

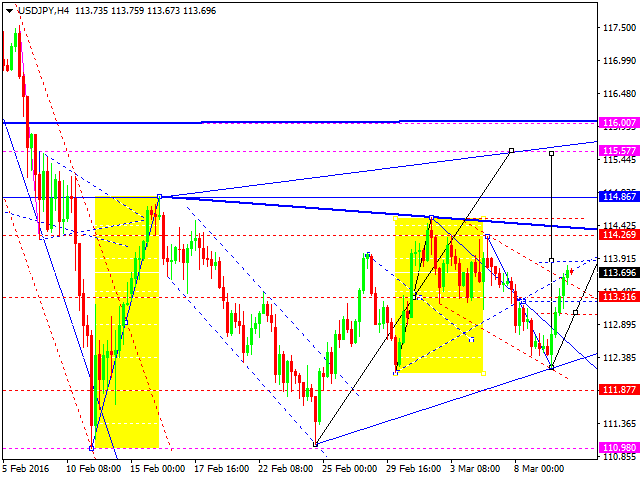

USD JPY, “US Dollar vs Japanese Yen”

Although Yen has grown a bit higher than we expected, the main scenario still implies that the pair may fall towards 111.88. Later, in our opinion, the market may grow to reach 114.27. in fact, the pair is consolidating and forming triangle pattern.

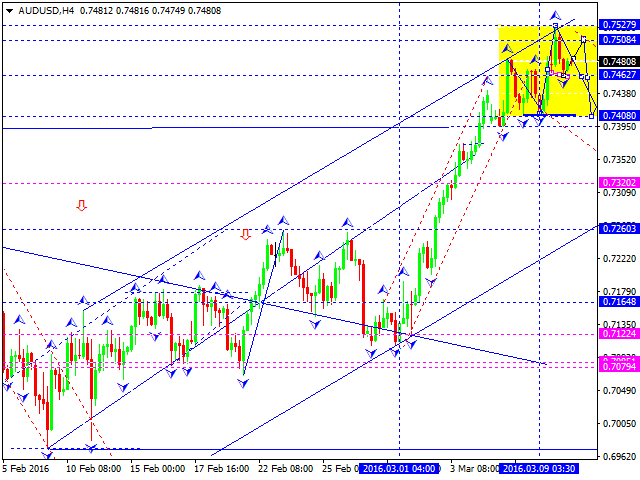

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is forming another descending impulse. We think, today the price may reach the target at 0.7400. After that, the pair may test 0.7460 from below and then start another decline with the target at 0.7200.

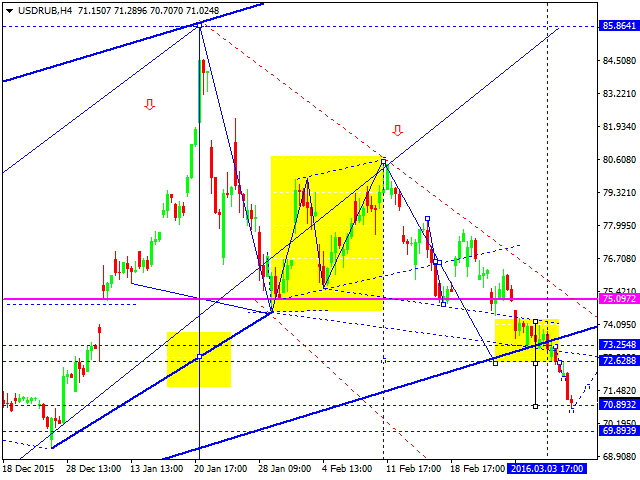

USD RUB, “US Dollar vs Russian Ruble”

Russian Ruble has expanded its trading range downwards. In fact, the pair is forming the third wave inside the downtrend with the target at 65.00. We think, today the price may test 72.60 from below and then continue falling.

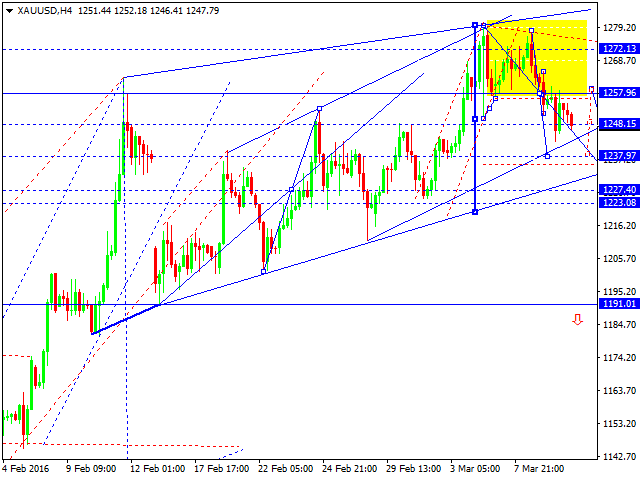

XAU USD, “Gold vs US Dollar”

Gold is still falling to reach 1237. Later, in our opinion, the market may grow towards 1257 and then continue falling with the target at 1191.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.