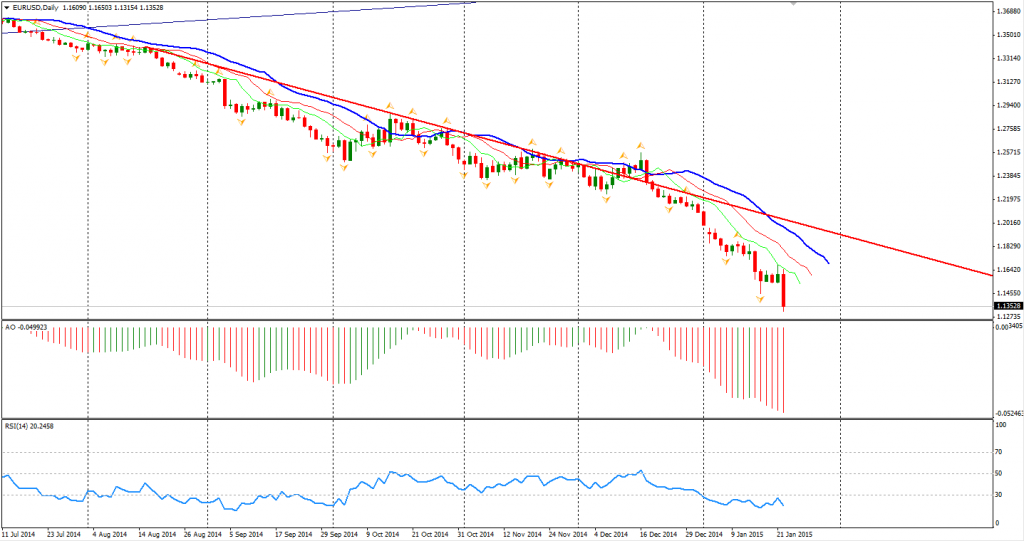

We have been expecting the result of this ECB decision for quite some time now. Many see this announced asset purchasing program as a chance to temporarily allow market participants to have some faith in that the ECB is serious on fighting deflation. The release though subdued the Euro down to a refreshed low below 1.1350 and pushed up the global stock markets. In fact, the Euro hit a 11 year low.

The total amount of the program is no less than 1.1 trillion Euro – 60 billion Euro per month, starting in March and until at least the end of September, 2016. Mr. Draghi emphasises that the program is open-ended like the QE3 of the US and will continue until the inflation level of Eurozone returns to 2%. As aforementioned, this QE was expected but the amount was actually twice as much as any prediction had set out. Traders now are mostly satisfied.

The falling Euro also helped the USD rise against other majors. A breakout just happened as I was writing this report. The Aussie Dollar slumped below its former mouth low of 0.8030 – finishing the over-a-month consolidation. The 0.8000 integer level is being tested and may not support the currency for long. The Australian Dollar still is the strongest currency among other commodity pairs. After NZDUSD broke the bottom of its three-month consolidation and the Bank of Canada just cut its interest rate, the Aussie Dollar won’t be able to defy gravity on its own. The next target may be 0.78 and 0.75.

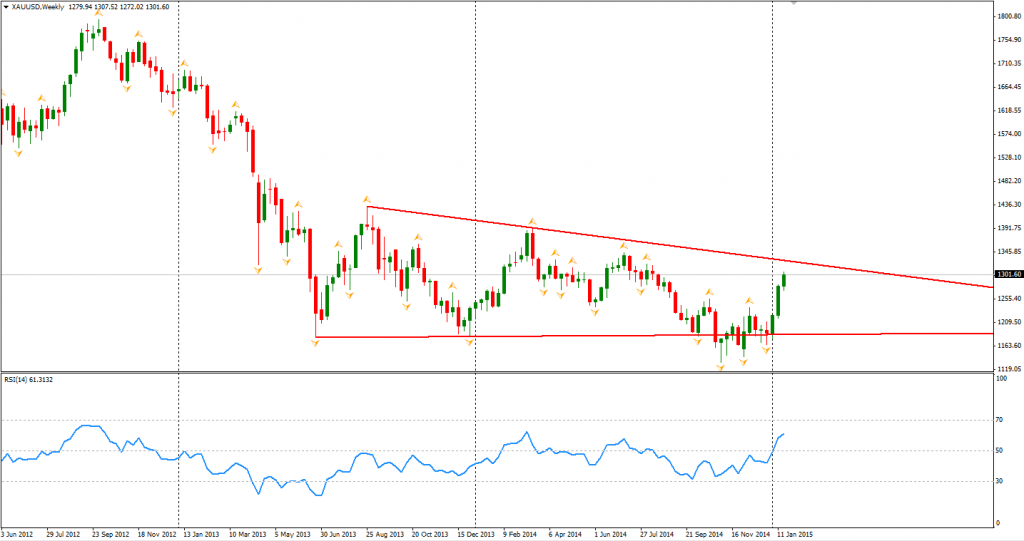

Gold prices surged to $1304 refreshing recent highs as the newly announced QE provided enough funds for the market. In the weekly chart, we can see a downward trendline connecting the highs of 2013 and 2014. The next target of gold may be this trendline and the price level is around $1325.

Stock markets were in a sea of green. The Shanghai Composite rose 0.59% to 3343. ASX 200 bounced 0.49% to 5420. The Nikkei Stock Average gained 0.28%. In European markets, the UK FTSE was up 1.02%, the German DAX gained 1.32% and the French CAC Index rose 1.52%. The US market closed inspired by QE as well. The S&P 500 closed 1.53% higher to 2063. The Dow gained 1.48% to 17813, and the Nasdaq Composite Index surged 1.78% to 4750.

On the data front, China HSBC Flash Manufacturing PMI will be released at 12:45 pm AEDST. PMIs of Euro area will also be out in this afternoon. UK retail sales will be at 8:30 AEDST and Canada CPI and retail sales will be at midnight.

Recommended Content

Editors’ Picks

GBP/USD bulls retain control near 1.3300 mark, highest since March 2022

The GBP/USD pair trades with a positive bias for the third straight day on Friday and hovers around the 1.3300 mark during the Asian session, just below its highest level since March 2022 touched the previous day.

EUR/USD grapples with higher ground as Fed cuts weigh on Greenback

EUR/USD found the high end on Thursday, holding fast to the 1.1150 level, though most of the pair’s bullish momentum comes from a broad-market selloff in the Greenback rather than any particular bullish fix in the Euro.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.