The era of US Dollar has truly come. Maybe this statement is quite late, but it is never too late to trade with the trend.

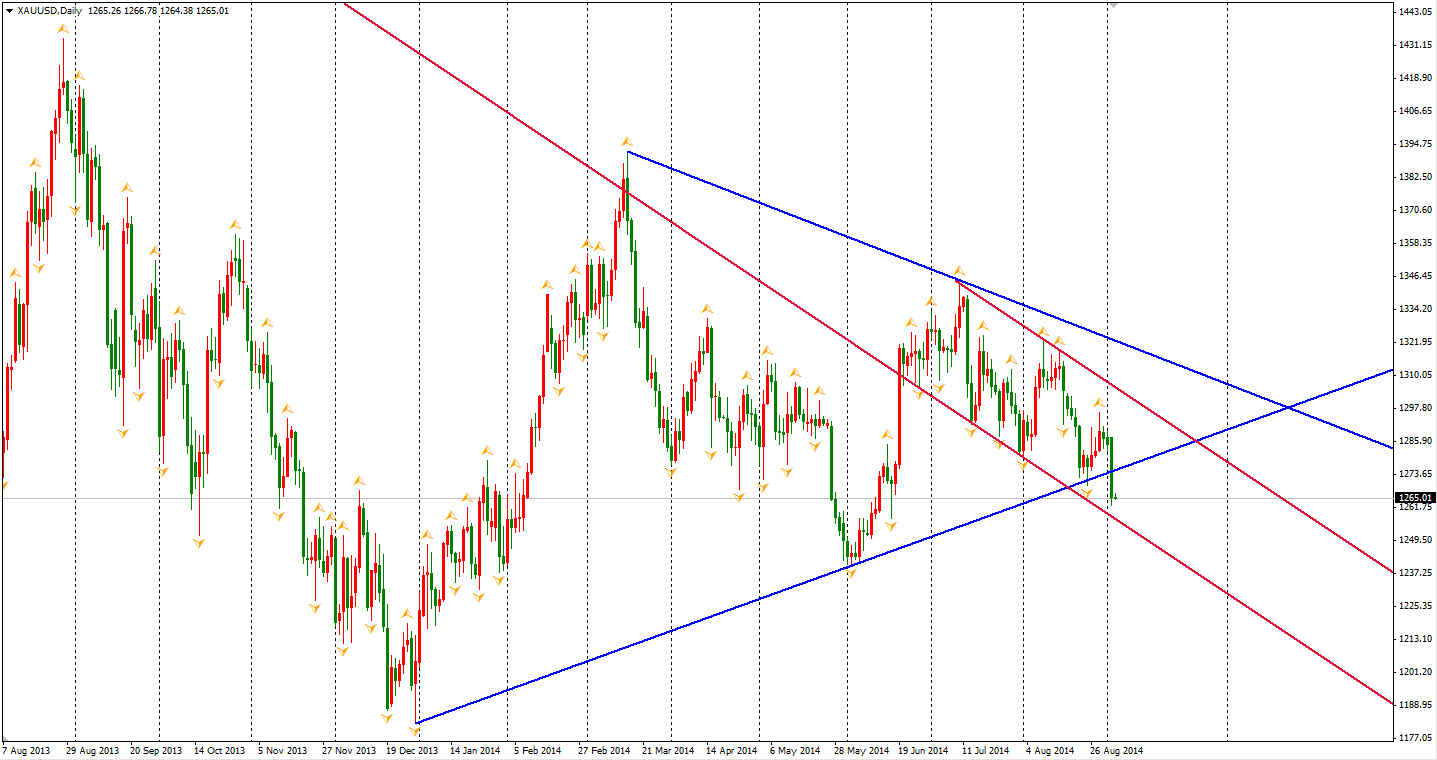

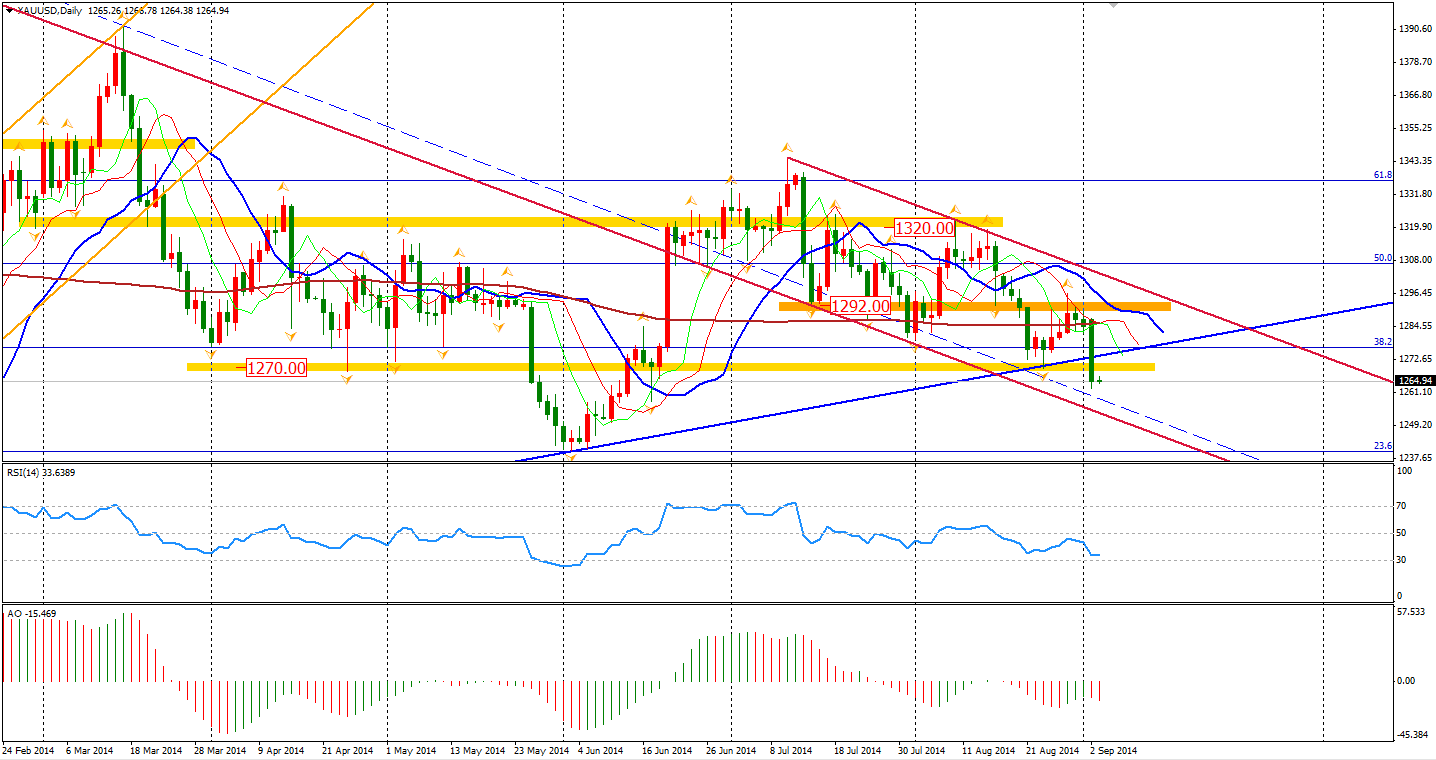

We have witnessed most major currencies depreciating against the Dollar, and now, Gold has joined the party. Gold yesterday plunged by over $23 per ounce to $1265, breaking several key supporting levels, including level $1270 and the uptrend line from the low of last December. The large triangle pattern that Gold has been forming since this year began has now finished and a new bearish trend is under way.

Yesterday’s fall is reminding me of what happened to the Gold price back in April 2013 when it lost over $270 just in one week. Maybe I was too sensitive and that history will never repeat. The break in this triangle continuation pattern still implies Gold may fell below $1180, the double bottom of 2013.

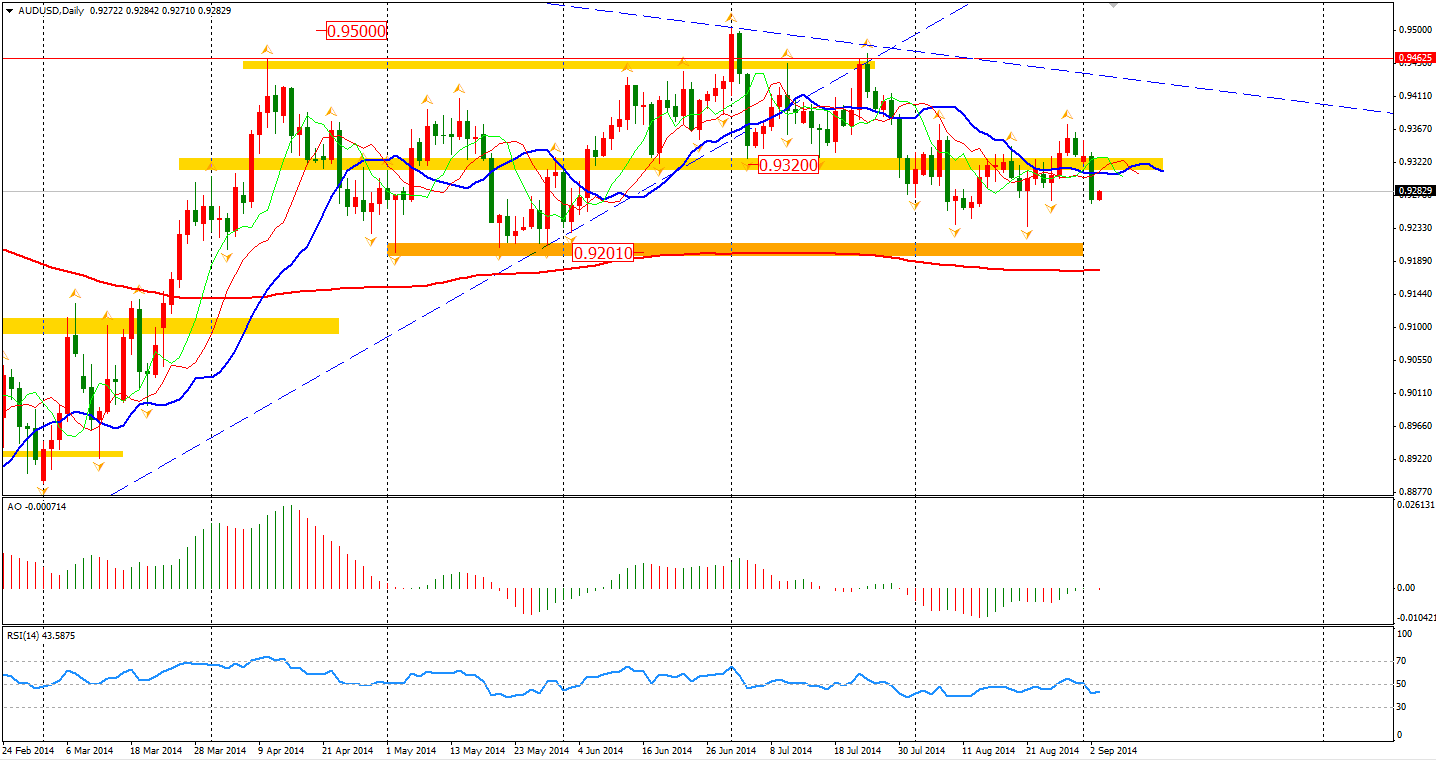

Aussie/Dollar, probably the last one of major currency pairs that defied gravity, fell back below 0.9320 again on Tuesday. Will this time be the one to break the 5-month-length sideway?

The RBA has decided to extend its longest pause in rate adjustments in eight years and its statement did not change much for September, stating that the “exchange rate remains above most estimates of its fundamental value”. Impacted by the background where the Chinese economy is slowing down, Australia’s expansion will be ‘a little below trend’.

The Q2 GDP today and Retail sales tomorrow may decide whether the Aussie will keep falling. The weak job market and contracting company profits have dampened the economic outlook – a clear negative sign of the future price movement.

Asian stocks markets performed quite strongly yesterday. The Shanghai Composite surged up 1.37% to 2266, 15-month high. The Nikkei Stock Average gained 1.24% on the weaker Yen. The Australian ASX 200 was up 0.51% to 5658. In European stock markets, the UK FTSE was up 0.06%, the German DAX gained 0.3% and the French CAC Index lost 0.03%. U.S. stocks closed with little changes after the long weekend. The S&P 500 closed flat at 2002. The Dows lost 0.18% to 17068, while the Nasdaq Composite Index was up 0.39% to 4598.

On the data front, Australia Q2 GDP will be released at 11:30 AEST. The RBA Gov Stevens speech will begin from 13:20 AEST. Several Service PMI will be released during the European session, including the UK one at 18:30 AEST. Canada Central Bank’s decision will be at midnight.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.