The US Dollar jumped up again across the board last night with results showing the U.S. economy growing faster in Q2 than economists had expected. The annual rate of GDP Growth is 4% higher than the forecasted 3% and former reading of 3.1%.

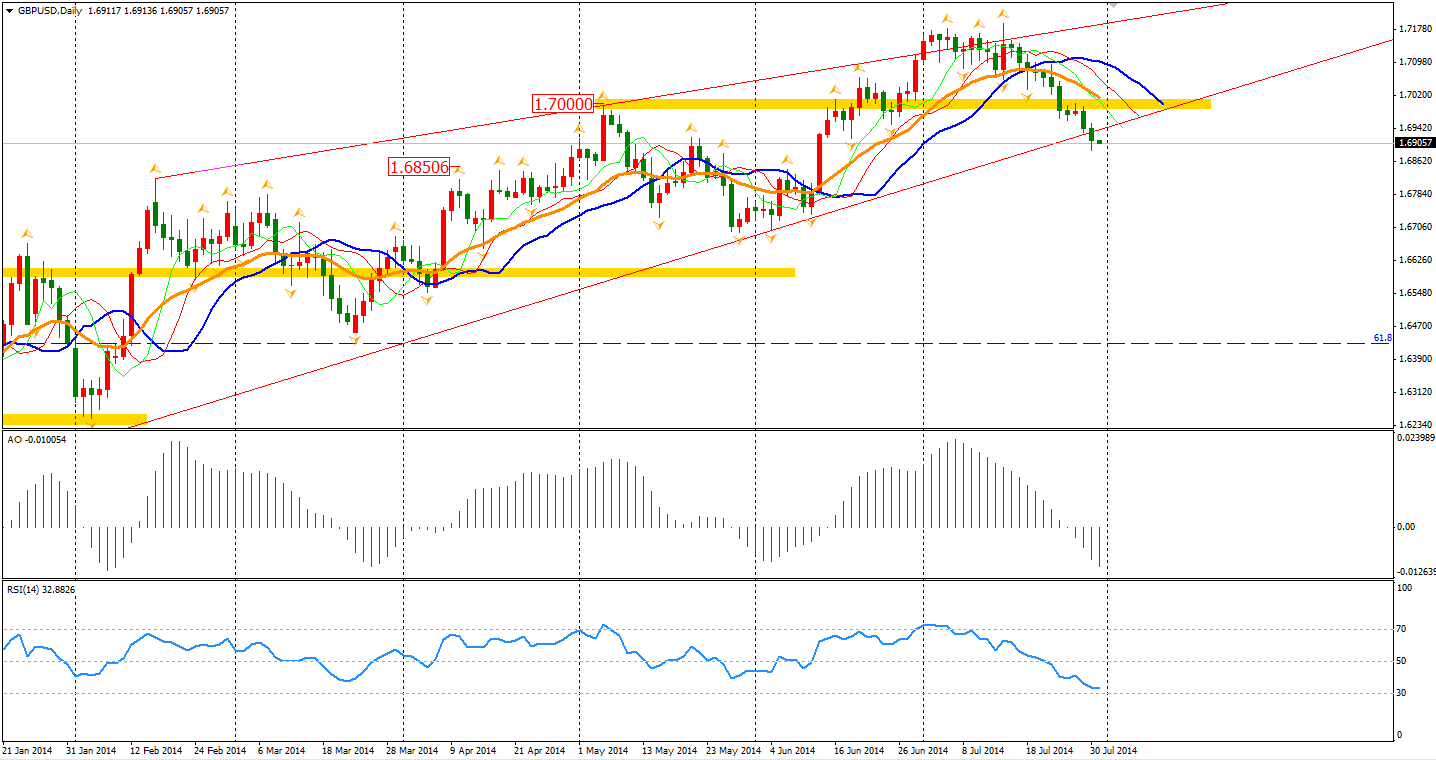

The Sterling kept its weakness yesterday and broke the upward trendline that we had previously mentioned. Although the breakout is not confirmed yet, this certainly is a bad sign for traders who are gone long the sterling against Dollar.

It’s no surprise the Fed continued tapering with another 10 billion dollar monthly bond purchasing amount in its July meeting, but the committee has also boosted its growth perspective on the U.S. economy. The minutes caused little impact on the FX market as the Fed’s policy stays unchanged- is in line with the expectation. Only Gold pared as the positive economic outlook decreased the need of safe-haven assets.

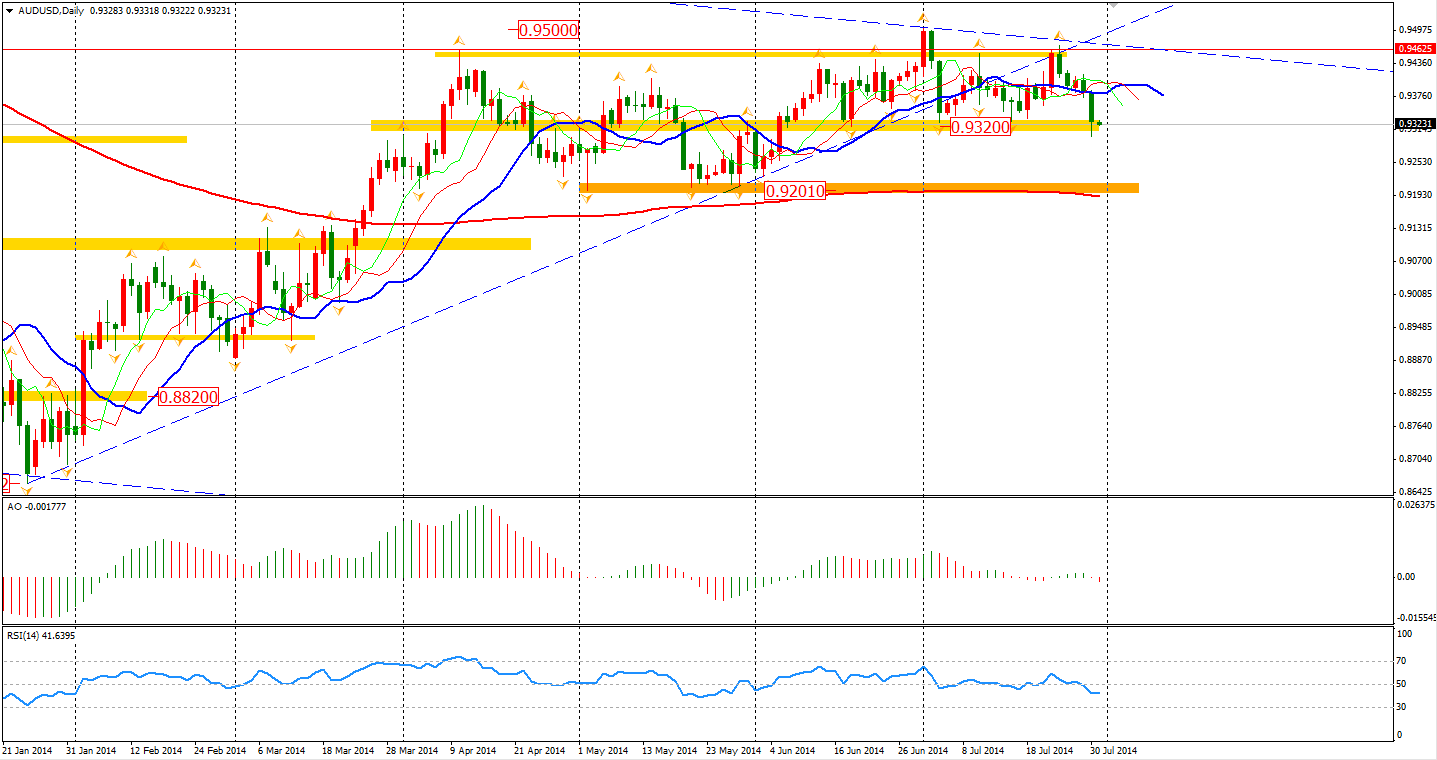

The Aussie Dollar too fell to the support level of 0.9320 yesterday and hit a six-week low. Am I looking at head and shoulder pattern? If the exchange level breaks 0.9320, it will be heading to 0.92.

The Asian stocks moved slightly higher with earnings reports improving. The Shanghai Composite lost 0.1% to 2181 whilst the Nikkei Stock Average gained 0.18%. The Australian ASX 200 advanced 0.62% to 5623. In European stock markets, the FTSE closed 0.5% lower, the DAX lost 0.62%, and the French CAC slumped 1.22%. U.S. stocks were in choppy trading on mixed news of geopolitical tensions, GDP and the Fed’s view on the economy. The Dows lost 0.19% to 16880. The S&P 500 closed flat at 1970, while the Nasdaq Composite Index was up 0.45% to 4463.

In other news, Argentina had failed to reach an agreement with its bondholders and faced a selective default. As has been discussed, this may not mean a domestic crisis for Argentines, but the first domino of a bigger storm. Investors will wait for more information to decide the reaction.

On the data front, local traders will watch the Building Approvals at 11:30 AEST. In the European session, Germany will disclose Retail Sales and Unemployment Change. Also, Eurozone CPI Flash Estimate may have significant impact on Euro if the data is other than the expected 0.5%. Later, at 22:30, there will be Canada GDP and U.S. Unemployment Claims.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.