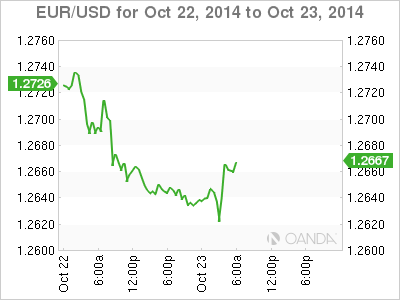

EUR/USD has stabilized on Thursday, after recent losses which have pushed the euro below the 1.27 line. On the release front, there was good news out of Germany as Manufacturing PMI improved in September. In Spain, the unemployment rate dipped to 23.7%, its lowest level since Q4 of 2011. In the US, today’s highlight is Unemployment Claims. The markets are expecting another excellent showing, with a forecast of 269 thousand.

Eurozone PMIs are carefully monitored by the markets, as they provide an important gauge of activity in the manufacturing and services sectors. German Manufacturing PMI led the way with a reading of 51.8 points, easily beating the estimate of 49.6 points. French Manufacturing PMI failed to keep pace, slipping to 47.3 points. This was short of the estimate of 48.6 points. Other PMIs met expectations.

The Deutsche Bundesbank issued its monthly report on Monday. The German central bank said that the economy showed little growth in the third quarter, as manufacturing production fell and business confidence weakened. At the same time, employment numbers and consumer spending were higher, so GDP was likely to remain unchanged. As for Q4, the report stated that the outlook is “moderate”. The report underscores weakness in the German economy, long considered the locomotive of Europe. The euro is sensitive to German data, so weak German numbers could hurt the shaky euro.

EUR/USD 1.2665 H: 1.2670 L: 1.2614

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.