Analysis for June 24th, 2014

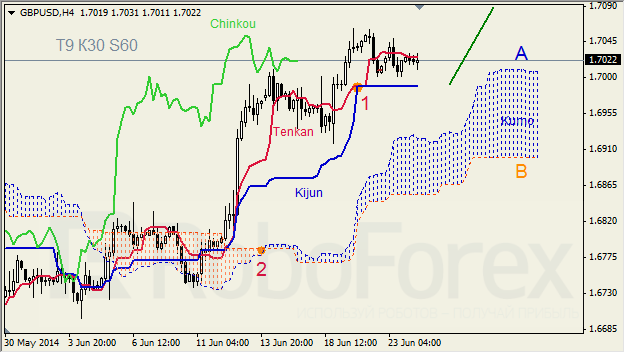

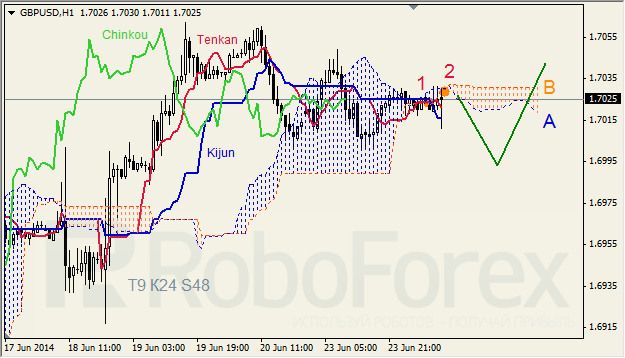

GBPUSD, “Great Britain Pound vs US Dollar”

On H4 chart Tenkan and are moving apart by the «Golden Cross» (1) above Kumo. Ichimoku cloud is going up (2). Lagging line of Chinkou indicator is located above the chart, price is near Tenkan. Kijun can provide support with further ascending impulse.

At H1 chart, Tenkan and Kijun are moving apart by the «Golden cross» on the lower side of Kumo (1), but Tenkan and Senkou A are heading down. Chinkou is on the chart, Ichimoku cloud is going down (2) In short-term perspective we can see descending trend.

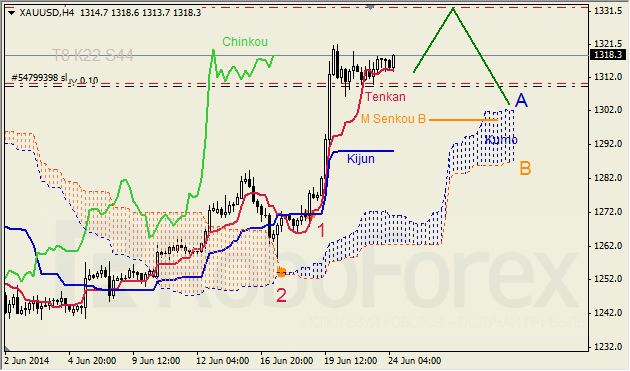

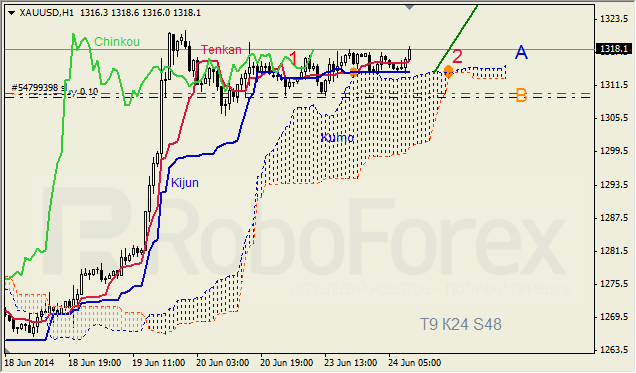

XAUUSD, “Gold vs US Dollar”

Tenkan and Kijun are influenced by the «Golden cross» (1). Ichimoku cloud is going up (2). Chinkou is located above the chart, price is located above all lines. In short-term perspective we can expect support from Tenkan and further ascending impulse.

At H1 chart we see that Tenkan and Kijun are moving apart on the upper side of Kumo by the «Golden cross» (1), Tenkan and Senkout A are going up. Ichimoku cloud is going up after narrow phase (2). Chinkou is reversing to the upside from the chart. In short-term perspective we may expect support from Tenkan-Senkou A and further ascending impulse.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.