Dollar finds support across the board

Greece committed to the EUR’s downfall

ECB applying subtle pressure via banking system

German Sentiment Dented by Greek Crisis

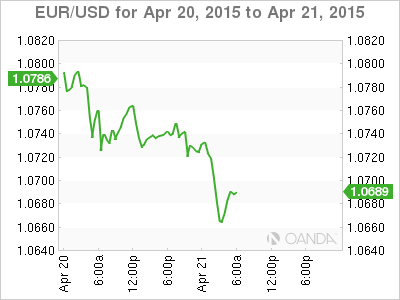

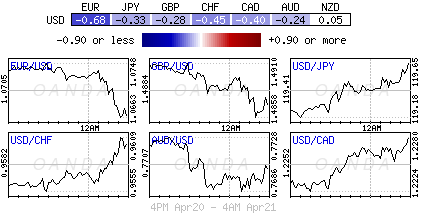

The mighty dollar is quietly going about regaining some of its natural pose as the market heads stateside. Greece on the other hand remains committed to the EUR’s downward trajectory in a week that’s deprived of fundamental data and long on Greece surviving as a Euro member.

The markets are wary that elevated Greek uncertainty is to persist as the country problems are on the verge of worsening and reason enough why investors remain cautious about Friday’s upcoming Eurogroup meeting to see if Greece will actually delivers any of its promised reforms.

The Perception of Applying Pressure

Interested parties are trying to get Greece to conform to creditors demands. There are currently two avenues of pressures on Greece to force them into fulfilling said demands. There is firstly via the banking system, and second via the liquidity situation of the government. By the latter, the Greek government has more control. The markets saw that yesterday when the Greek government issued various decrees for local government cash balance to be deposited in the Central Bank for government use.

It’s the funding of the banking system that Greece has no control over. That’s dependent on the ECB’s role as “lender of last resort” through the use of ELA (Emergency Liquidity Assistance). The market now believes that ECB staff is preparing a proposal to subtly apply further pressure. They could do this by increasing haircuts on Greek bank collateral offered for ELA. The Eurogroup require a Greek reaction, as a member they are required to fulfill all protocols and not just back away from responsibility. Applying subtle pressure hopefully will garner a positive reaction. To date it has not and time is running out as the uncertainty over how Greece and its creditors will come to an agreement has led the market to continue to price in a rising risk of Grexit. The Greek yield curve continues to invert (short yields rise faster than long would suggest default).

The question and answer yet to be discussed in detail is if a default and exit does become a reality, will the ECB’s QE limit contagion?

German Sentiment Dented by Greek Crisis

This morning, German data is beginning to be affected by Greece. April’s fall in German ZEW investor sentiment would suggest that fears over Greece are starting to dent confidence in German economic recovery. The fall in the headline Economic Sentiment Indicator (53.3 vs. 54.8) was the first in six-months. Although the trend remains high, the headline decline follows this month’s fall in the German Sentix investor sentiment index, implying that the worsening Greek crisis is having an effect.

Data like this would suggest the possibility of Grexit could be a key threat to German business confidence and activity, not matter how large one’s economy is to try and buffer such possibilities. Forex traders were short the EUR going into this morning’s event with market bids scattered well below (€1.0645-55).

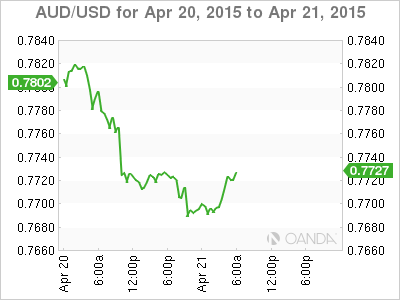

RBA Keeps the Door Ajar on Rates Cut

It seems to be official, the Governor and his fellow cohorts will probably stop at nothing to keep their own currency underperforming. Yesterday, the RBA’s Stevens reassured investors regarding the likelihood of further policy easing. This seems to have been backed up by the latest RBA meeting minutes overnight.

This month’s RBA was a rather close call – although a narrow majority favored a hold at +2.25%, the fixed income dealers were very much onside for another rate cut. Nevertheless, the RBA minutes saw an advantage to wait for more data (central bank favorite stalling tactic), including the quarterly inflation figures (to be released this evening) for support in their decision. RBA added that household consumption and home building have picked up, but GDP growth would likely remain below trend. Moreover, the central bank saw non-mining business investment as softer than expected, with the possibility of continued decline this year. RBA did acknowledge that excessively low rates risk the fuelling of housing market imbalances.

Stronger commodity prices supported the AUD above $0.78 for a brief period. The currency has since slipped; temporarily visiting sub AUD$0.77 after the minutes in the overnight session. The currency pair moves remain choppy with liquidity not as strong as to be expected. For the time being, the commodity and interest rate sensitive currency is expected to struggle under the pressure from high frequency selling interest and from too many long retail interest long AUD at bad levels.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.