Syriza win ‘big’

Form coalition with center-right fringe party

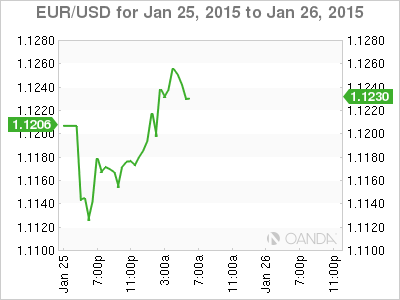

EUR touched sub €1.11 new-lows

Market pricing QE vs. anti-austerity talks

Greece’s Syriza party (opposition) is set to become the first anti-austerity party to be at any euro-members helm. Most of the market had been expecting the victory, but it was the margin of the win that’s considered to be most significant. The overwhelming 10pt spread (36/38% vs. 26/28% for ruling the ND) is rather expressive of the austerity exhaustion felt throughout the eurozone periphery. The rise of the Greek anti-bailout left to power is now expected to provide further motivational support throughout Europe for like-minded individuals.

Earlier this morning Syriza formed a new coalition government with a center-right fringe party that will thrust immediately into the task of reversing austerity policies and negotiate with European leaders to reduce Greece’s debt burden. The new Prime Minister Tsipras, repeating his winning mandate, said the election marks the end of bailout agreement for Greece and cancels the program of austerity, but also pledged to cooperate with partners to achieve a “mutual solution” rather than a “destructive collision”. Not untypical, Germany’s Bundesbank Weidmann pre-empted any re-negotiation plans, stating that “Greece will remain dependent on support and it’s also clear that this aid will be provided only when it is in an aid program.”

EUR flight of fancy

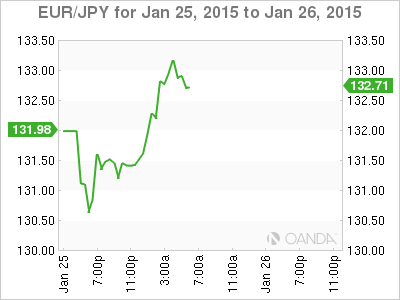

The markets initial reaction was to further penalize the EUR, pushing it briefly to a new 11-year low (€1.098) in Asia as the Greeks radical leftist vowed to tear up term’s of the country’s bailout. However, the EUR weakness has been short lived, with the single unit riding higher outright (€1.1246) and against the yen during European trading (€133.00). The market seems a tad more confident that last week’s QE support by the ECB leaves the markets less vulnerable to break up fears. Many are viewing Draghi’s backstops have “effectively firewalled Greek developments and should limit contagion.” In translation, investors will have to gage the EUR’s natural price weakness that is supported by QE and not by euro-zone periphery fears.

Many will interpret the larger than expected victory by Syriza could be leaving the EUR vulnerable for further short selling in the short term. The fact that the single unit is down 14-big figures since December, with little or no retracement, consolidation and some profit taking could be a risk factor to some of the weaker EUR short positions. The Greek results gives Tsipras a strong mandate to push through major national changes, however, the external negotiations will be more of a market risk factor, and are sure to heighten volatility over the coming months. But, that is a “tomorrow” problem; for now the market should be pricing fair value EUR QE vs. an expected Greek result with a wider margin win.

Shock, but no awe

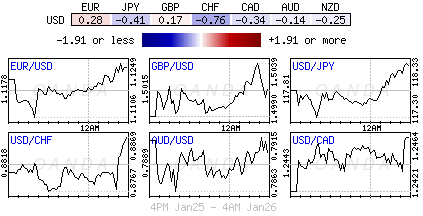

The Fed’s progress away from easy money policies is not the only supporter for current market volatility. The fact that other Central Banks cannot, and some never able to, follow in the Fed’s footsteps is certainly propping up current market unpredictability. As the Fed reduces its economic intervention, the ECB and BoJ are increasing theirs. The PBoC is using different programs to support its own economy whose growth levels are at 24-year lows. Rate divergence is leading to greater volatility and market opportunity.

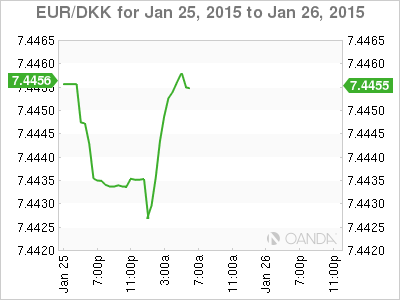

Three central banks that officially met last week all took action. The Bank of Japan extended its bond buying program time lines and acknowledged that the +2% inflation target goal would not be met by Q2 of this year. Governor Poloz at the BoC lowered his key interest rate by -25bps to +0.75%, acknowledging the impact of sliding oil prices on the Canadian economy. And finally, the European Central Bank added a quantitative easing program to fend off deflation and jab their economy into growth. Other surprise actions have come courtesy of Denmark’s Central Bank who twice slashed its overnight rates due to safe-haven demand (DKK a substitute for some CHF players).

Fed expected to hold the line

From an economic event perspective, last week was always going to be a difficult one for event risk action. Still, with rate divergence dominating currency direction any time the Fed is on the agenda markets take note. This week may not appear to promise the same amount of market thrills and spills but one can never be sure in these uncertain times. The Fed meets Wednesday, and no policy change is expected. Other headlines that are expected to make a difference, the U.S. and UK report their respective first estimates of Q4 growth. While Japan posts it’s usual end of month deluge of economic reports including unemployment, industrial production, consumer prices, household spending and retail sales.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.