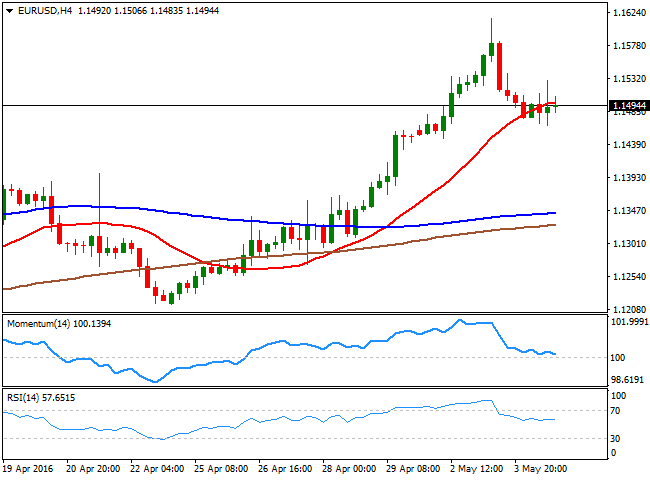

EUR/USD

The greenback advanced some against most of its major rivals, edging sharply higher against the CAD and the AUD as commodityrelated currencies were weighed by falling oil and gold prices and poor local data. The common currency was unable to recover above the 1.1500 figure, and ended the day a handful of pips below the level against the greenback, with mixed data coming from both sides of the Atlantic being for the most mixed.The release of the final Services and Composite readings for the month of April in the EU, showed that activity grew at a slower pace than initially estimated, indicating a tepid start of the second quarter. Retail Sales in the EU, declined by 0.5% in March compared to the previous month, up by 2.1% compared to a year before, against expectations of a 2.5% advance. In the US, data came in mixed, with the ADP employment survey disappointing, as it showed that the private sector added 156,000 new jobs in March, although the Services sector grew by more than expected whilst new orders for U.S. factory goods also rose more than expected up by 1.1% after February's downwardly revised 1.9% decline. The 4 hours chart for the EUR/USD pair shows that the technical indicators have erased all of their extreme readings and stabilized above their midlines, with the Momentum indicator heading lower right above its100 level and the RSI flat around 57, whilst the price is unable to establish itself above a still bullish 20 SMA. The daily low was of 1.1469, showing that buying interest is aligned around the major support, yet at this point, the pair needs to advance firmly above the 1.1530 level to regain its previous positive tone and be able to retest the high at 1.1615. Below the mentioned support on the other hand, the price can decline down to 1.1380, and it will take a break below this last to deny the recently born bullish trend.

Support levels: 1.1500 1.1460 1.1420

Resistance levels: 1.1530 1.1565 1.1615

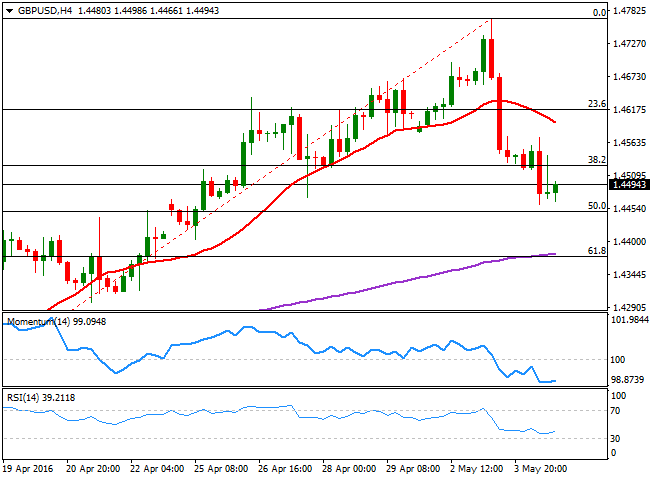

GBP/USD

The Sterling fell against the greenback to its lowest in seven days, after the release of the UK Construction PMI, which showed that output growth eased to the weakest for almost three years, finally resulting at 52.0, amid stalling new business volumes in April, according to the Markit report. The GBP/USD pair fell down to 1.4460, bouncing from this last up to 1.4571 before losing momentum and closing the day below the 1.4500 mark. The daily chart shows that after over two weeks of advances, the pair retreated almost 50% in just two days, confirming that buying interest somehow faded. For the upcoming sessions, the risk is towards the downside, as in the 4 hours chart, the 20 SMA continues grinding lower well above the current level, whilst the technical indicators have lost their downward strength near overbought levels, but are far from indicating an upward move. Further slides below 1.4375, should see the decline extending down to 1.4450, the 61.8% retracement of the latest bullish run and the 200 EMA.

Support levels: 1.4450 1.4410 1.4375

Resistance levels: 1.4530 1.4580 1.4620

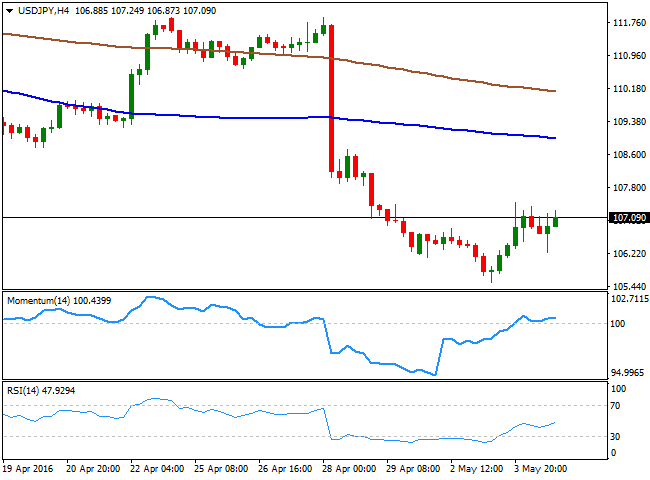

USD/JPY

The USD/JPY pair trades around the 107.00 level as the US session ends, modestly higher daily basis, but maintaining the overall bearish tone seen on previous updates. With a long holiday going on in Japan, market players remain away from JPY crosses due to the lack of local clues, whilst a still weak greenback limits chances of a strong advance. The pair remained below Tuesday's high of 107.43, and the 1 hour chart shows that the price is a few pips above a bearish 100 SMA, still unable to clearly advance beyond it, whilst the technical indicators have reentered negative territory and present bearish slopes, keeping the risk towards the downside. In the 4 hours chart, this latest consolidation has helped indicators to correct extreme oversold readings, but are currently flat around their midlines, whilst the price is far below its 100 and 200 SMAs, all of which supports additional slides towards the 105.00 region, particularly if the ongoing negative mood prevails.

Support levels: 106.60 106.20 105.70

Resistance levels: 107.45 107.90 108.30

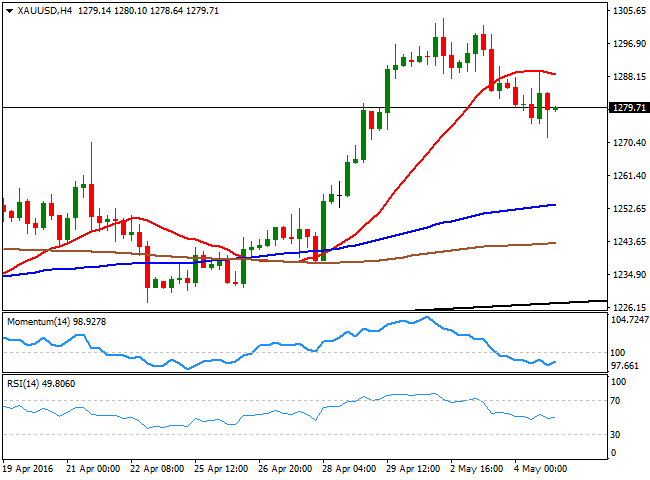

GOLD

Gold prices edged once again lower this Wednesday, with spot down to $ 1,271.77 a troy ounce in the US afternoon, to close the day roughly at 1,280.00. The commodity retreated on dollar's strength, but also on speculation of a June US rate hike fueling some profittaking ahead of the Nonfarm Payroll report next Friday. Strong US data will most likely threaten the latest bullish trend in the bright metal, as it will point for more chances of a sooner rate hike. From a technical point of view, the daily chart shows a limited downward potential, as the price remains well above a still bullish 20 SMA, whilst the technical indicators have lost bearish strength within positive territory, after retreating from overbought readings. Shorter term, the 4 hours chart shows that the intraday spike up to 1,289.71 stalled right at a mild bearish 20 SMA, now the immediate resistance, whilst the technical indicators have turned slightly higher within negative territory, with no actual momentum at the time being, also limiting the downside.

Support levels: 1,271.80 1,262.30 1,252.60

Resistance levels: 1,289.70 1,297.10 1,308.40

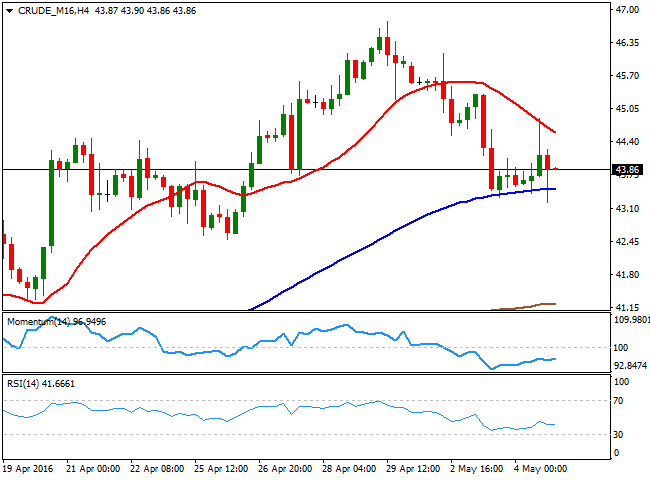

WTI CRUDE

Crude oil prices started the day with a strong footing, with WTI advancing up to $44.86 a barrel, but the commodity trimmed all of its daily gains after the US government reported that commercial stockpiles rose by 2.8 million barrels in the previous week, almost doubling market's expectations. The American Petroleum Institute report released late Tuesday showed that US crude inventories rose by 1.3 million barrels. The daily chart shows that the commodity managed to close the day a few cents above a now horizontal 20 SMA, whilst the Momentum indicator turned lower within positive territory, and the RSI indicator stands flat at 56, suggesting an increasing downward potential yet to be confirmed. In the 4 hours chart, the 20 SMA heads strongly lower above the current level, capping the upside now around 44.60, while the technical indicators head nowhere within bearish territory, also supporting the need of additional confirmations before the bearish run begins.

Support levels: 43.20 42.50 41.80

Resistance levels: 44.60 45.10 45.80

DAX

The German DAX shed 97 points this Wednesday to end the day at 9,828.25, a fresh 3week low, affected by another raft of weak earnings reports across Europe. Mining related shares suffered the most as commodities fell, but among local equities, Deutsche Telekom AG slipped 2.1% after posting a 2.5 percentdrop in German sales, even as total revenue beat forecasts and earnings rose. Fraport AG slid 6.1% percent after the operator of Frankfurt airport reported quarterly earnings and sales that missed estimates. The index remains near the mentioned close ahead of Asian opening, with the daily chart showing that it closed the day below its 100 SMA for the first time since early April, whilst the technical indicators have extended their declines within negative territory, maintaining strong bearish slopes and supporting some further declines. In the 4 hours chart, the technical indicators are turning modestly higher within oversold levels, but with the index near its low and below its moving averages, any upward corrective movement should result limited by selling interest now around the 10,000 figure.

Support levels: 9,802 9,741 9,685

Resistance levels: 9,867 9,914 10,000

DOW JONES

US stocks closed in the red, with the DJIA down 99 points to end at 17,651.26. The Nasdaq extended its decline by 37 points to end at 4,752.64 while the SandP fell 12 points to 2,051.12. Mixed data in the US continued suggesting the economy is struggling to slowly advance, with no signs of contraction, but neither of a strong pick up. Employment data disappointed, as the ADP survey printed 165K against 200K expected, while US productivity fell by a 1% annual rate in the first quarter, marking the fourth decline in the past six quarters. US trade deficit, however, shank to its lowest in a year during March, resulting in 40.40B. The DJIA daily chart shows that the index extended further below its 20 SMA, whilst the technical indicators gained additional bearish momentum within negative territory, maintaining the risk towards the downside for this Thursday. In the 4 hours chart, the 20 SMA has crossed below the 100 and 200 SMAs above well above the current level, reflecting the ongoing strong selling interest, whilst the technical indicators flattened near oversold levels, rather reflecting the lack of volume after the close that suggesting a downward exhaustion.

Support levels: 17,604 17,530 17,440

Resistance levels: 17,692 17,758 17,812

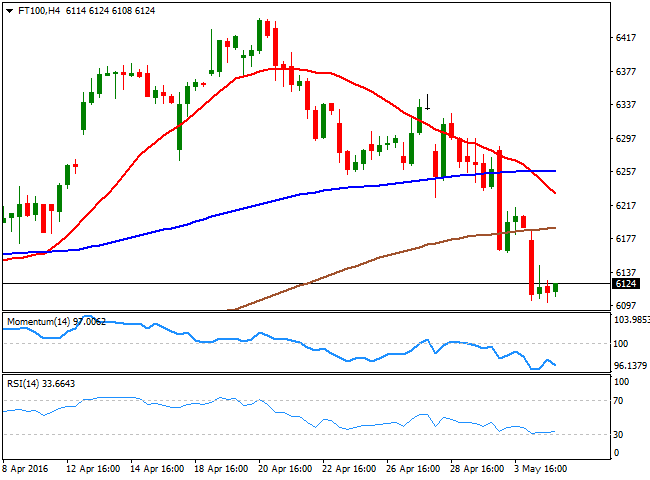

FTSE 100

London shares extended their slides, and the Footsie closed at 6,112.02, down by 1.19% or 72 points. The index fell to near a 1month low as poor earnings reports sent the mining sector nosediving. Randgold Resources led the decline by plummeting 11.7% as, despite reporting a 13% rise in net profit to 54 million in the first quarter of 2016, the firm's metal production declined 11%, compared to the previous record quarter. BHP Billiton fell 5.8% after Brazilian prosecutors filed a $44 billion lawsuit against the miner and its partner Vale over the collapse of a dam that killed 17 people. Glencore lost 3% after reporting a cut in production of copper, zinc, lead, coal and oil as a result of low commodity prices. From a technical point of view, the daily chart shows a strong downward potential at the time being, as the index has plummeted below its 200 DMA and is now barely holding above the 100 DMA, whilst the technical indicators present sharp bearish slopes within negative territory. In the 4 hours chart, the technical picture also favors the downside, as the Momentum indicator resumed its decline near oversold levels, while the RSI indicator consolidates around 33.

Support levels: 6,101 6,062 6,006

Resistance levels: 6,155 6,214 6,256

The information set forth herein was obtained from sources which we believe to be reliable, but its accuracy cannot be guaranteed. It is not intended to be an offer, or the solicitation of any offer, to buy or sell the products or instruments referred herein. Any person placing reliance on this commentary to undertake trading does so entirely at their own risk.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.