Central Banks are over, at least for the month, and have left a sour taste in everyone's mouth. The futures is dark and negative outlooks are the new normal. The Federal Reserve of course, did not eased, as such move will literally destroy confidence in the Central Bank. Instead, Janet Yellen came in with an extreme cautious stance, blaming the ongoing market conditions of their decision to downgrade the economic growth outlook. Hopes of a rate hike for this 2016 faded after the dot plot showed that policy makers now estimate two rate hikes for this year, instead of the previously expected four.

And the dollar suffered. A sharp recovery in commodities also played against the American currency, whilst BOJ inaction added to the picture, with the JPY surging to fresh over a year and a half high of 110.66.

View the Live chart of the EUR/USD

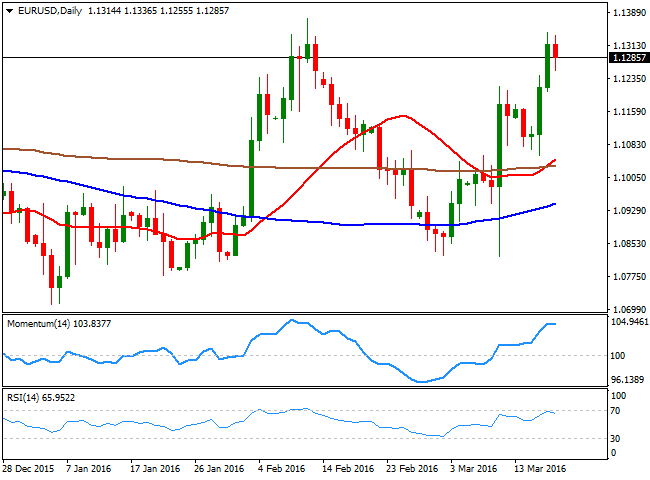

As for the EUR/USD pair, is up for a third week in-a-row, but with no clear long term definitions, still range bound. The pair reached 1.1341, a few pips below 1.1375, February 11th high, before retreating slightly below the 1.1300 level. This Friday's decline is mostly due to some profit taking ahead of the weekend, particularly considering than the pair added around 500 pips in a bit more than a week.

In the daily chart, the bias is higher, as the price has advanced and remains well above its moving averages, whilst the technical indicators have barely retreated from overbought levels, rather tracking the daily decline than suggesting the pair may extend its decline. In the weekly chart, however, technical readings lack upward momentum, with the price above a flat 20 SMA.

For the upcoming week, the pair is poised to extend its advance, with a break above 1.1375, opening doors for a test of 1.1460 a major static resistance level. Given that the level has contained rallies since early 2015, further gains beyond it should trigger big stops, and result in a continued advance up to the 1.1550/1.1600 region.

The pair has an immediate support at 1.1245, but it will take a steady decline below 1.1120 to deny a bullish continuation, with the market then pointing to retest the 1.1000 psychological support.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.