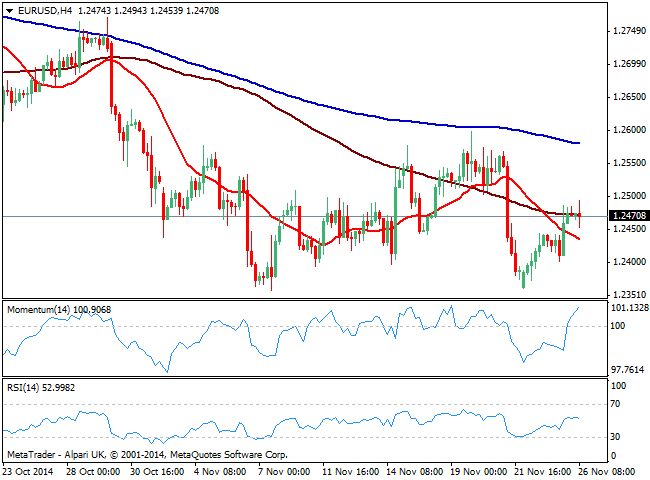

In the meantime, the technical picture shows momentum aiming higher above 100, RSI flat around 50, and price extending above a bearish 20 SMA. It’s also easy to appreciate a double floor established at 1.2360 with the neckline of the figure at 1.2600, the level to overcome to confirm an interim bottom and a steadier recovery in the pair midterm. But it will take really disappointing readings all through the US session to trigger such 150 pips recovery in the EUR/USD, something quite unlikely considering latest economic improvement. Shorter term however, the pair can advance up to 1.2520/50 daily basis, if market decides to dump the greenback.

The main support stands at 1.2400 and it will take a downward acceleration through it to see the pair resuming the bearish tone, with the immediate target at 1.2360, mentioned year low.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD turns negative near 1.0760

The sudden bout of strength in the Greenback sponsored the resurgence of the selling pressure in the risk complex, dragging EUR/USD to the area of daily lows near 1.0760.

GBP/USD comes under pressure and challenges 1.2500

GBP/USD now rapidly loses momentum and gives away initial gains, returning to the 1.2500 region on the back of the strong comeback of the US Dollar.

Gold retreats from highs on stronger Dollar, yields

XAU/USD trims part of its initial advance in response to the jump in the Dollar's buying interest and the re-emergence of the upside pressure in US yields.

XRP tests support at $0.50 as Ripple joins alliance to work on blockchain recovery

XRP trades around $0.5174 early on Friday, wiping out gains from earlier in the week, as Ripple announced it has joined an alliance to support digital asset recovery alongside Hedera and the Algorand Foundation.

Week ahead – US inflation numbers to shake Fed rate cut bets

Fed rate-cut speculators rest hopes on US inflation data. After dovish BoE, pound traders turn to UK job numbers. Will a strong labor market convince the RBA to hike? More Chinese data on tap amid signs of slow Q2 start.