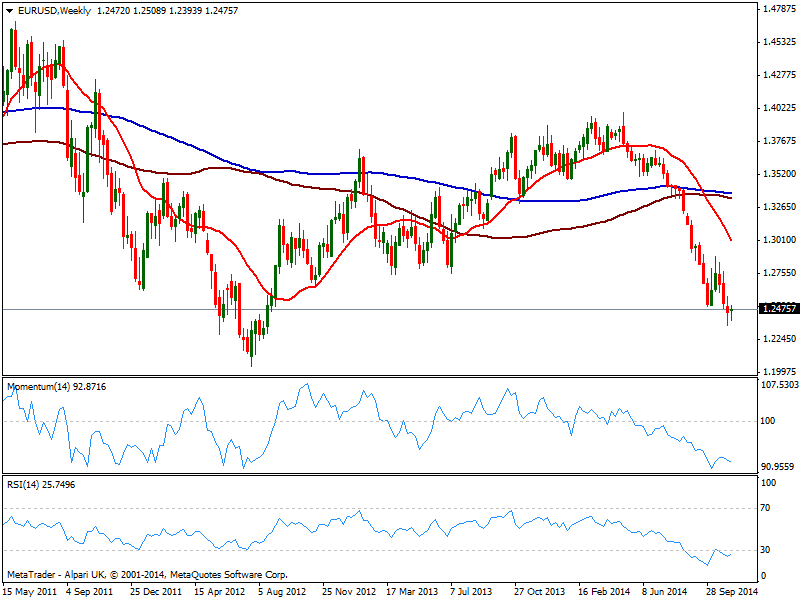

Technically, the weekly chart shows 20 SMA has extended its decline through larger ones, momentum maintaining its bearish slope and RSI still below 30, with sellers surging on advances towards the 1.2500 price zone.

Daily basis, 20 SMA offers dynamic resistance well above current price in the 1.2550 price zone, whilst indicators had erased oversold conditions but remain well into negative territory, and showing no aims to advance further. For the upcoming days, the year low of 1.2357 will be the critical support to follow, as it will take a break below to see the pair resuming the side, down to 1.2280/90 price zone, where the pair presents several weekly historical lows. If this last gives up, an approach to 1.2100 seems likely, opening also doors for a test of the long term key psychological level of 1.2000 in a longer term view.

Above afore mentioned 1.2550 the pair may correct higher, but the line in the sand remains at 1.2660, next resistance and probable top in case of a weekly recovery. In the unlikely case the pair manages to break above it, next target comes at 1.2750/70 price zone, albeit chances of such advance seem extremely poor at this point.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.