In order to answer this question, first we need to contextualise the recent trend in international debt. Certainly this has grown substantially: according to data from the Bank for International Settlements, between 2010 and 2014 the outstanding balance of international debt (both public and private) for 15 benchmark emerging countries as a whole grew by 82%, around 20% annually on average. The international debt of developed countries remained almost stable over the same period. The question is therefore relevant.

However, when we look at a longer timescale and compare this with GDP (a more effective measure to determine a country's capacity to repay than absolute sums), it can be seen that although there has certainly been an upward trend in the international debt of the group of leading emerging countries over the last few years, this has not reached historically high levels. In fact, the levels in 2014 were below the long-term average of 1992-2014. And if we look at external debt rather than debt securities, a broader concept that also includes loans, credit and other liabilities in addition to debt securities, the conclusions remain the same: there has been clear growth since 2010 but the current levels cannot be considered excessive in historical terms.

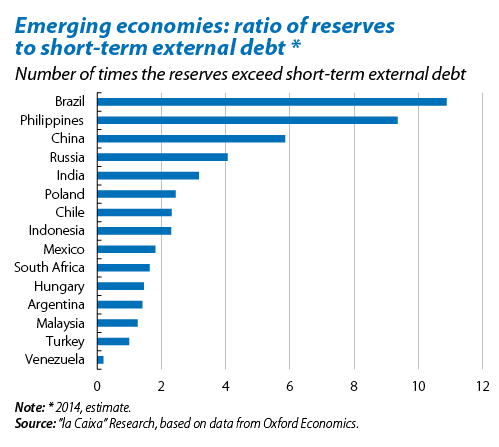

This conclusion is even more comprehensive when we analyse the differences between countries. Among the main emerging economies, seven countries have seen above average growth in external debt from 2010 to 2014: South Africa, Malaysia, Poland, Turkey, Chile, Mexico and Venezuela. However, of these, only the first two are at their highest levels of external debt since 1990. This disparity between countries is repeated when we look at the room to manoeuvre of those most affected by the accumulation of external debt. One typical way of tackling this question is to compare a country's short-term external debt with its level of reserves. It should be noted that, in a situation of exchange range uncertainty and external financing, a country's reserves determine its ability to respond.

So when we compare the level of reserves with short-term external debt, the only country whose reserves do not cover its short-term external debt is Venezuela. At the next level of risk are those countries whose reserves cover less than twice their external debt1: Turkey, Malaysia, Argentina, Hungary, South Africa and Mexico. Should we be concerned about these six countries? The likelihood of an episode of uncertainty occurring can be related to the quality of their macroeconomic fundamentals. In this respect, when their main imbalances are analysed (inflation, public deficit and current balance), we can see that South Africa has accumulated the most challenges (with excessive imbalances in the three variables mentioned). Some distance after it comes Turkey, with high inflation and a high current deficit, and therefore also relatively at risk. In the case of Argentina the main problem is inflation, which is high and has poor prospects, as well as a worrying upward trend in the country's public deficit (although the current levels are not alarming per se). The other members of the group seem to be more protected: Hungary and Malaysia have a current account surplus and do not suffer from any excessive inflationary tensions while Mexico's imbalances remained stable (and at levels that are not excessive for the country) in 2014.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.