Weekly Wrap-Up Mar 14 - 18; Fed, BoE and BoJ Decisions

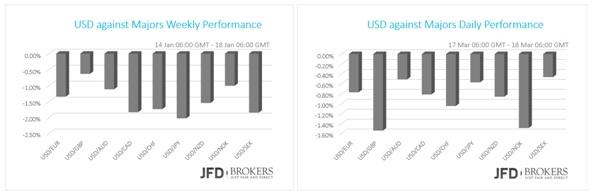

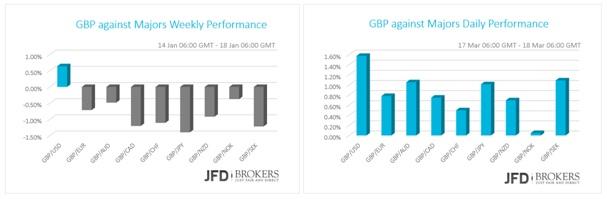

The greenback suffered heavy sell-off this week before and after Fed’s interest rates decision and Yellen’s implication for only two rate hikes this year from four that had planned in December. The British pound recovered some of its earlier losses following BoE policy meeting that kept the monetary policy unchanged, but the weekly performance remained in the negative territory.

The Bank of Japan Governor Haruhiko Kuroda mentioned that theoretically there is more room to slash interest rates further and the central bank will revise this possibility. The U.S. stocks rallied upwards, closing with gains.

U.S. dollar continues to lose ground

Fed’s positive macroeconomic updates during the week overshadowed easily by Yellen’s statements after Thursday’s policy meeting. Fed kept current monetary policy unchanged, as expected, and kept the dot-plot forecasts indicating two rate hikes in 2016 unchanged but less than four rate cuts had planned in December. However, the dollar dived as Fed Chairwoman avoided to speak much for the upcoming rate hikes and instead she underlined the global economic headwinds. Although, she stated that tightening in April’s meeting is still on the table and the U.S. GDP growth will run above potential.

The inflation rate indicated a stability in the improvement of consumer prices. The consumer prices rose by 1.0% in February higher from the market consensus of 0.9% but by far below last month’s figure of 1.4%. However, above 1% figures boost confidence that it will soon approach Fed 2% target. The U.S. Retail Sales came in line with forecasts of the Commerce Department. They declined modesty by 0.1% in February, following a drop of 0.4% in January. The Producer Price Index slid by 0.2% while the Business Inventories rose by 0.1% in January versus expectations of a flat month.

EUR/USD Profit Taken at 1.1300; Remain Target 1.1380

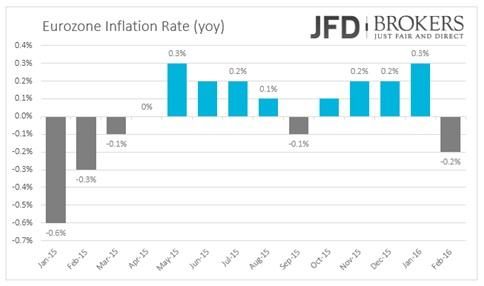

The euro was traded mixed versus the majors the whole despite as the domestic indicators were incapable to define a meaningful direction in the market. Eurozone’s inflation rate improved to 0.2% month-over-month from -1.4% in January, however, year-over-year inflation rate turned negative to 0.2% and away from central banks’ target of just below 2%. The other news released in the week were the Employment Change for Eurozone as a whole that surpassed market consensus of 0.2% and rose by 0.3% qoq and the industrial production that increased by 2.1% reaching a 6-year high. The month before, the production declined by 0.5% and was expected to have increased by 1.5%.

The EUR/USD pair has recovered well from the 1.1060 lows seen earlier in the session, and which also coincides with both the 4-hour 50-SMA and the 200-SMA, as well as with the ascending trend line which started back in December. The greenback came under heavy pressure across the board following the dovish Fed outlook, as a result to send the single currency aggressively higher, taking out several significant levels, including the first suggested target at 1.1300. At the moment, the EUR/USD pair is sitting just above the 23.6% Fibonacci level, near 1.1300. The short-term indicators remain positive and thus further gains could be on the cards. Therefore, ahead of yesterday’s reaction, the significant level at 1.1370 will act as a target – second suggested target.

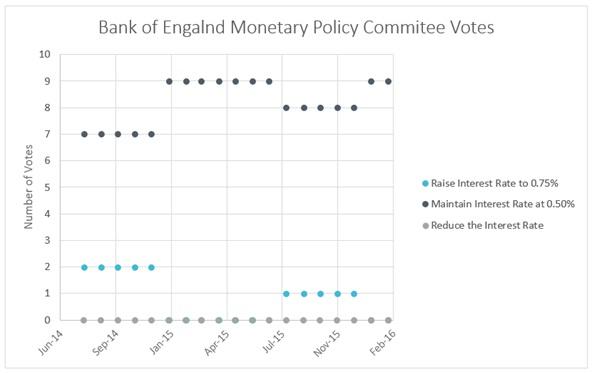

BoE policymakers voted 9-0 to keep interest rates unchanged!

The British pound recovered some of its earlier losses following BoE policy meeting that kept the monetary policy unchanged, but the weekly performance remained in the negative territory. No changes to BoE Monetary Policy Committee voting pattern on yesterday’s meeting. The policymakers voted unanimously to keep the rates unchanged at 0.5% for the seventh year amid worries about global growth and the cementing Brexit referendum. The Asset Purchase Facility also kept unchanged at £375B. Earlier this week, the sterling plunged due to the Annual Budget Report published by the Chancellor of Exchequer. The report revealed non-expected changes to the taxes, lowered GDP forecasts from 2.4% to 2% and increased spending cuts by £3.5 billion. The Chancellor also emphasised on the bad consequences of Britain exiting the European Union. In other news, the unemployment fell down by 18.0K and the average earning rose by 2.1% above expectations of 2%. The unemployment rate for the three months to January remained at 5.1%.

The GBP/USD had headed sharply higher following the Bank of England Policy meeting and is currently in the process of breaking above suggested level of 1.4350. The pair has broken above 1.4500 during the Asian session, a previous level of resistance, which, if we see an hourly close above here, should prompt a move towards 1.4530 and then at 1.4600. This has been a very aggressive move higher so far, without any significant retracements along the way. Therefore, we remain USD-negative and a pound buyers.

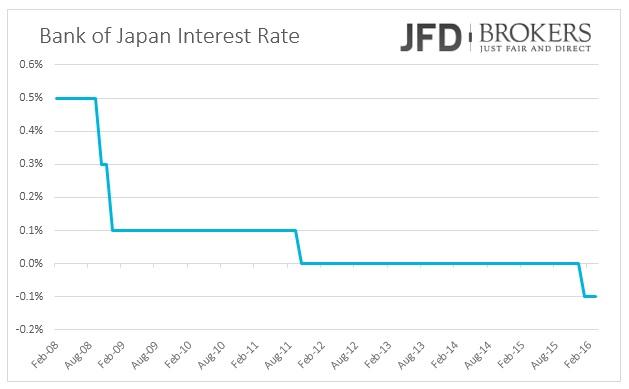

BoJ may cut rates further in the negative territory

The Bank of Japan kept its interest rates unchanged on Tuesday overnight driving Japanese yen higher against its major peers. The bank maintained its negative rate policy of -0.1% and the same level of asset purchases under bank’s qualitative and quantitative easing (QQE) program of 50 trillion yen a year. However, yesterday, the BoJ Governor Haruhiko Kuroda mentioned at his press conference that theoretically there ismore room to slash interest rates further and the central bank will revise this possibility. Another easing tools may be the modification of the QQE program.

The Japanese yen is continuing to push lower against the U.S. dollar, although is continuing to struggle near the psychological level of 111.00. We’re seeing a bit of a recovery in the dollar early Friday, following an aggressive sell-off yesterday. Technically speaking, this enabled the pair to break below the key level of 112.25, as well as below the sideways channel that has been created over the last few weeks, however it failed to achieve a daily or a 4-hour close below 111.00. The setup was already bearish, given that it's came following a major sell-off from 16 March, but this just provided the catalyst for the break. We are seeing it pare some of these losses today, but I don’t expect that upward move to be sustained. For the medium term holders/traders, the next level to watch will be the 107.25 barrier, which coincides with the 38.2% Fibonacci Retracement level. Slightly below that area, the 200-SMA near 105.00 is ready to provide a significant support to the price action, which I set as a second target for the long-term.

What to watch today

Not much to data on the economic calendar to drive the market today. The most important macro-updates are January’s Retail Sales and February’s Inflation Rate for Canada and March’s preliminary Michigan Consumer Sentiment Index in U.S.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.