Weekly Outlook Feb 22 – 26

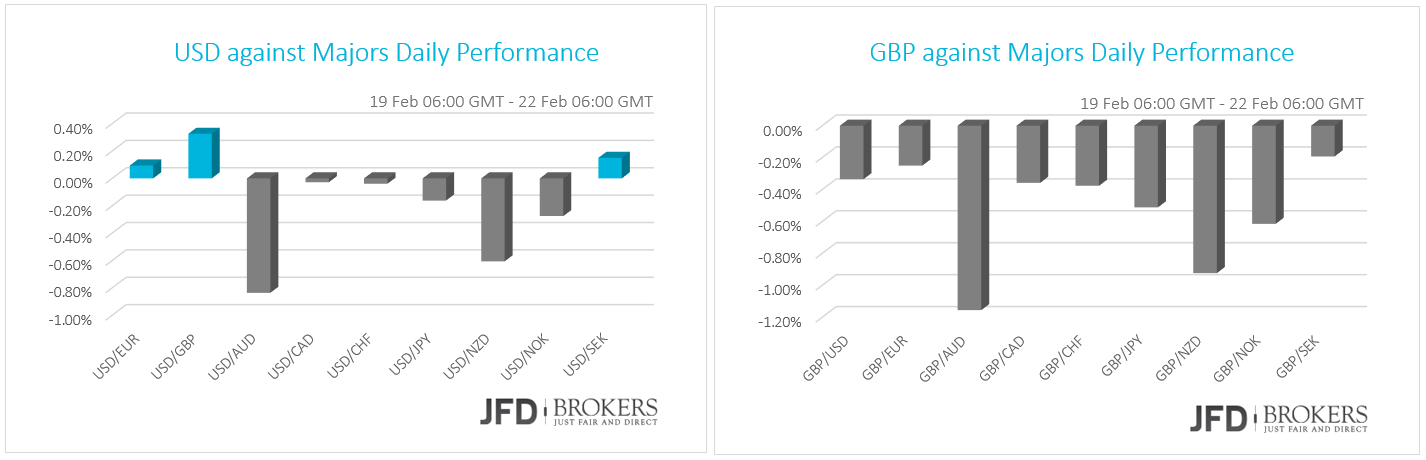

A slew of economic data is due out this week in the U.S., highlighted by the release of the second reading of 4Q GDP, the Durable Goods Orders and a batch of Housing data. The Fed will be keeping an eye on all these data, looking for further signs to continue raising interest rates. The dollar was mixed against its G10 counterparts during the European morning Friday and early Monday. It was sharply lower against the AUD, NZD and CAD, in that order, while it was higher vs GBP.

The worst performing currency was the GBP, which plunged more than 1% against its majors, after London Mayor Boris Johnson, one of Britain's best-known politicians, backed the Brexit Leave campaign. The pound fell sharply versus the commodity currencies, such as AUD, NZD and CAD. The GBP/USD pair gapped down in early Monday to trade below the significant level of 1.4300. The British pound finished the week down 0.8% vs. the dollar, while it’s trading up 0.20% so far this month, following a negative January -3.35%. It should be noted, that over the weekend British Prime Minister David Cameron set the date, June 23, for a referendum to be held on Britain's evolvement in the EU.

The single currency ended Friday pretty much unchanged against the greenback, at 1.1110, regaining earlier losses seen after the release of the U.S. CPI, which increased to 1.4% yoy from 0.7% yoy. There is no change to the EUR/USD outlook from a technical perspective, although the daily chart is pointing mildly lower, so it may be that selling rallies is the short term plan today, with the first target being the 1.1025 barrier, which coincides with the daily 200-SMA. Meanwhile, the euro recorded its biggest losses against the Australian dollar and the New Zealand dollar, while it gained only against the British pound.

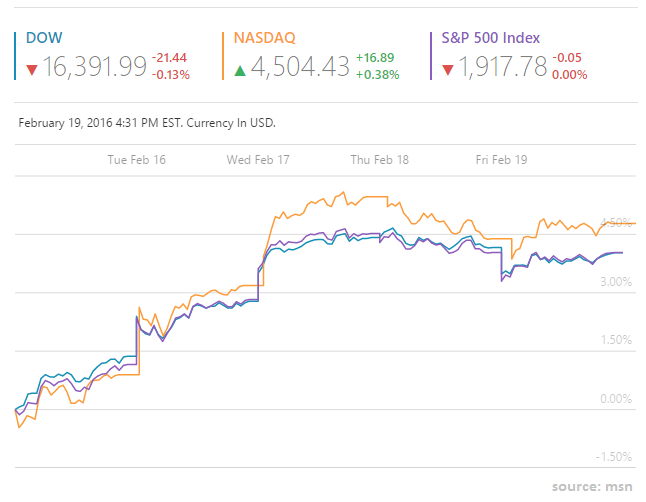

U.S. equities closed little changed during Friday’s session to finish the strongest weekly gains since November 2016. The DJIA index fell 0.1% to 16,391.99, while the S&P 500 index lost less than 0.1 percent to 1,917.78. The Nasdaq Composite Index rose 0.4% to end the day above the significant level of 4,500.

The Dow Jones is testing a significant level, 16500, the last couple of days, which could determine the medium outlook. Around there, the 50-SMA on the daily chart is ready to provide a significant resistance to the index. If a break above the aforementioned obstacles occur, the points to watch will be the 16900 barrier and then the psychological level at 17000, which coincides with the daily 200-SMA.

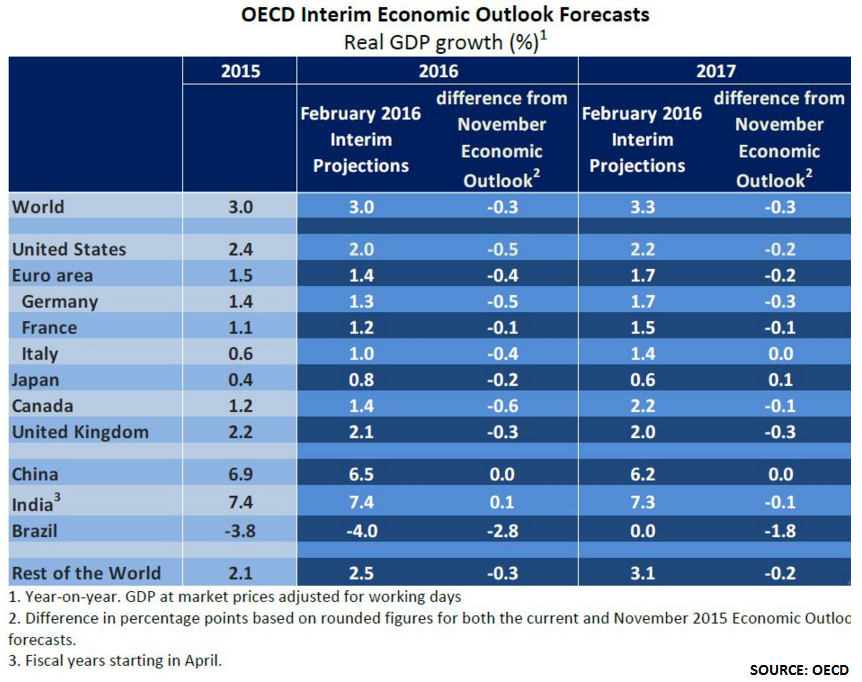

The previous week, the Organisation for Economic Co-operation and Development (OECD) cut its global and U.S. economic growth forecast and called for “urgent” action to spur growth. The OECD cut its estimates for global growth to 3% this year and 3.3% in 2017. The OECD downgrade was especially sharp for the U.S., now forecasting 2% growth in 2016, down from its previous 2.5% estimate, and 2.2% in 2017, down from 2.4%. In the euro area, 1.4% growth is expected this year and 1.7% in 2017, down 0.4 and 0.2 percentage points, respectively. UK growth is now forecast at 2.1%, down from the 2.4%. In Japan, OECD projects growth of 0.8% this year, down from its previous forecast of 1%, and 0.6% in 2017, down from 0.7%. China’s economic forecast was unchanged at 6.5% this year and 6.2% in 2017. India, which imports a lot of its energy, saw its forecast for growth revised up from 7.3% to 7.4%.

The week ahead:

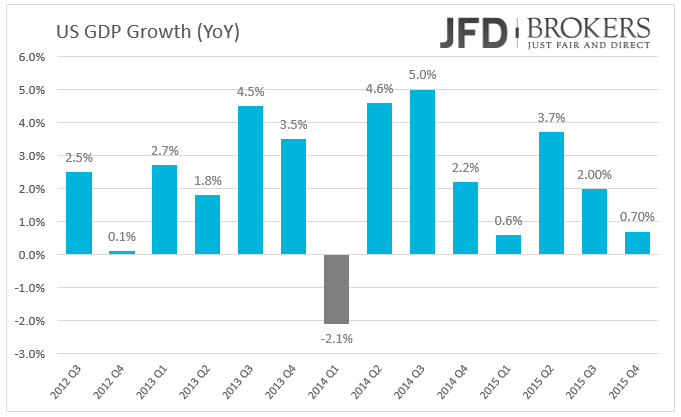

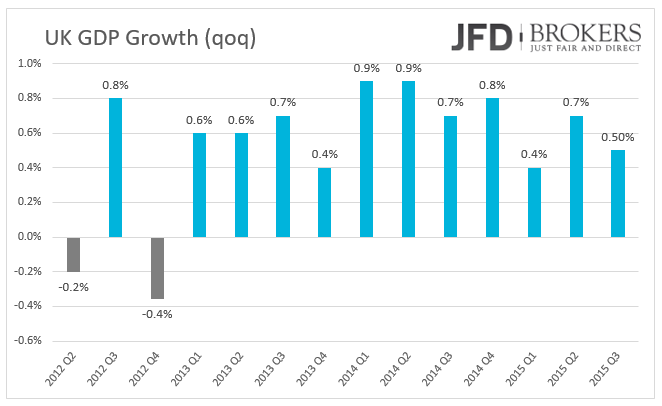

A quiet week ahead from an economic front is often the case for the last week of the month. A minimal amount of significant top tier releases means there is often a strong platform for technical traders. Of the notable releases to watch out for, the major one from the U.S. come in the form of GDP on Friday. Analysts believe the GDP number, due out Friday, will be revised downward to 0.5% from the first estimate of 0.7% released last month. In the UK, the GDP figures on Thursday and the Consumer Confidence on Friday are likely to provide the opportunity for most volatility going forward.

Meanwhile in the Eurozone, a particular quiet week sees the German unemployment data provide one of the few highlights. In Asia, the Japanese market look to dominate, as late Thursday Japan nationwide CPI is coming out. The eurozone region has a number of releases this week, yet there are two which are especially worth looking out for. The Consumer Confidence, Business Climate and the Industrial Confidence releases on Friday are well worth noting. Also, the release of the final CPI figure on Thursday is important given the impact the flash figure had a fortnight ago.

Besides that, early Monday, we have the Markit Services PMI for France, Germany and Eurozone as a whole for February. The Service PMI for the Germany is expected to rise slightly, while France’s PMI is expected to decline slightly to 50.1 from 50.3. Shortly afterwards, Deutsche Bundesbank releases the German Buba Monthly Report, which contains statistical tables, speeches and analysis of current and future economic conditions from the bank’s viewpoint. In the U.S., the only economic event for today is the Markit Manufacturing PMI for February; no forecast is available and not usually that marking affecting.

Among this week’s other indicators, Tuesday we get Germany’s IFO survey for February and preliminary release on CPI for January on Thursday. Other indicators coming out include U.S. Existing Home Sales for January and Consumer Confidence for February on Tuesday. U.S. New Home Sales and Markit PMI on Wednesday. U.S. Durable Goods for January are coming out on Thursday (3% vs -5.1% exp.). Finally on Friday, the Michigan Consumer Sentiment Index for February is expected to fall slightly to 90.1 from 90.7.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.