This week is looking a little quieter in the markets, especially compared to the one just gone. The dollar continues to advance against all the major pairs after the U.S. government reported a surge in hiring last month and the lowest unemployment rate in seven years. The Non-Farm Payrolls figures showed 271,000 jobs were added in the U.S. economy last month, easily topping expectations of 180,000. At the same time, the unemployment rate fell to 5%, the lowest since April 2008, while payrolls data for August and September were revised to show 12,000 more jobs created than previously reported. The dollar gained more than 1% following the NFP report against the euro and the pound, extending the monthly losses to 2.13% and 2.28% respectively. The USD surged above the key resistance level of 121.65 against the JPY, recording its sixth positive day in a row while it added more than 2% to its value the last week – the largest weekly gain since May. Moreover, U.S. Treasury yields jumped following the labour report, with the 2-year yield marking its highest level in 5-1/2-years.With the above in mind, expectations of a rise in US interest rates in December have soared following the labour report.

Today, there are no major indicators or speeches from Eurozone, apart from the sentix investor confidence for November. A while later, the Organization for Economic Cooperation and Development will present an economic outlook for the overall activity in the OECD area, however, it poses no threat to the euro. The Canadian housing starts for October will be released. At the afternoon, in US, the labour market conditions index for October will be out. The National Australia Bank will release October’s business confidence. The Westpac consumer confidence for November will be also out. In China, the yoy inflation rate is expected to slow down further to 1.5% from 1.6% before while the consuming prices growth, on a monthly basis, is forecasted to enter the negative territory again, at -0.2%, after four months.

On Tuesday, a Eurogroup meeting will take place. In the morning, the UK inflation report hearings is expected to confirm the slashed forecasts of the BoE quarterly inflation report that released the week before. In US, the NFIB Business Optimism index will be out as well as the export and import price indices for October. Moreover, the Wholesale inventories for September will be released and forecasted to have grown steadily by 0.1%.Later in the day, the RBNZ Financial Stability Report will be followed from a press conference from the RBNZ Governor Graeme Wheeler and may have a significant impact on the local currency.

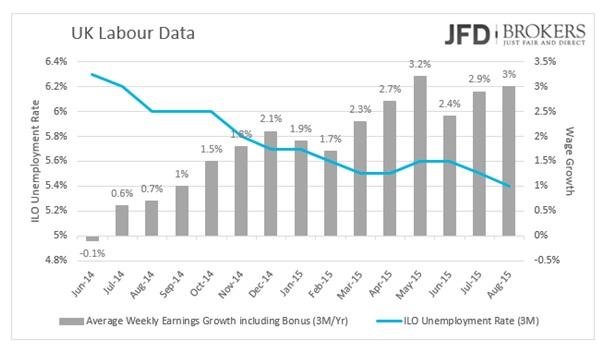

On Wednesday, the traders’ attention turns to UK where the country’s employment report. Even though last week economy revealed a weak growth and its inflation rate grinding to a halt, its labour market is robust. The ILO unemployment rate decreased to 5.4% in the three months to August, the lowest since March to May of 2008. The weekly earnings are growing more than 2% the last half year and peaked to 3% in August while the market expects them to have grown even more by 3.2%. The claimant count change, which represents the number of British claiming for unemployment benefits, rose above zero the last two months while it was coming out negative for a long time before. However, the market expects it to decrease back to 1.4k from 4.6k before.

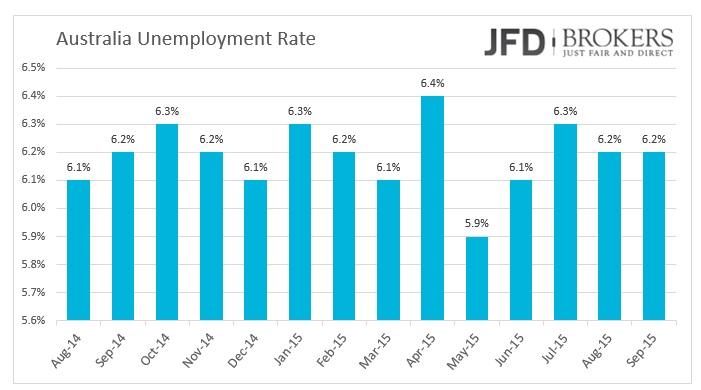

Overnight, Australia’s consumer inflation expectation report in November will be published. A while later, the employment report will complete the picture of the Australian economy. October’s unemployment rate is expected to remain at 6.2% while the employment change is forecasted to show 15.0k new job positions from -5.1k before.

On Thursday, the German inflation rate for October will be released – no major changes are expected. The traders will keep a tab for Eurozone’s industrial production for September as they expect to grow on a steeper pace of 1.7% from 0.9% before, year over year, opposite to the recent ECB move to cut economic growth forecasts. In US, the JOLTS job openings for September and October’s monthly budget statement will be out. During the night, in Japan the capacity utilization and the industrial production for September will be posted.

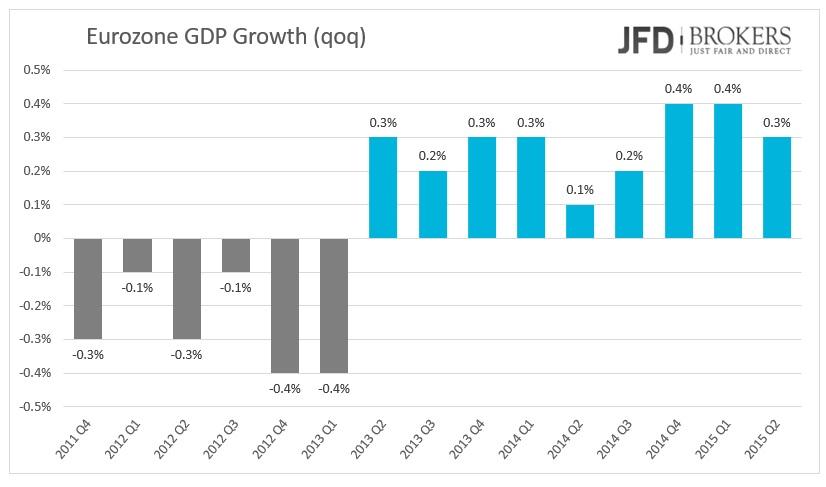

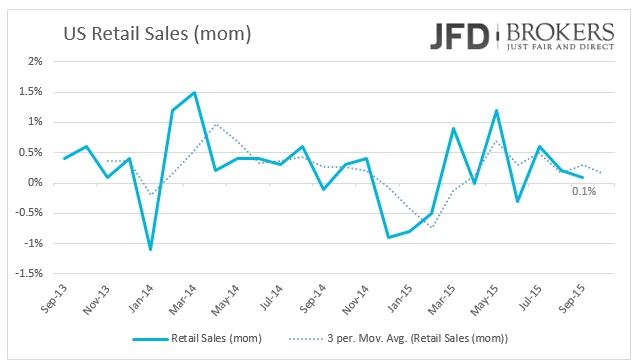

On Friday, the two spotlight events of the day are the first preliminary release for Eurozone’s GDP for Q3 and the US Retail Sales for October. Eurozone’s GDP is predicted to pick up by 1.7% in the threemonths to September, on a yearly basis. The trade balance for the Euro Area in September will be printed as well.

After the last huge surprise of the NFP report, theretail sales for October will be closely monitored. Both the retail sales and the retail sales indicators are expected to have picked up in October.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.