Market Overview

Financial markets are beginning to settle down after the significant volatility of earlier in the week. The hard facts are that although the IMF may call it being in “arrears”, Greece has effectively defaulted and joined a small club of countries to have failed to pay the IMF, including Somali and Zimbabwe. Ait appears that the game is not yet played out though with a late request from the Greeks for a third bailout last night (even before the 2nd has been fully distributed, remember the €7.2bn tranche that the recent negotiations have been all about). However with no extra concessions of any note this is little more than a desperate tactic by the Greeks. Expect more chicanery in the next few days in front of the referendum.

However after the initial shock of the Monday, market volatility has been gradually calming down and now appear to be looking forward again. That means the immediate impact of key tier one US economic data that could be a significant guiding influence on the Federal Reserve’s monetary policy decision in the coming months. The ISM Manufacturing data picked up last month and this bodes much better for growth prospects and if this trend continues today then the Fed will sit up and take notice.

Overnight, Wall Street closed marginally higher, with the S&P 500 up 0.3%. Asian markets were also mixed to slightly higher (Nikkei 225 was up 0.3%), and this was despite a slight miss of expectations on the China manufacturing PMIs where the official data dipped back to 50.2 and the HSBC number was 49.4. European markets have started the day in a move positive mood after significant selling pressure in the past couple of days.

In forex markets there has been little real movement overnight ahead of the key US economic data, although the Kiwi is managing to unwind some of the recent losses. Gold is broadly flat in early trading as they look to form support after a couple of days of selling pressure.

The Manufacturing PMIs around the world are the key focus today and the Europeans are announcing early in the session. The UK data is released at 0930BST with a slight improvement to 52.5 (from 52.0) expected. The ISM Manufacturing data is at 1500BST and is expected to show a pick up to 53.2 (form 52.8). The US labor market data also begins with ADP employment report at 1315BST which is expected to show 218,000 jobs (up from 201,000).

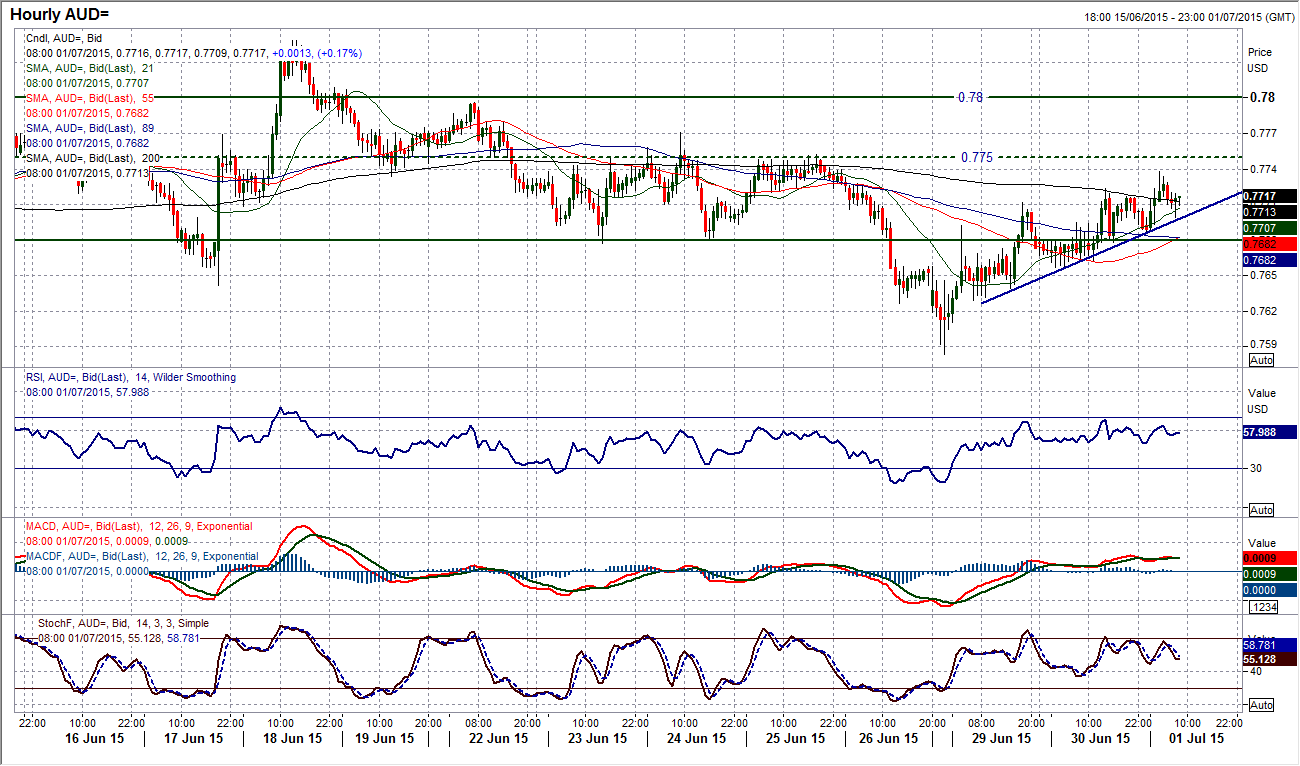

Chart of the Day – AUD/USD

The Aussie has rallied for the past three days, (helped higher by an upside breakout above 1.1300 on AUD/NZD) however this looks to be a near term move that is seen once more as an opportunity to sell on AUD/USD. The outlook on the daily momentum indicators remains broadly negative with RSI again just unwinding back higher towards 50 which has been used as a consistent chance to sell in the past few months. The intraday hourly chart shows there is a pivot level around $0.7750 which has acted as resistance recently. The hourly chart shows there is a sequence of higher highs over the past few days but the momentum indicators are somewhat disappointing, with the hourly RSI failing to push into strong territory (above 70) and the hourly Stochastics showing a slight bearish divergence. I do not believe that this rally will move too much further before the selling pressure kicks in once more. Watch the small uptrend on the hourly chart coming under pressure, whilst a breach of the support around $0.7680 would be the signal for an end to the rebound.

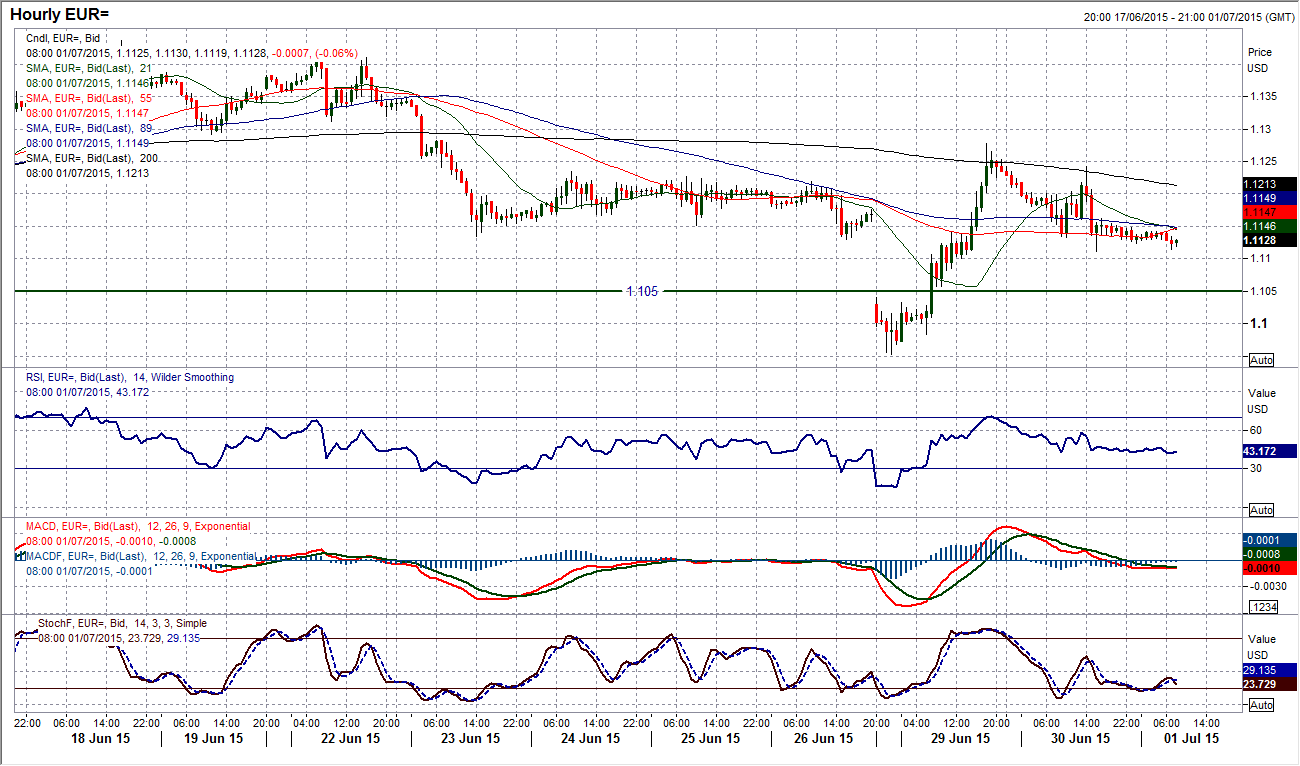

EUR/USD

There are just a few signs that after a tumultuous couple of days, the euro is beginning to settle down. Interestingly enough too, the settling level as we enter the European session on Wednesday morning is not far from the consolidation support around $1.1130/50 that the euro had traded in last week prior to the dramatic movements. The bullish engulfing pattern of Monday has been neutralised by an almost “dark cloud cover” candle, so on a net net basis, I would say that is honours even. The momentum indicators reflect this too with RSI and MACD lines all but neutral. Interestingly the Stochastics are actually rising, whilst the fact that the euro is trading above the $1.1050 pivot suggests there is still a slightly positive bias still. The intraday hourly chart shows that trading over the past 12 hours has settled and we now await the next catalyst with hourly momentum indicators also rather benign. This consolidation comes ahead of a huge couple of days of US economic data so this is not too surprising as we look to the States now to drive sentiment.

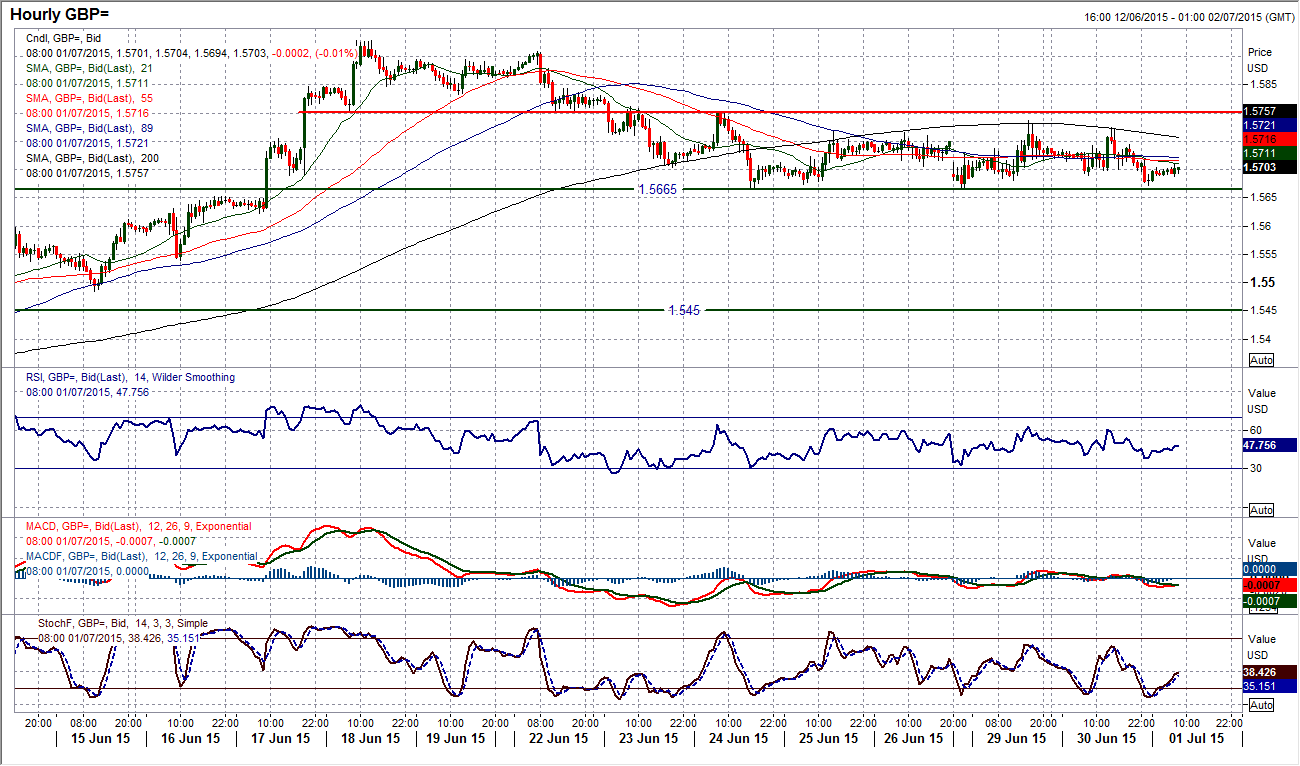

GBP/USD

Cable has largely escaped the volatility that flooded the euro in the past couple of days, as a trading range of just over 130 pips between $1.5665/$1.5800. However I am still of the opinion that on the balance of the indicators there is a likelihood of a downside break of the support at $1.5665. There is still a slight corrective configuration on the momentum indicators, mainly driven by the Stochastics which are in decline. The intraday hourly chart shows the tight range and hourly momentum indicators broadly neutral. The hourly moving averages are broadly flat. This looks to be a market waiting for a catalyst and with ISM manufacturing today and Non-farm Payrolls tomorrow, this could be the calm before the storm. A downside break of $1.5665 would imply a target of $1.5535, whilst the key support comes in around $1.5450. There is key old support turned new resistance at $1.5800.

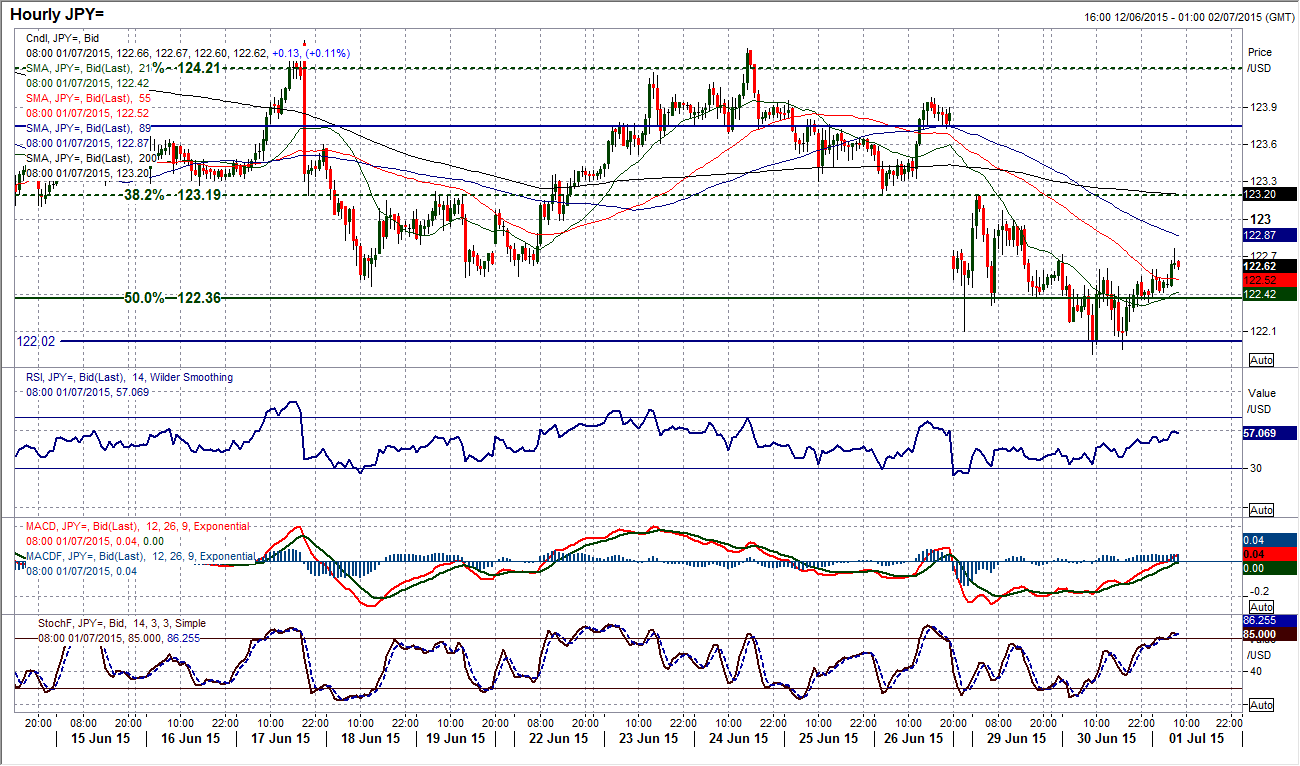

USD/JPY

The last two completed candles have painted a rather uncertain picture for the bears. The sellers have tried to pull Dollar/Yen lower, but for two straight days the support around the old 122 breakout has encouraged the buyers to return again. I still see this as being part of the process of forming the next key low on Dollar/Yen (which for some time I have said is likely to be around 122). Although the momentum indicators are still corrective, the almost “doji” candle that formed yesterday suggests a lack of decisive selling. The intraday hourly chart shows the support around 122.00 has been tested and held three times now, whilst a move above 122.70 would end a near term sequence of lower highs and open a recovery again. The key resistance remains with the 38.2% Fibonacci retracement level of 118.86/125.85 at 123.20.

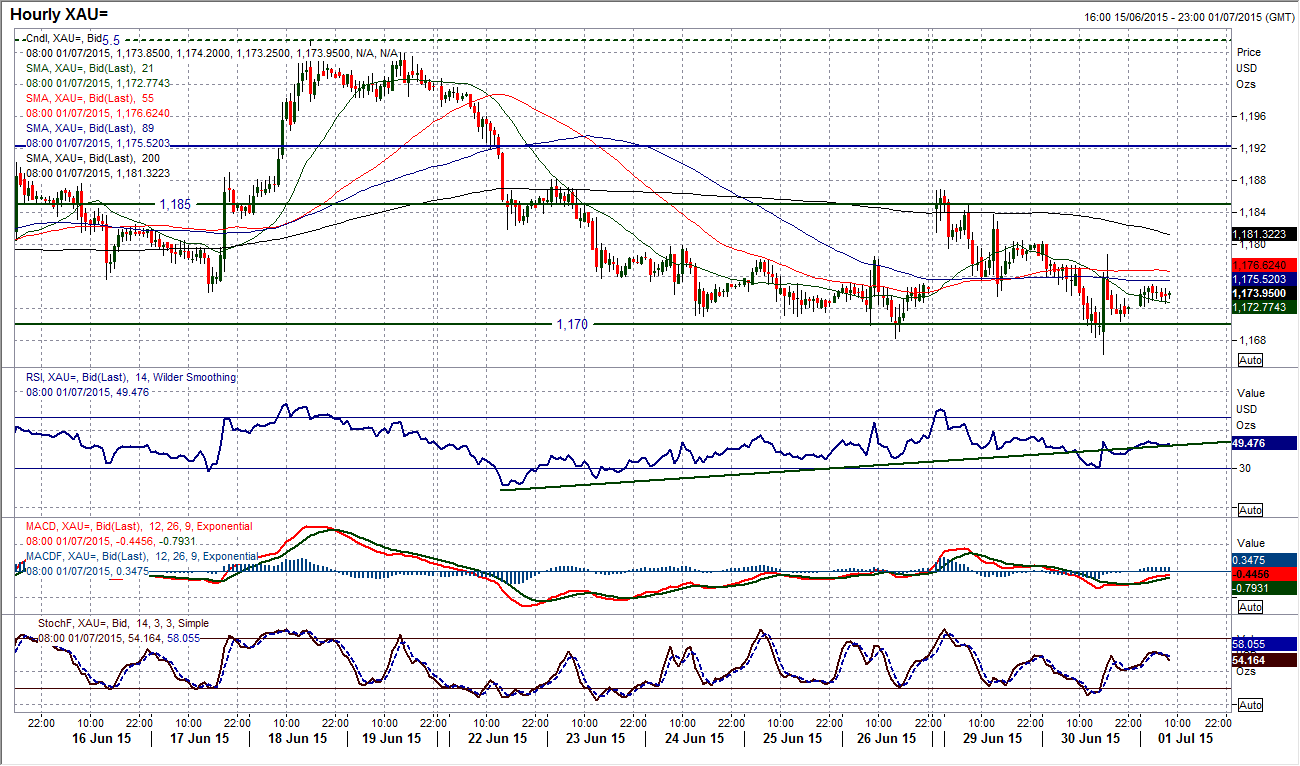

Gold

I almost see that Monday’s gap up at the open was a case of blindly buying gold as a safe haven, rather than a real appetite for it, because the reaction since has been for gold to drift back again to put pressure on the range lows once more again. The two subsequent candles show sharply bearish moves that suggests the bears are in control. The intraday hourly chart shows a series of lower intraday highs over the past couple of days that has left resistance around $1180. There is now a feeling that $1170 is seen as a key level for the market, which if it is decisively breached will result in a test of the key support of the June low at $1162. The hourly momentum indicators have taken on more of a corrective outlook once more and selling into the intraday bounces continues to be seen. The key resistance comes in at $1186.90 that is needed to really turn the outlook round.

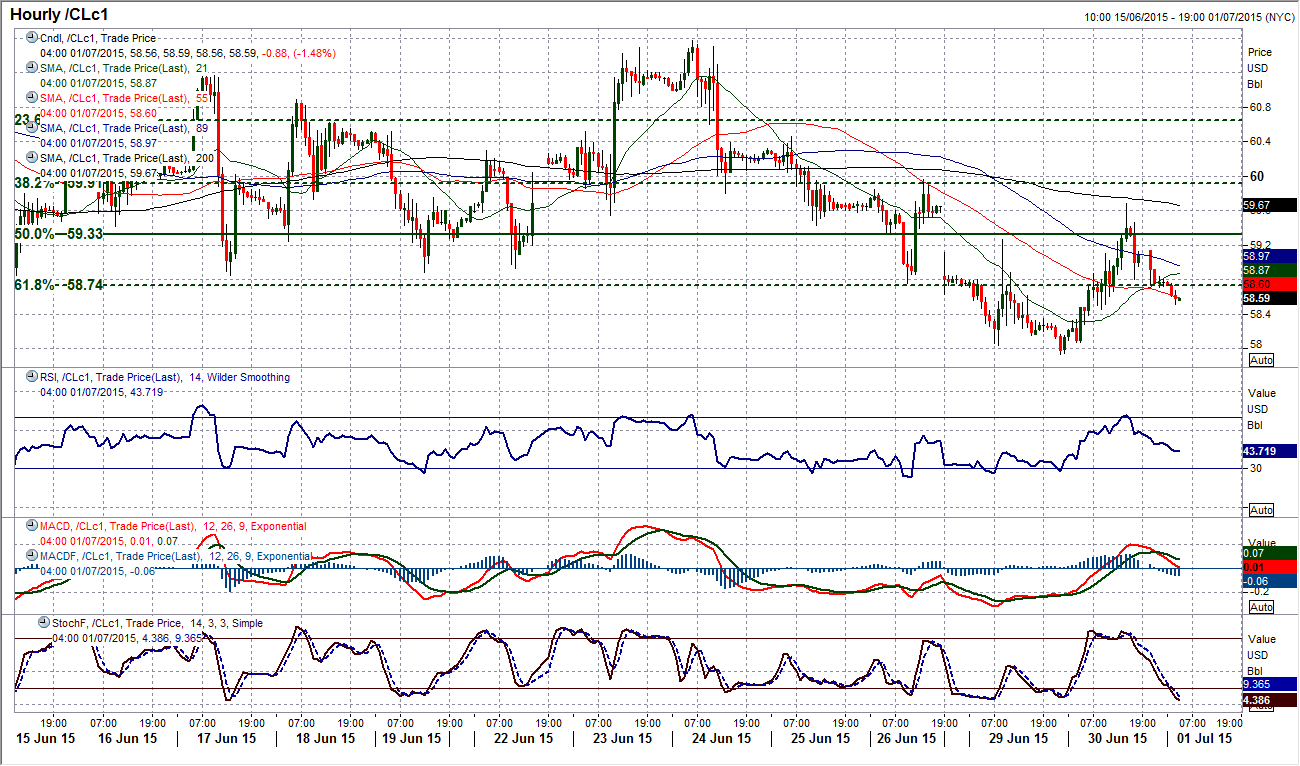

WTI Oil

After four consecutive negative candles, the continuation of the rangeplay has kicked in once more and the buying pressure has returned. Now the outlook for WTI faces an important near term crossroads. The recent decisive break below the 61.8% Fibonacci retracement level at $58.74 should mean that the sellers are in control near term and a move back towards the low at $56.83 is now likely. I said yesterday that a rebound into the resistance band now between the 61.8% and 50% Fib levels (between $58.74/$59.33) would be a chance to sell. This is what happened yesterday and with the hourly momentum indicators having unwound to help renew downside potential (within the range) the opportunity to sell is now there. A sell signal in this zone $58.74/$59.33 would be ideal but it will be interesting to see if this rally is just a near term move as if it fails under the 50% Fib level the bears are likely to pounce again. As IO said yesterday, a move above $60 resistance would abort this view.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.