Market Overview

In the wake of the FOMC meeting last week, the key US economic data has become particularly in focus with strong US data being strong for the dollar. And this is what we saw playing out yesterday. The big dollar correction was stopped in its tracks as positive US data on inflation, housing and manufacturing all helped to support the greenback. With the market being so dollar focused, this induced a correction on equities and signs that the dollar could be ready for further gains. Not all is decided yet though, with the promise of further data today to muddy the waters once more near term. With a stronger dollar seen as impacting on US exporters, Wall Street fell away yesterday, with the S&P 500 closing down 0.6%. This has resulted in consolidation in Asian markets too overnight with the Nikkei up just 0.2%, whilst European markets are slightly lower in early trading today.

In forex trading we see the dollar beginning to lose a bit of ground again against the euro, sterling and the yen as the European session is getting underway, whilst the dollar is finding support against the commodity currencies as the oil price trades slightly lower. Gold continues to consolidate around the $1191 resistance.

Traders will be looking out for the German Ifo Business Climate data which has shown improvement in the last few months (there is a positive correlation between the Ifo and economic growth). The data at 0900GMT is expected to show a slight improvement to 107.3 (versus 106.8 last month). The primary impact will be seen on the euro and the DAX. There will also be a look at the US durable goods orders for signs of life in the purchase of white goods (which have a read through to how the consumer is feeling). The adjusted data (ex-transport) is expected to show a month-on-month improvement by +0.3%. Again this could have an impact on the dollar.

Chart of the Day – EUR/JPY

There has been a near term recovery put together for the euro which has seen the momentum indicators unwind from oversold. However in the past couple of days the recovery is stalling. There is a resistance band between 131.50/132.00 which is holding back a continued recovery. However the interesting moves are seen on the intraday hourly chart. This looks to be a very similar chart to that of EUR/USD. The uptrend is in place just under 130.00, but the support at 130.40 is key near term (just like $1.0900 on EUR/USD) as it is also a potential near term top pattern. The recovery towards key overhead resistance at 132.00 remains intact while the uptrend is in place and this could just simply be a minor consolidation within the rally before further upside. A move back above 131.50 re-opens the 132.00 resistance again.

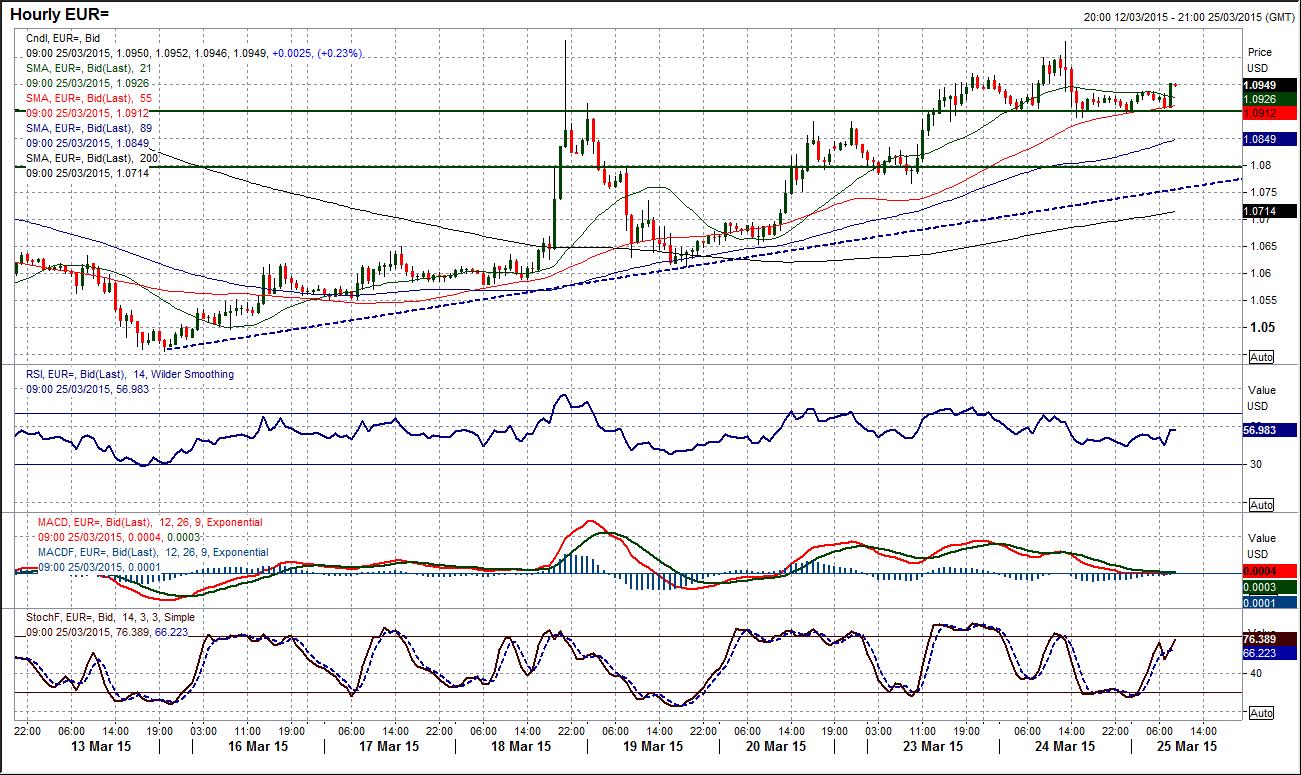

EUR/USD

It is interesting that we are seeing consolidation on the euro right around the resistance of the 3 month downtrend and also around the 21 day moving average. This is also coming with the RSI up and close to 50. This adds to my feeling that the euro is still sitting at a key crossroads for the near/medium term outlook. The intraday hourly chart shows the continuation of the recovery uptrend but now we are seeing the old resistance around $1.0900 acting as the support. There is a concern though that this support could actually be a neckline of a small head and shoulders top on the hourly chart. A consistent decline back below $1.0900 would therefore imply an immediate downside target of $1.0770 which would be a test of the recovery uptrend again. It is also a concern that the hourly momentum indicators are deteriorating once more and suggest that the steam is being taken out of the rally. A push back above yesterday’s reaction high at $1.1030 would reignite the bull run.

GBP/USD

The concerns that I have on the euro are magnified on Cable. The bull run has never really been able to get going on Cable as the resistance around $1.5000 has held the recovery back for four consecutive days and now there is beginning to be some direction forming to the downside. The momentum indicators are a concern with the recovery on RSI and Stochastics seeming to tail off once again, whilst the MACD lines could not even muster a bull cross (unlike most of the other majors). This all points towards sterling underperformance. The intraday hourly chart shows the consistent failure around $1.5000 whilst the drift away yesterday is now putting pressure on the recovery uptrend, whilst the support around $1.4835 is coming under continued test. A clean break to the support around $1.4835 would complete a small top pattern that would imply further retreat back towards $1.4700 support area. With formerly positive hourly momentum now having wilted, it would take a break back above $1.5000 to really suggest there was a real prospect of any recovery.

USD/JPY

Another forex major sitting on the brink of a significant move is Dollar/Yen. The support around 119.40 is protecting the dollar from a correction back towards 118.30, but aside for a brief test yesterday, for now the support remains. This is reflected in the daily momentum indicators which are sitting around key turning points too. The daily RSI is in the mid-40s, a level where the bulls supported in January and February; whilst the MACD lines are fairly neutral too and the Stochastics are looking to bottom out with the recent consolidation. For now we must wait for direction then. Look for a consistent trading clear of the 119.40 support for the trigger to the downside, whilst the resistance at 120.17 is holding back a dollar rebound. Hourly momentum is flattening off with the consolidation.

Gold

After 5 straight days of solid gains, there are signs that the gold price rally is just seeing a pause for breath. This is interesting as it is coming as the dollar is consolidating across all the major forex pairs. Furthermore, the consolidation is coming around the resistance of the old key low around $1191. The bulls will need to quickly resume control otherwise the promising momentum indicators will begin to lose the impetus. The intraday hourly chart shows the recovery and the consolidation, whilst the support of the initial reaction low at $1185 will be an interesting gauge. There are slight signs of negative divergences on the hourly momentum which could also be a sign of a loss of impetus in the rally. I think that it becomes important today for a move above yesterday’s high at $1195.30 to continue the run, otherwise we could be looking at yet another bear market rally that gets sold into.

WTI Oil

WTI has held on to the gains made over the past few days however there is still a few hurdles to overcome to suggest the bulls are gaining control. The 21 day moving average ($47.77) remains a basis of resistance. There was also an interesting consolidation yesterday as the market continued to trade around the resistance band of the old key lows $47.36/$48.00. Looking at the hourly chart, this consolidation does not tell the whole story though as the intraday moves were choppy and volatile as the market fluctuated in the wake of the strong US economic data. This suggests a battle for control is playing out. The near term support at $46.67 is now the level that the bulls need to hold to maintain the run. The overhead old pivot level around $48.70 is holding back a continued recovery towards $50.80. A slight bearish divergence on the hourly momentum indicators is certainly not a good sign for the bulls.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.