Market Overview

Wall Street has once again given a positive handover after a sixth consecutive higher close amid a series of strong M&A news from the pharmaceuticals sector. Despite this, Asian markets were fairly mixed as HSBC’s flash PMI for Chinese manufacturing contracted (below a reading of 50) for a fourth straight month. The reading was though slightly improved on last month, at 48.3 and was better than some had feared, with talk that any number below 48 being taken as a big concern. There was also the announcement that Australian CPI inflation came in lower than estimates which has hit the Aussie dollar in early trading.

News of the death of a Ukrainian politician in eastern Ukraine and subsequent talk of tougher action against Russia has not really impacted the markets too much yet, but any escalation today could be for the benefit of the Japanese yen, and perhaps gold.

Forex trading this morning is fairly muted, with the only real move coming from a slight bout of strength in the Euro. Traders will be looking towards this morning’s minutes from the Bank of England at 09:30BST, whilst there is also a raft of flash Eurozone PMIs to be considered and the German Ifo. The Reserve Bank of New Zealand gives its rates decision tonight at 22:00BST.

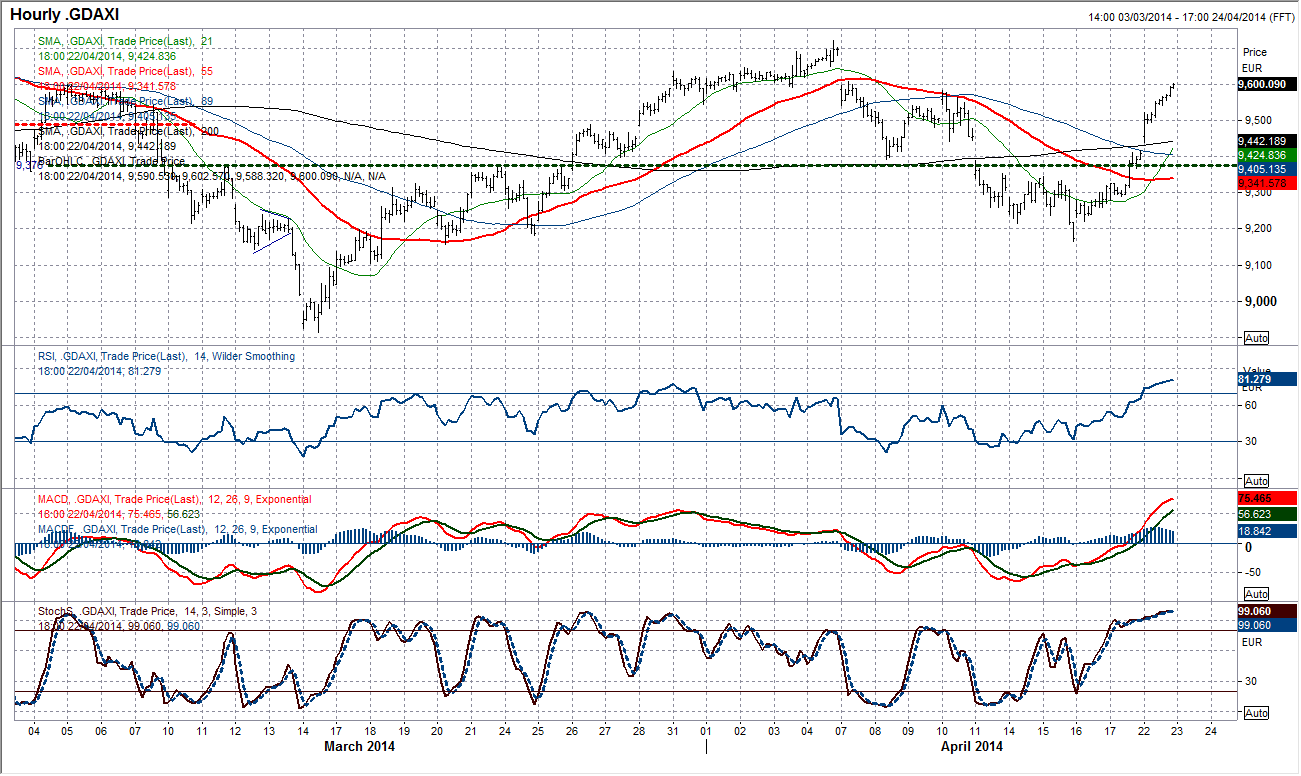

Chart of the Day – DAX Xetra

A hugely strong day for the DAX yesterday, significantly outperforming both the FTSE 100 and the CAC 40. The DAX has now broken above the key near term resistance at 9581 which now opens the way for a test of the key April high once more at 9721. The daily momentum indicators are once more looking positive, with the Stochastics advancing following a bull cross and RSI also pushing positively. The intraday hourly chart also reflects the strength of the move, with momentum extremely strong although now looking overbought near term. The chart suggests that corrections should be bought into once more. There is an initial band of support back at 9540/9580.

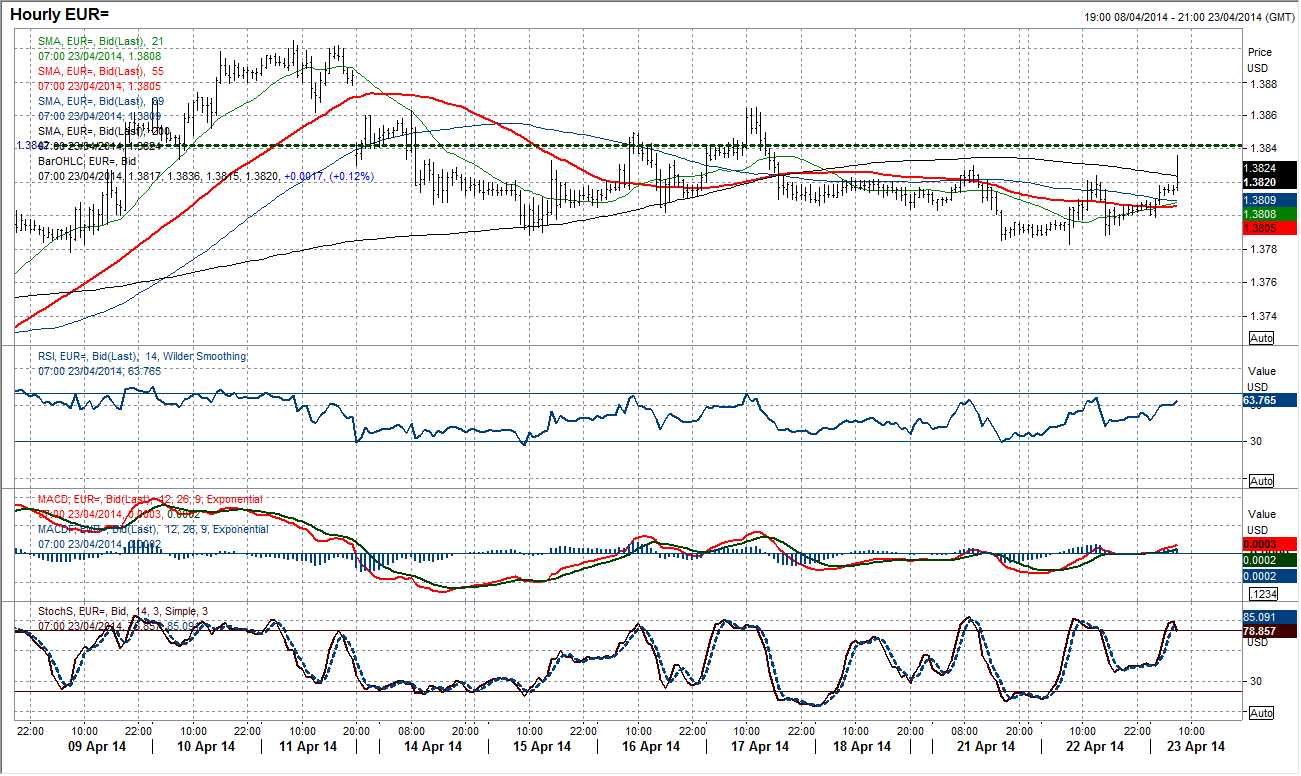

EUR/USD

A disappointing day for the dollar yesterday continued overnight as the Euro made further recovery. After the Easter break had shown a consolidation which threatened a correction, if the pick-up in Euro/Dollar that was seen yesterday can be repeated today then this trading period over the past few days could turn out to be a bullish flag continuation pattern. This would need a move above $1.3865 on the daily chart to suggest this was the case. The intraday hourly chart shows that yesterday’s move still has to continue today otherwise it will merely be another lower reaction high. A sustained move above the high at $1.3830 would significantly improve the outlook, whilst also taking the Euro back above the falling 200 hour moving average (now $1.3823) the underside of which has been capping recent gains. The key low to hold on to for a recovery is $1.3783.

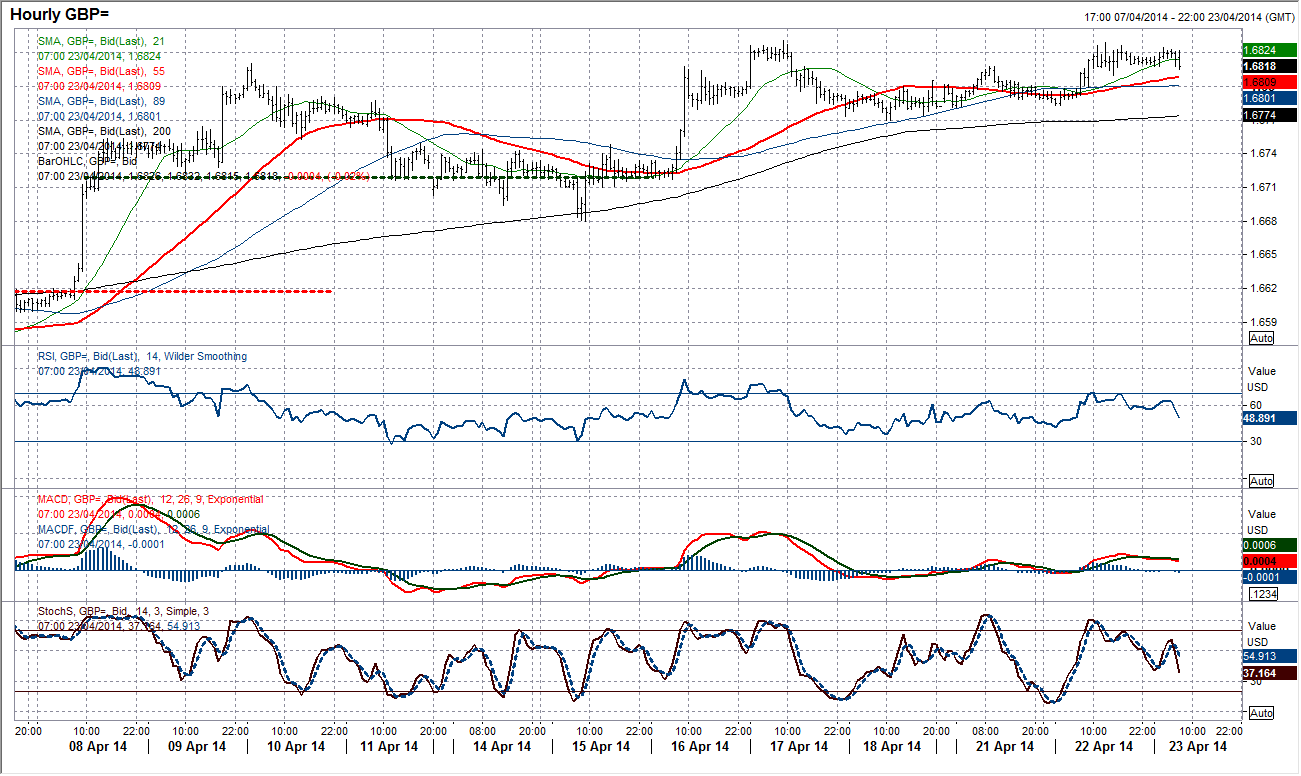

GBP/USD

With traders back from their Easter break, the conviction threatened to return for the Cable bulls. For now, the resistance at $1.6841 remains intact, but the outlook remains positive and it should just be a matter of time before Sterling pushes to another multi month high. The intraday hourly chart shows all moving averages are rising and supportive, whilst momentum indicators are in bullish configuration. This suggests that corrections continue to be used as chances to buy. There is a good band of support that has formed from key lows of yesterday between $1.6783/$1.6799. However, there is still a small nagging feeling that this break to the upside needs to be seen soon, in order to prevent the bulls from tiring. The bulls failed yesterday 2 pips below the key $1.6841 level and will try again today. Failure again today may induce some near term concern over how strong these bulls actually are.

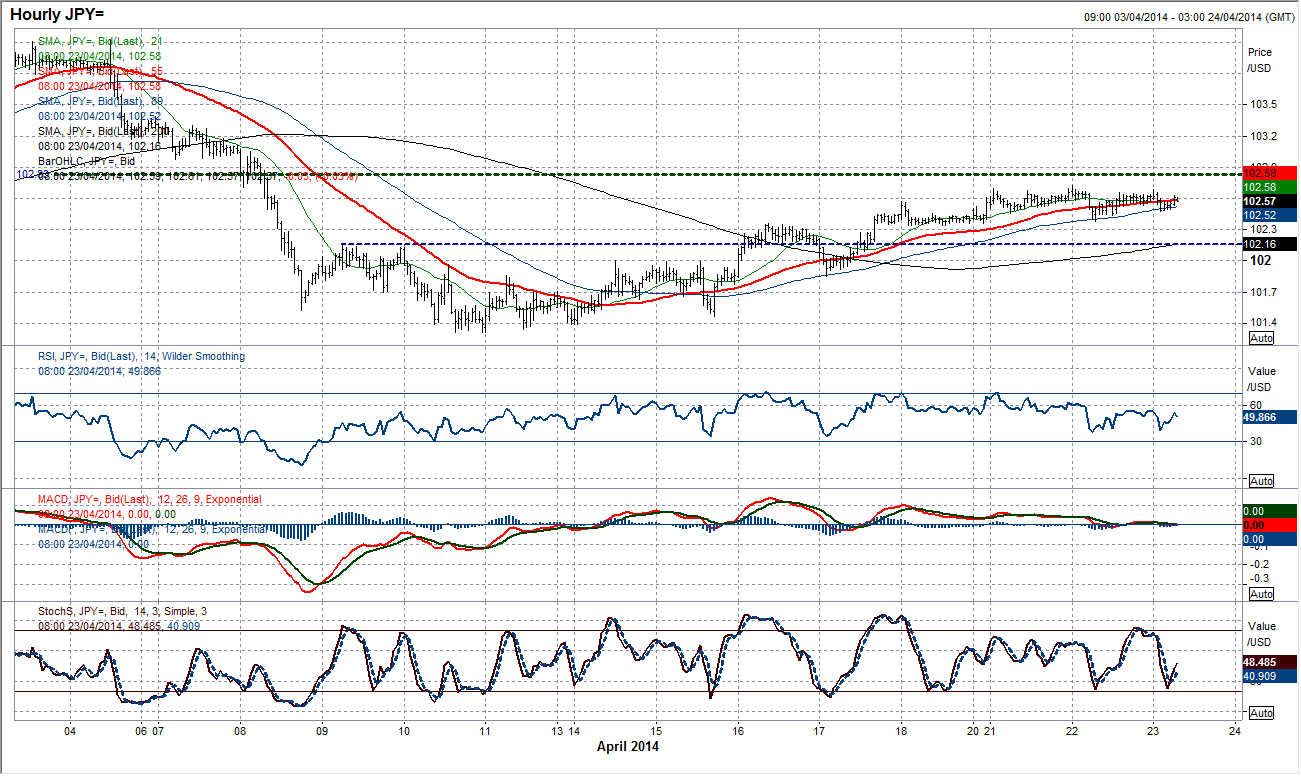

USD/JPY

There has been a 7th consecutive higher low on the daily chart which is a positive, however the appearance of a “long legged doji” candlestick pattern (open and close at the same level with an intraday test to the downside) is a warning sign. Momentum indicators have now unwound to neutral and this could be a case of the bull recovery beginning to run out of steam. Yesterday’s low at 102.38 now becomes key support. With the high coming at 102.72 yesterday, the legacy of the old 102.83 pivot level could still be holding back the advance of the dollar. On the intraday chart, perhaps an early warning signal could be a breach of the rising 89 hour moving average (now 102.51) which has supported the recovery. Furthermore, the rate has made very little ground in the past two days. Perhaps it is time to pull up stop-losses or profit triggers on long positions.

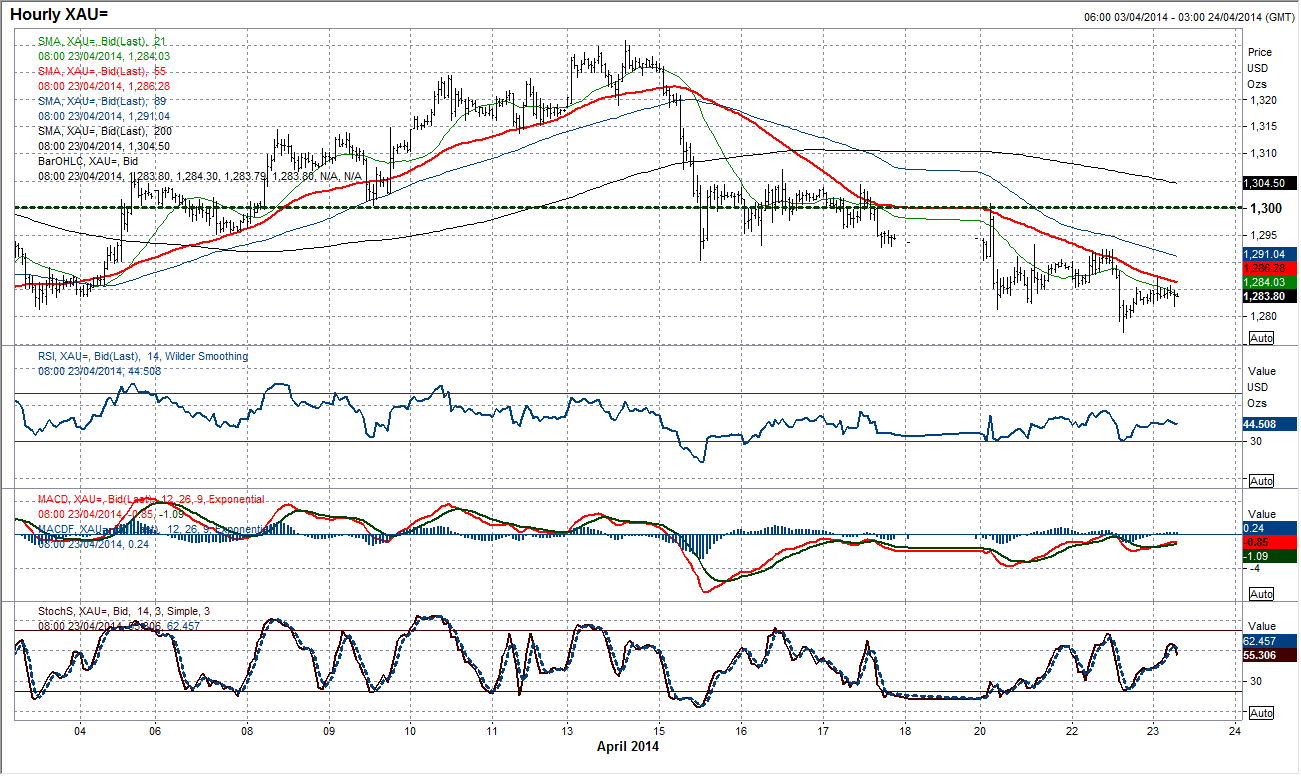

Gold

Yesterday’s dip saw gold hit its lowest level since early February as the downside pressure continues to test lower. Daily momentum indicators continue to point lower, however, the bulls will continue to point to the support of the 144 day moving average which is the key long term gauge for gold. The intraday chart is not great reading though for the bulls, with consistent lows being hit and now the falling 55 hour moving average (c. $1286.65) pulling the price lower and hourly momentum indicators firmly in bearish configuration. There is little reason to suggest that yesterday’s low at $1277.10 will not be revisited, with a break opening $1252 and $1238. Realistically, there now needs to be a move above $1300 for the bulls to regain the initiative.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.